Yesterday saw Wall Street stage a respectable rebound following a softer-than-expected CPI report, though it did little to invigorate futures trading during the Asian session, leaving European investors with little initial enthusiasm. At one stage, Nasdaq futures were down nearly 2%, shedding around 385 points from yesterday’s high. Not exactly an inspiring start to the day, one might say. However, as Europe’s markets opened, dip buyers re-emerged, nudging index futures upwards. But by mid-morning London trade, futures then drifted lower again, along with European indices, ahead of the release of PPI. Trump threatened heavy tariffs on French wines and EU alcohol products. Volatility remains the name of the game, making it difficult for both the bulls and bears to predict the Nasdaq 100 forecast. Recent sessions have seen efforts to establish a base, with tech megacaps staging a strong recovery yesterday. Nvidia surged 6.4%, climbing back above $115, Tesla rallied 7.6%, and AMD regained the critical $100 level with a 4.1% gain. While volatility remains, there are early indications that the market could be on a recovery trajectory—though further confirmation is required before declaring a definitive low.

More Inflation Data Incoming: PPI

Following the cooler-than-anticipated CPI print, market attention now shifts to today’s PPI release (alongside jobless claims). The PPI figures could prove even more significant, given their close correlation with the Fed’s preferred inflation gauge—the Core PCE Price Index. A notable deviation from expectations could influence sentiment around the Fed’s next move, making this data particularly consequential. Expectations are for both headline and core PPI to rise by 0.3% month-on-month.

Once the inflation and jobless claims data are digested, focus will shift to Friday’s University of Michigan consumer sentiment surveys. A sharp drop in last month’s reading heightened concerns over the impact of Trump’s trade policies on economic confidence. This widely watched survey, canvassing around 420 respondents on current and future economic conditions, should offer further insights into sentiment trends. Inflation expectations—spiking last month to 4.3% from 3.3%—will be scrutinised for signs of persistent price pressures. The implications for monetary policy and broader market direction could be considerable.

Reflecting on yesterday’s CPI data, while inflation showed some moderation, it hardly represented the game-changing shift some had hoped for. The cooling was primarily concentrated in services, meaning it may not translate directly into a lower PCE Price Index. Moreover, February’s data doesn’t fully capture the ripple effects of Trump’s aggressive tariff measures. The Fed is unlikely to rush into rate cuts regardless, preferring a steady hand until sustained improvements are evident. This sentiment was reflected in FX markets, where the dollar rebounded following the CPI release. But the real concern for markets isn’t merely inflation: it’s growth, or rather, the lack of it, plus tariffs uncertainty.

Tariffs: A Persistent Risk

Markets have swung wildly on tariff-related headlines, as was evident again yesterday. Mid-session losses followed Canada’s announcement of new tariffs on $21 billion worth of US goods, only for stocks to recover as Trump softened his stance, backing away from an additional 25% levy on Canadian exports. Optimism surrounding trade negotiations, combined with the softer inflation print, propelled tech equities higher after two days of steep declines.

However, Europe now finds itself firmly in Trump’s sights. The EU’s threat of countermeasures was swiftly met with a warning of reciprocal duties from Washington. One can’t help but wonder whether Trump’s approach to Europe will mirror his strategy with Canada and Mexico—escalate before offering relief—or if he will adopt the China playbook: tariffs upon tariffs. Time will tell.

Regardless, Trump’s 25% tariffs on steel and aluminium imports took effect yesterday, triggering immediate retaliatory measures from both the European Union and Canada.

Technical Nasdaq 100 forecast: Is a Sustainable Recovery on the Horizon?

Markets have struggled to form a clear bottom in recent sessions. However, given the strong bounce in tech megacaps yesterday and the short-term oversold nature of indices, could the Nasdaq 100 now mount a more meaningful recovery?

One recurring theme throughout this prolonged bull market is that every significant sell-off has been met with aggressive dip-buying, pushing indices to fresh highs. Whether it was the Covid-19 crash, the unwinding of yen carry trades in 2024, Russia’s invasion of Ukraine, or the inflation-driven bear market of 2022—investors have repeatedly stepped in to stabilise markets. The pressing question now is whether we are at the start of another resurgence or merely a pause before a deeper correction unfolds.

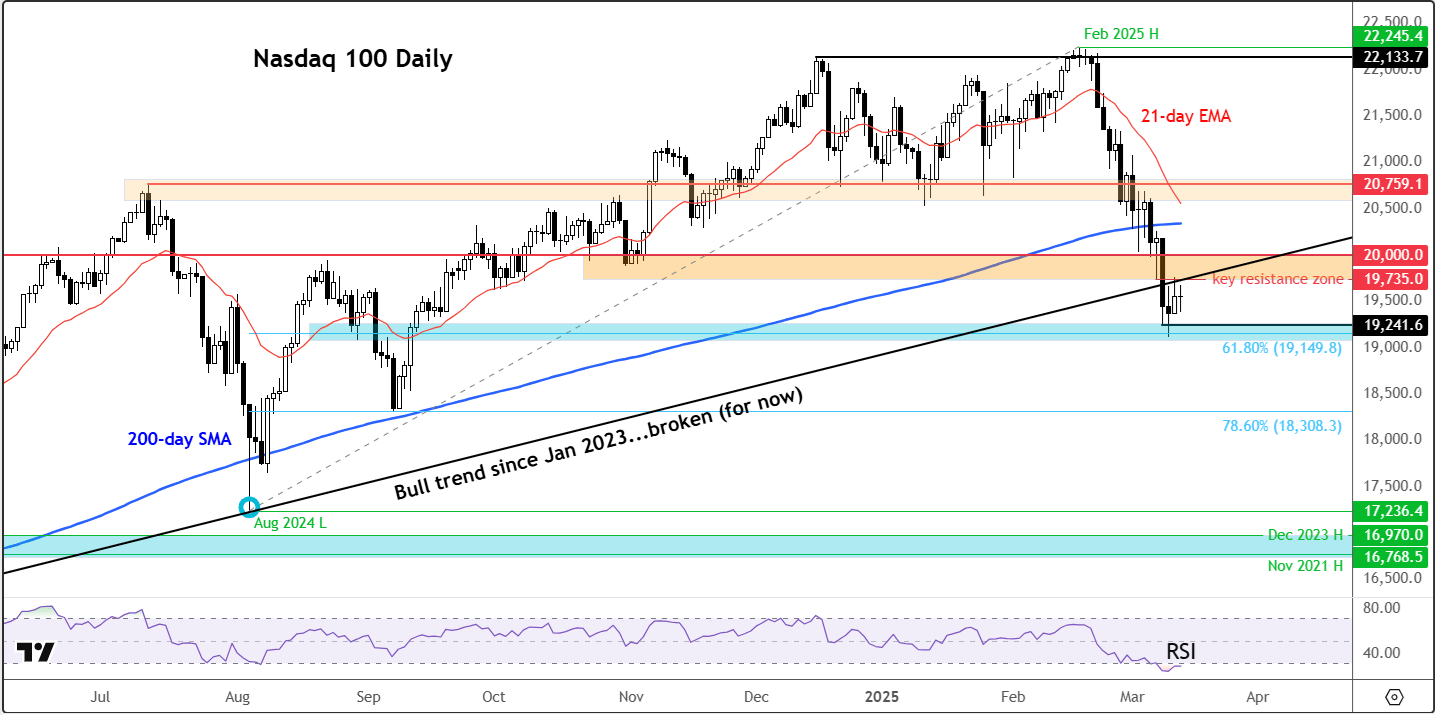

Source: TradingView.com

The Nasdaq 100 has found some support this week in the 19,115-19240 region, which aligns with a prior support/resistance zone and the 61.8% Fibonacci retracement of the last major rally from August. With the daily RSI now firmly in oversold territory, the potential for a further rebound remains strong – if it can now start to break down a few resistance hurdles.

The initial resistance stands at 19,735—the low from Friday, which was breached during Monday’s steep sell-off. Here, we also have the backside of the broken trend line that had been in place since January 2023. A clean move beyond this zone could be quite significant, potential opening the way for further gains towards the next resistance levels such as the psychological 20,000 level, and then the 200-day moving average near 20,340. Should dip buyers return in force, these levels could come into play in the sessions ahead.

However, should selling pressure resume, downside targets include 18,800 and, potentially, the 78.6% Fibonacci retracement level near the next support around 18,310.

All things considered, my Nasdaq 100 forecast has shifted. Having previously anticipated a correction—which has now finally materialised—I am now leaning towards a potential recovery rather than a continuation of the recent sell-off. But I want to see some confirmation before turning decisively bullish.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R