Key Events

- UK unemployment claims rise to a seven-month high of 44.2K

- BOE holds rates at 4.5% (0-1-8 vote); GBP/USD stays below 1.30 as markets await the press conference

- U.S. indices sustain a positive rebound despite Fed Powell’s downgraded growth outlook

GBPUSD Holds Below 1.30 Ahead of BOE Press Conference

UK unemployment claims have surged to a seven-month high of 44.2K, following a contraction in UK economic growth to -0.1%, marking a three-month low. These figures raise concerns about the UK’s economic health, particularly amid deteriorating global conditions. Market attention is now on the BOE press conference, as traders assess the 1.30 level for potential bullish breakouts or bearish reversals.

U.S. Indices Maintain Rebound Despite Growth Concerns

As uncertainty persists over the transition from trade wars to trade deals with the U.S., global economic confidence remains fragile. Gold prices have surged beyond $3,050 an ounce, reflecting increased risk aversion among central banks. During Wednesday’s FOMC meeting, Fed Chair Jerome Powell downgraded U.S. GDP growth forecasts from 2.1% to 1.7%, with unemployment expected to rise to 4.4% and core inflation increasing to 2.8% by year-end. Despite these concerns, U.S. indices rebounded, though caution remains. A confirmed bullish reversal would require a sustained breakout above key resistance levels mentioned below.

Technical Analysis: Quantifying Uncertainties

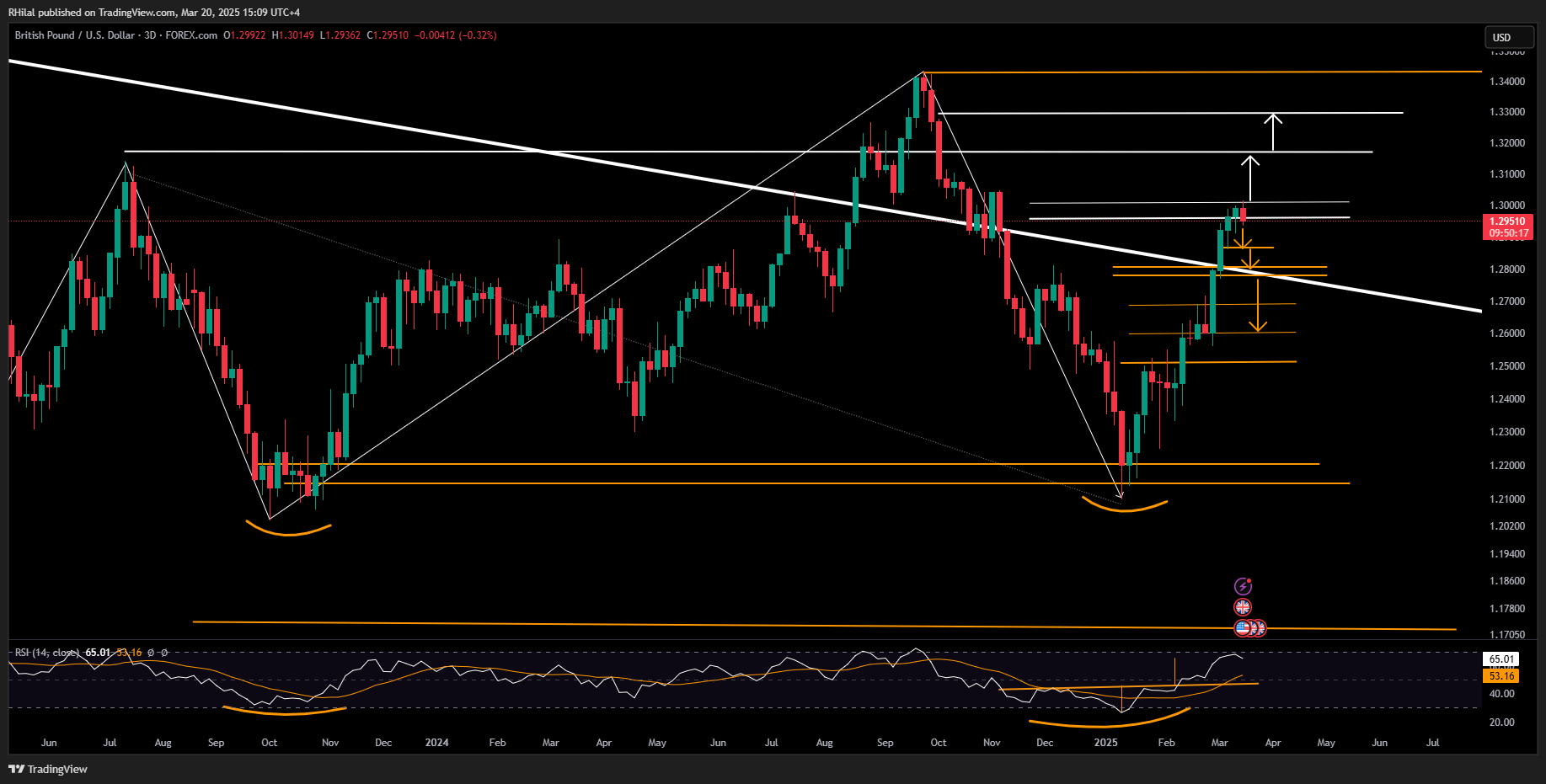

GBPUSD Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

GBP/USD is holding below 1.30, aligning with the 0.382 Fibonacci extension level of the uptrend between:

- Lows of September 2022 (1.0730)

- Highs of July 2023 (1.3140)

- Lows of January 2025 (1.2099)

A clear break above 1.30 could extend gains toward 1.3170, 1.33, and 1.3434. However, RSI overbought conditions, similar to those seen in 2024, indicate potential reversal risks. A sustained hold below 1.30 could trigger a pullback toward support levels at 1.2860, 1.28, 1.2770, and 1.27.

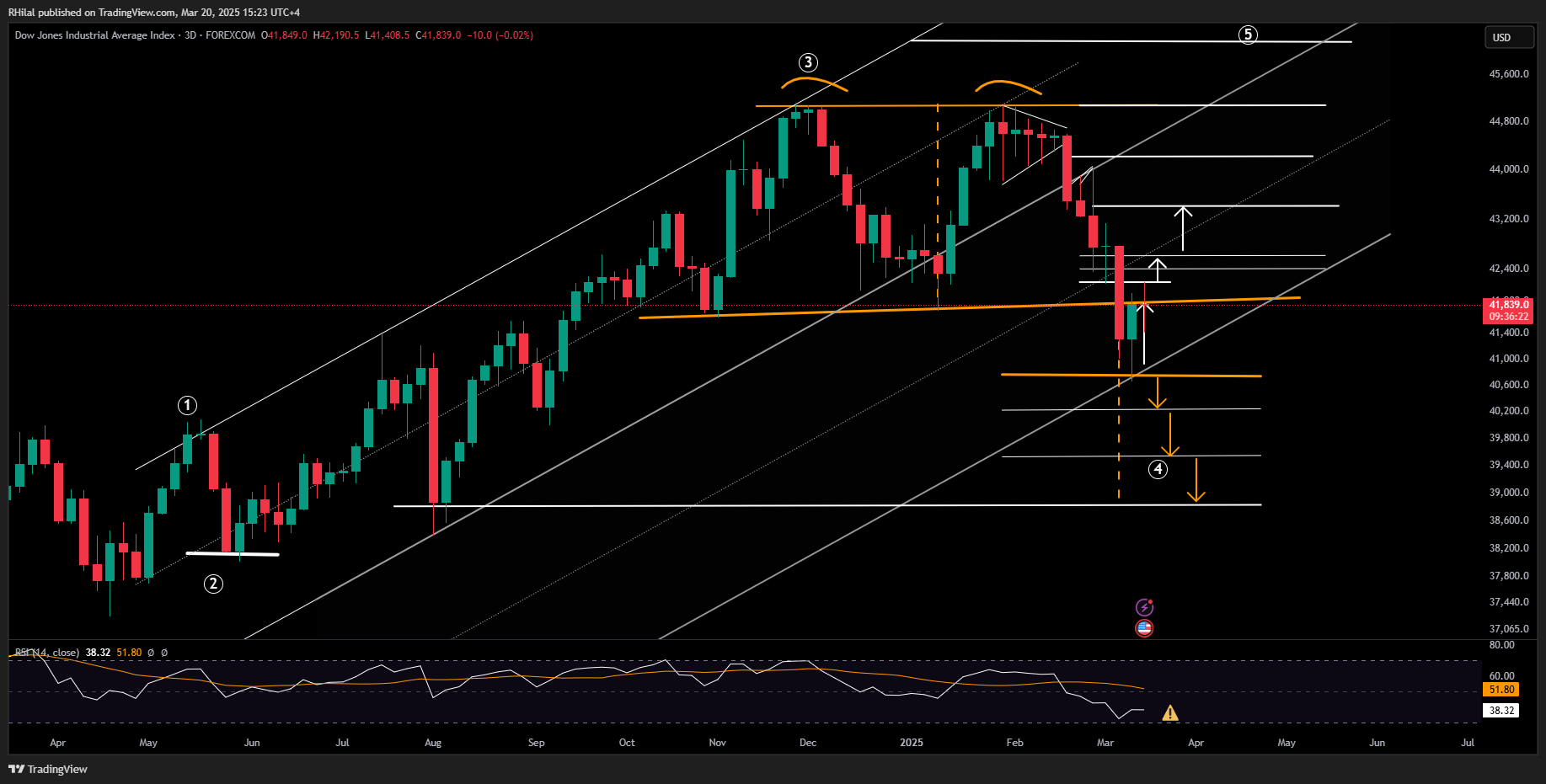

Dow Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

The Dow Jones continues to respect a key reversal level, rebounding from 40,660 in March following a global sentiment drop due to trade war risks. This level coincides with the 0.618 Fibonacci retracement of the uptrend from May 2024 (38,000) to January 2025 (45,000) and aligns with the lower boundary of the duplicated trend channel.

Additionally, RSI levels are overbought, last seen in October 2023. Despite this rebound, the double-top formation observed on the Nasdaq and S&P 500 remains uncertain for the Dow. Price action has broken above the 42,190-neckline, and holding this level could reinforce a bullish sentiment, invalidating the double-top scenario.

A sustained move above 42,000 could extend gains toward 42,400, 42,600, 43,400, and 44,200, aligning with record highs. On the downside, if the Dow falls below 40,700, the double-top formation may regain traction, leading to potential declines toward 40,200, 39,500, and 38,700.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves