At present, the markets seem wholly preoccupied with trade war tensions, leaving little room for other narratives. The latest bombshell from US President Donald Trump rattled financial markets, triggering a sharp sell-off across US equities and European automotive stocks. General Motors took a notable hit in pre-market trading, sliding 6%, while Tesla managed to edge higher. However, by mid-morning in London, both European indices and US futures staged a modest recovery. Whether this rebound can evolve into something more sustained remains to be seen. Much now hinges on Trump’s rhetoric—should he soften his tone, markets might find some relief. If not, the risk of prolonged volatility looms large, particularly as April 2 approaches—a date dubbed “liberation day” by Trump. So, the near-term Nasdaq 100 forecast remains uncertain and dependent on Trump’s rhetoric.

Trade war takes centre stage

Yesterday, Trump signed an executive order imposing a 25% tariff on auto imports, intensifying the ongoing trade conflict under the guise of strengthening domestic industry. This move sets the stage for further tariff measures next week, including the introduction of so-called reciprocal tariffs on 2nd April – an escalation likely to exacerbate tensions with key trade partners.

The president also hinted at additional levies on the European Union and Canada, should they collaborate in ways he perceives as economically detrimental to the US. At the same time, he signalled a potential relaxation of tariffs on China—albeit contingent on Beijing facilitating the sale of TikTok’s US operations to an American firm. Is this classic deal-making or yet another episode of market turbulence? Either way, investors are keeping a wary eye on developments.

European stocks endured a brutal session, with the auto sector bearing the brunt of the damage. Porsche and Mercedes-Benz Group were among the hardest hit, as Bloomberg reported an estimated €3.4 billion impact from the fresh US levies. Concerns over the broader economic consequences of the trade spat could undermine investor confidence and weigh on markets for a while yet.

Nasdaq 100 forecast: Technical analysis and trade ideas

Source: TradingView.com

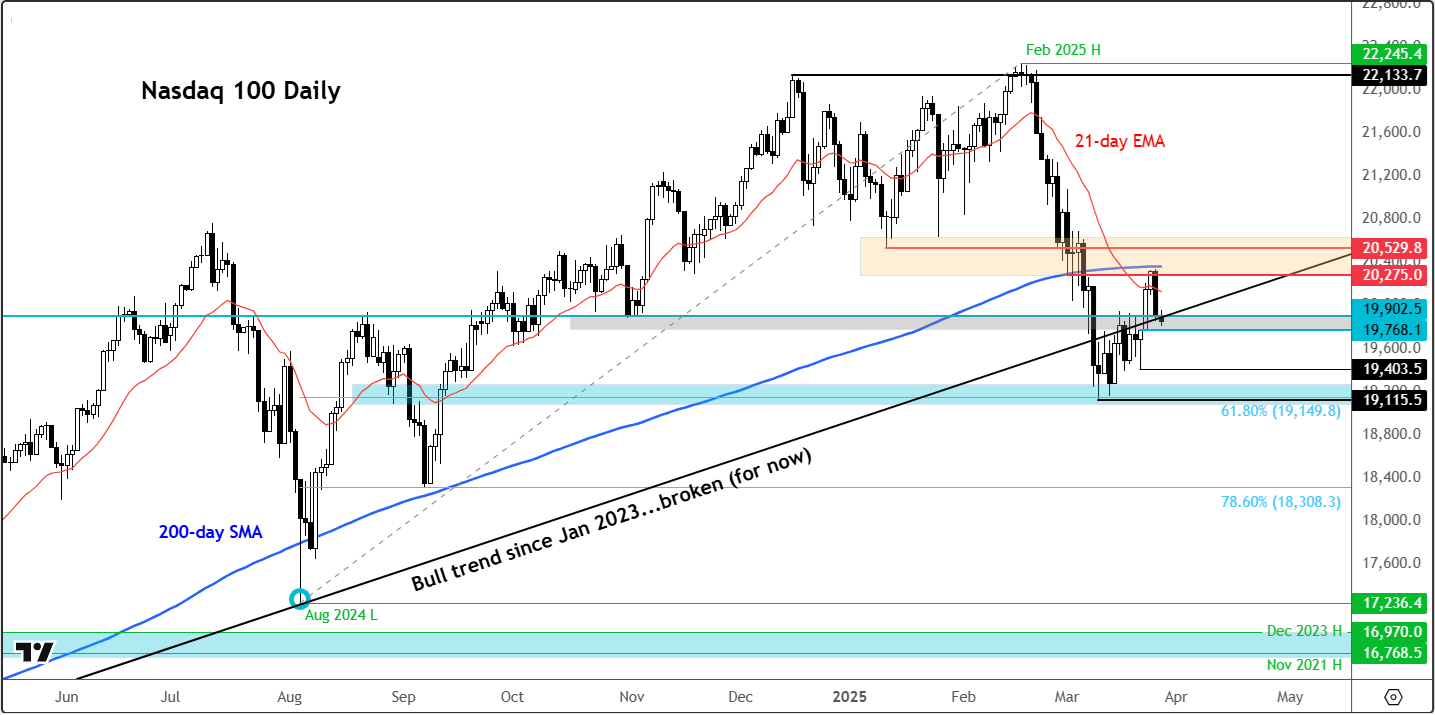

From a technical perspective, the Nasdaq 100 remains vulnerable, despite futures finding some support following yesterday’s sharp decline. Several major indices, including Germany’s DAX, have broken key support levels, and the Nasdaq 100 has also slipped below short-term technical barriers. This raises the prospect of a renewed downtrend, following the decent recovery seen earlier this month.

On the daily chart, the Nasdaq 100 has found support around top end of the 19768 - 19,900 range. This area represents a former resistance-turned-support zone, as well as the long-term bullish trend line that was briefly breached before being reclaimed. Additionally, this level aligns with the low prior to the post-election rally base, further reinforcing its importance. Whether this support holds or fails will likely dictate near-term direction.

Key technical levels to watch

- Support levels: A decisive break below the 19768 - 19,900 range could see the index slide towards 19,520, with further downside risk towards last Friday’s low of 19,403. Should selling pressure intensify, the broader 19,100-19,200 support zone may come into focus again.

- Resistance levels: The 19,944 mark serves as an immediate hurdle, representing last week’s high, when the Nasdaq 100 formed an inside bar pattern, breaking a four-week losing streak. Failure to sustain gains above this level could see the index dip below last week’s low of 19,392 in search of liquidity. Should the bulls defend the 19,900 level and maintain the bullish trend line, despite the prevailing trade war anxieties, it would suggest underlying strength in the market. In that scenario, a retest of the 200-day moving average could be on the cards.

The bottom line

In summary, 19,900 area remains the key battleground. A convincing break lower would signal further downside, while a successful defence of this level could set the stage for a renewed push higher. Traders should remain vigilant, as geopolitical risks continue to dictate the Nasdaq 100 forecast and market sentiment generally.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R