Key Events

- Tokyo Core CPI rises from 2.2% to 2.4%, sustaining BOJ rate hike expectations

- Gold hits new record highs above $3,080/oz

- Liberation Day, April tariffs, and ongoing geopolitical tensions spook markets

Tokyo CPI Remains Above BOJ Target

Tokyo’s Core CPI (y/y) rose from 2.2% to 2.4% amid escalating global trade war risks, sustaining market expectations of a possible BOJ rate hike. This kept USDJPY below the key 151 resistance level. While rising prices support the case for tightening, the BOJ is likely to proceed cautiously, given the uncertain trade environment.

New tariff quotas are set to be introduced in April, including auto tariffs and reciprocal measures targeting countries with significant trade surpluses against the U.S., and those restricting access to American goods. The full tariff package is expected to be announced on April 2nd, adding layers of uncertainty to the markets. This has added uncertainty over U.S. Dollar and equity market strength—while propelling gold to new all-time highs above $3,080 per ounce.

Tariff and Geopolitical Uncertainty Boost Gold Above $3,080

Beyond the looming April tariff measures and fears of retaliatory trade moves, gold’s safe-haven appeal remains strongly supported by ongoing geopolitical tensions. Conflicts involving the U.S., Yemen, Russia, Ukraine, Israel, and Gaza continue to create an unstable backdrop.

Ceasefire efforts and peace talks have repeatedly surfaced in headlines, only to collapse, triggering renewed violence and destruction—fueling gold’s broader bullish trend. Silver is also approaching multi-decade highs near $35 per ounce, while gold sets its sights on the $3,090–$3,100 range.

Technical Analysis: Quantifying Uncertainties

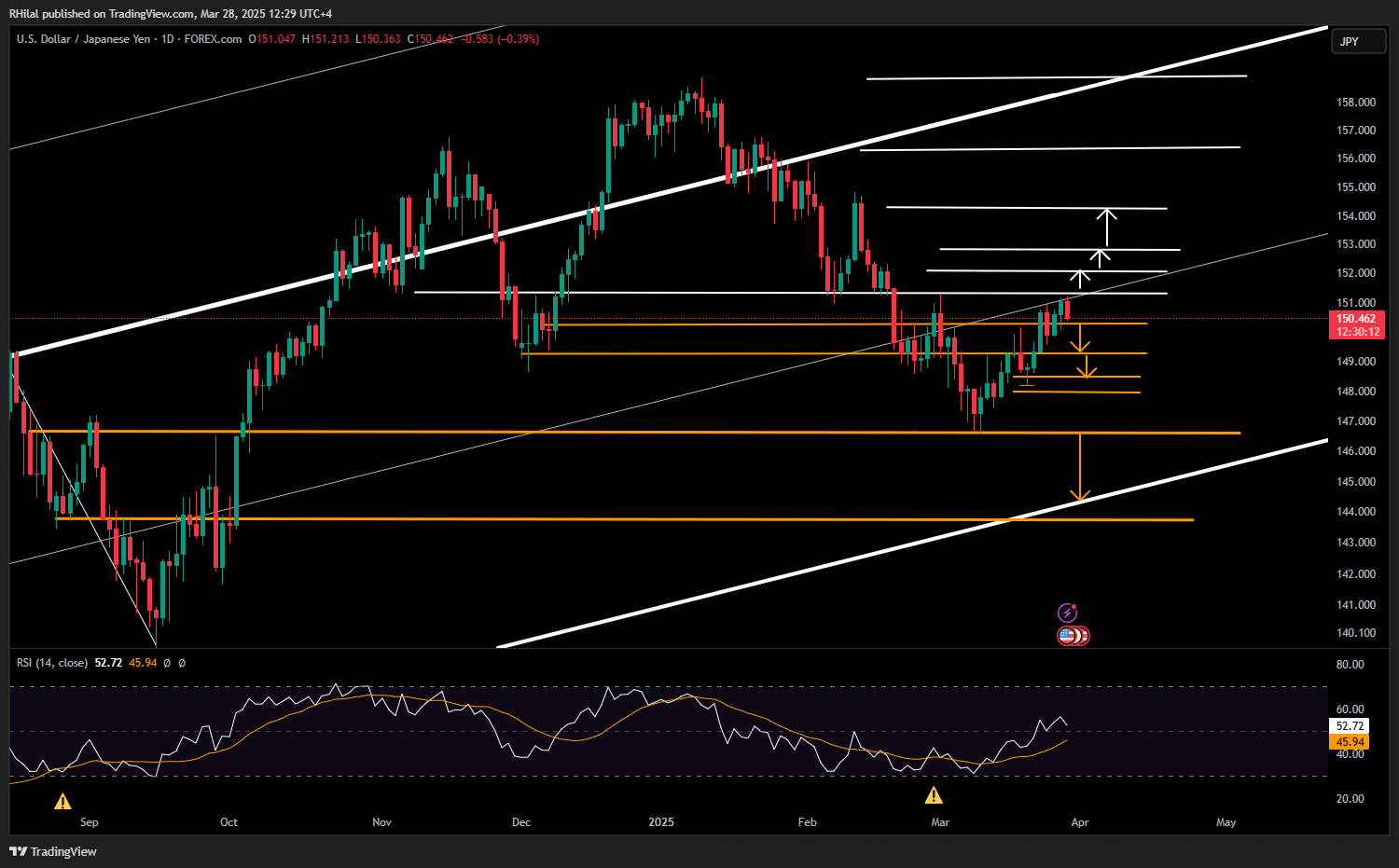

USDJPY Forecast: Daily Time Frame – Log Scale

Source: Tradingview

Following the uptick in Tokyo CPI and uncertainty surrounding April’s tariffs, USDJPY remains capped below the 151 resistance and March 2025 highs. Potential support levels to watch for confirmation of retracement include 150.20, 149.20, 148.00, and 146.90. The key technical level is 146.90—the 0.618 Fibonacci retracement of the September–January uptrend.

A decisive close below this level could open the door for new 2025 lows, with 143.60 as the next notable support. On the upside, if the dollar regains bullish momentum and USDJPY sustains a move above 151.70, resistance levels at 152.00, 152.80, and 154.30 may come into play.

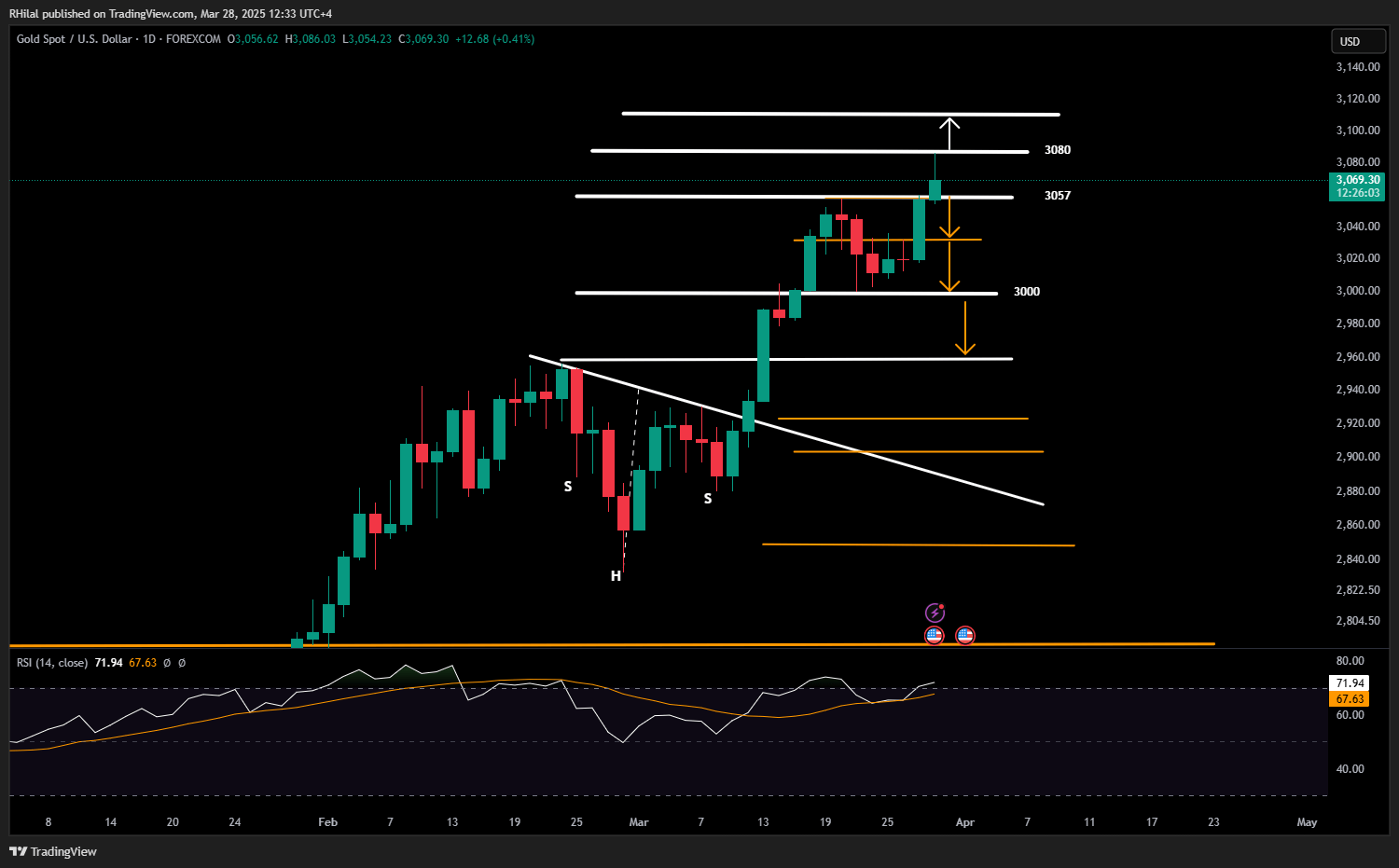

Gold Forecast: Daily Time Frame - Log Scale

Source: Tradingview

Gold is currently rebounding from the 50% Fibonacci extension of the uptrend from 2,880 to 3,057, with a retracement low at 3,000. A clean break and hold above 3,090 may extend the rally toward the 0.618 Fibonacci extension, possibly aligning with resistance at 3,110.

Should gold slip back below 3,080, nearby support levels to watch are 3,050, 3,000, and 2,955. Caution remains warranted at current highs, as the monthly RSI hovers near overbought territory—levels last seen in 2024, 2020, 2011, and 2008, which preceded steep pullbacks.

However, if U.S. Dollar uncertainty and geopolitical risks persist, gold’s bull run is likely to continue.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves