Nasdaq 100 forecast: After a roller-coaster week for US stock markets, Friday saw the major indices bounced sharply off their lows to end the day on a positive note after the Nasdaq 100 had earlier dropped to the official threshold of a correction (10% from the recent high). Traders tried to make sense of several conflicting headlines about tariffs, while the Fed Chair Jerome Powell said the economy was doing fine despite the release of a weaker than expected jobs report earlier in the day, and several other weaker reports in the prior couple of weeks. There was also an element of an oversold bounce too, to take into account, with reports that Russia was willing to discuss a temporary truce in Ukraine helping the cause. For the dollar, last week was its worst since November 2022. The US dollar is likely to remain under pressure in the week ahead as weakening US data raises the prospects of a sooner-than-expected rate cut by the Federal Reserve. It will be interesting to see if the commodity dollars will show some strength like we have seen the likes of the EUR, GBP and JPY display in recent trade.

Trump roils markets with conflicting remarks regarding tariffs and Russia

Last week was quite busy for the markets amid the escalation and then the de-escalation of trade wars. Risk assets started falling sharply on the back of Trump’s imposition of tariffs on Canada and Mexico, before rebounding on Wednesday and then dropping again, before yet another rebound on Friday after the US President significantly expanded the goods exempted from his new tariffs that were only imposed two days earlier. Then, Trump warned of fresh tariffs on Canada, causing more volatility intraday on Friday, when he also said he was "strongly considering" large-scale sanctions and tariffs on Russia until a ceasefire with Ukraine was reached. But later in the day on Friday, Trump backtracked and said it is "more difficult, frankly, to deal with Ukraine" than Russia in attempts to broker peace between the two countries, and that the US is "doing very well with Russia."

This is the sort of an environment we are at right now, so expect lots of headline-driven moves in the weeks ahead.

What’s on the calendar for US markets in the week ahead?

The week ahead promises a flurry of key economic reports, with at least four major releases to keep an eye on. Proceedings kick off on Tuesday with the ever-more significant JOLTS job openings data, followed by the all-important CPI inflation report on Wednesday. Thursday brings the latest PPI figures, while Friday rounds off the week with the University of Michigan’s consumer confidence and inflation expectations surveys.

US inflation has been creeping higher for the past five months, putting the Federal Reserve in a rather tricky position. On the one hand, economic strains are beginning to surface in certain sectors, yet inflation expectations among consumers are edging up—fuelled, no doubt, by concerns over tariffs and Trump’s tax-cut and spending plans. The key question now is whether these rising expectations translate into further inflationary pressures or whether softening economic data and lower oil prices have provided some relief in February.

The PPI release will also be one to watch, not least because it contains components that feed into the Fed’s preferred inflation gauge—the Core PCE Price Index—due later in the month. A stronger-than-expected PPI print could well shape expectations around the Fed’s next policy moves, so this release warrants close attention.

Once the inflation data is out of the way, focus then shifts to Friday’s University of Michigan surveys. Last month’s consumer sentiment reading took a sharp tumble from 71.1 to 64.7, raising questions about the impact of Trump’s protectionist stance on confidence levels. This survey, which polls around 420 respondents on current and future economic conditions, will be key in assessing broader sentiment. Equally significant is the inflation expectations component, which saw a sharp jump last month to 4.3% from 3.3%—a development that could have serious implications for actual inflation trends. A number to watch closely.

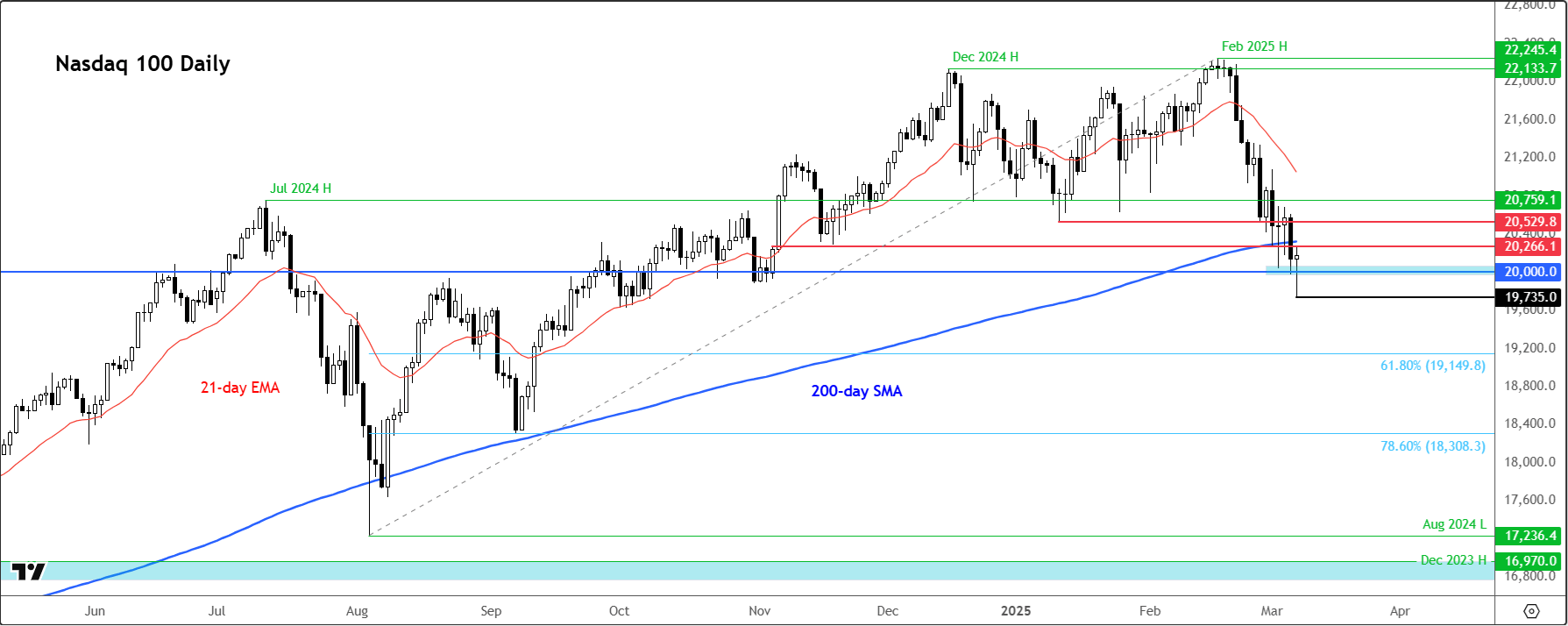

Technical Nasdaq 100 forecast – index regains key 20K level

Source: TradingView.com

With major US indices such as the Nasdaq 100 bouncing from key support levels, can we see a rebound for risk appetite in early next week, especially in light of a weaker US jobs report that was released Friday? The recent weakness in US data increases the likelihood of rate cut by the Fed by May, even if Fed officials have suggested a wait-and-see approach is better. Meanwhile, the potential for truce in Ukraine could also help sentiment. But the wildcard is Trump and his favourite word: tariffs.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R