Key Events:

- Central bank meetings: Press conferences from the FOMC, BOJ, BOE, and SNB this week will provide insights into economic growth projections amid escalating trade war tensions

- Cautious market sentiment: Investors are bracing for potential reversals in line with Russia-Ukraine tensions, ongoing tariff disputes, and upcoming rate decisions

- GBP/USD holds below 1.30, weighed down by extreme momentum conditions and economic contraction in the UK

- Dow Jones holds above 41,000, presenting potential "buy-the-dip" opportunities amid recent sharp declines

GBPUSD Outlook

The unexpected contraction in UK GDP to -0.1% last week has stalled GBP/USD's recovery below the 1.30 mark. The Bank of England (BOE) is set to announce its rate decision on Thursday, following high-volatility events such as the FOMC meeting on Wednesday and the UK claimant count change report.

Amid declining oil prices, now at three-year lows, and growing economic risks from intensifying trade wars, central banks remain divided between rate holds and cuts. To cushion economies from contraction, policymakers may opt for cuts until trade deals are settled.

Both the Fed and BOE are expected to hold rates at 4.5% in March yet forecasts near June lean toward potential rate cuts, adding weight to this week's press conferences in shaping the broader outlook.

Dow Outlook

The December 2024–January 2025 highs formed potential double-top formations across major indices, leading to sharp declines and oversold conditions on daily charts—levels not seen since 2022. Currently:

- Nasdaq holds above 19,000

- Dow Jones remains above 41,000

- S&P 500 stays above 5,490

While further catalysts may be needed to push indices toward new 2025 lows, current conditions suggest potential reversals and dip-buying opportunities. However, market sentiment remains vulnerable to risks from the Russia-Ukraine conflict, the FOMC meeting, and evolving tariff tensions, which could limit further gains.

Technical Analysis: Quantifying Uncertainties

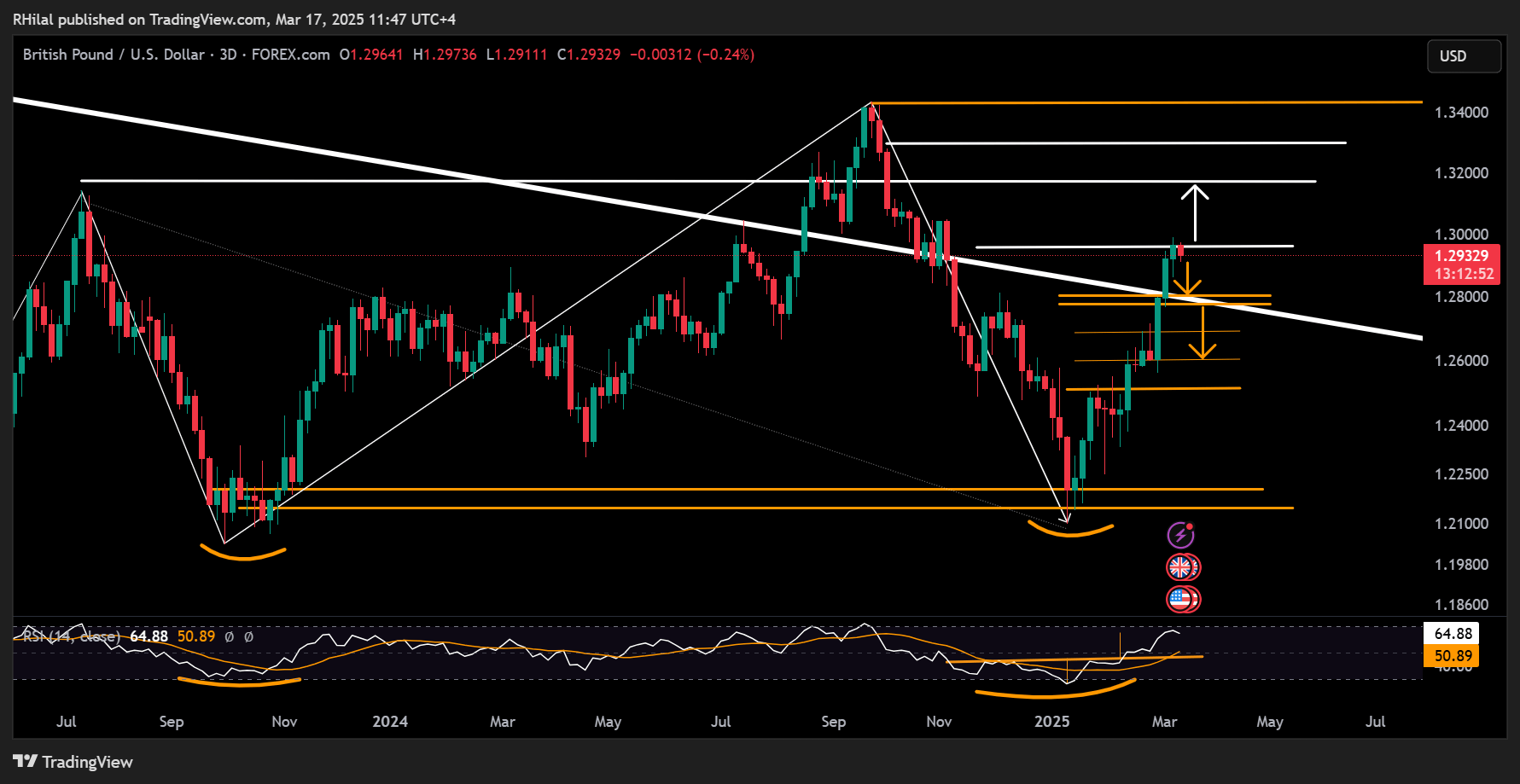

GBPUSD Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

In tandem with the hold of the US Dollar index and EURUSD charts over the highs and lows reached in November 2024, the GBPUSD pair is also holding its rebound below the highs previously seen in November 2024 at the 1.2960 mark, aligning with the 0.618 Fibonacci retracement level of the downtrend between September 2024 and January 2025.

The alignment of the 3-day RSI with overbought levels previously seen I September 2024 as well increases the likelihood of a correction back towards 1.2860, 1.28, 1.2680, and 1.26. from the upside, should the trend close above 1,2960 and climb above 1.30, levels 1.3170, 1.33, and 1.3434 may come back into play.

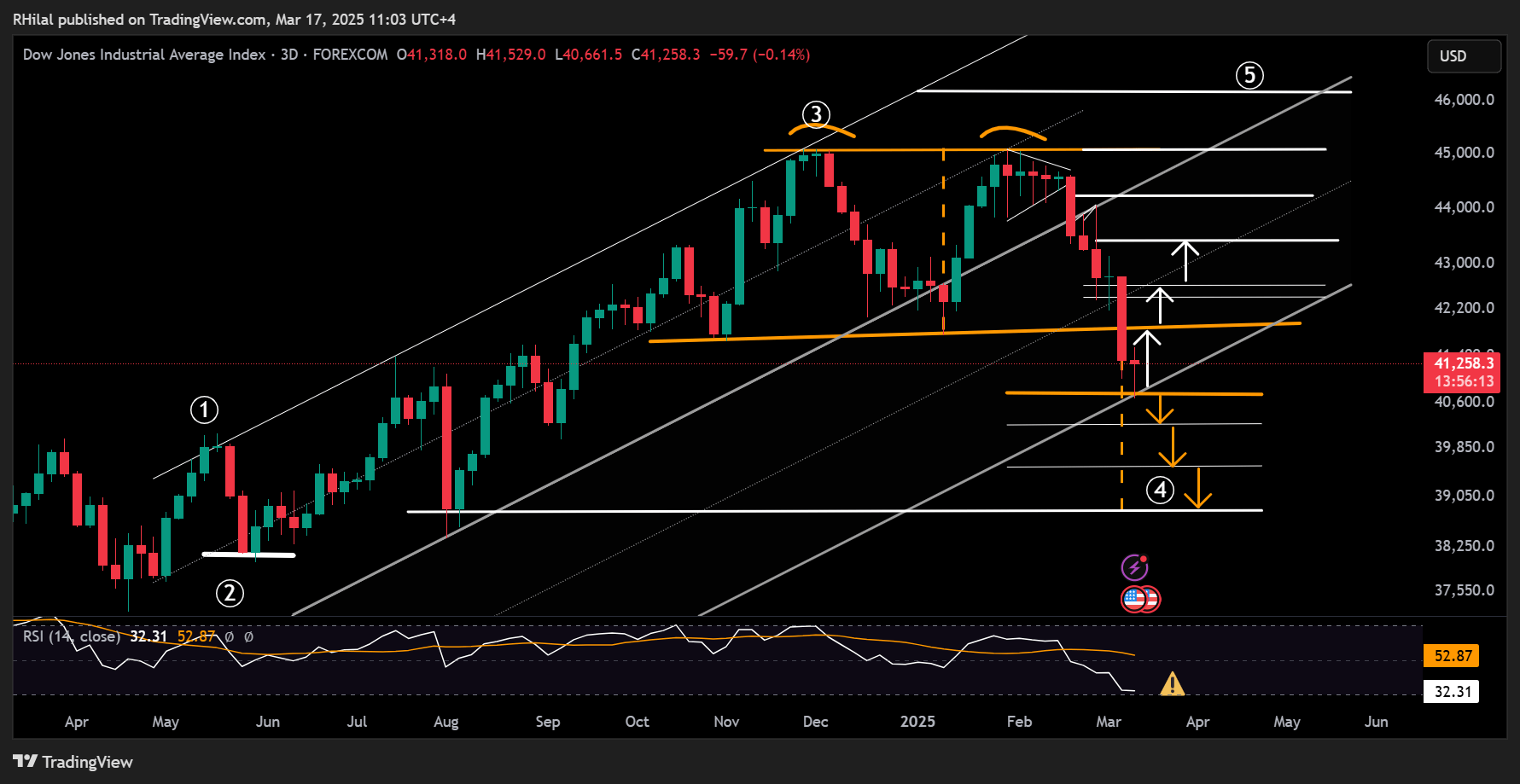

Dow Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

Unlike the Nasdaq and SP500, Dow did not trace the full potential of its double top formation between 2024 and 2025 peaks, yet in a similar manner to the US indices, it rebounded from the 0.618 Fibonacci retracement of the May 2024-Jan 2025 uptrend, coinciding with oversold levels on the 3-Day RSI previously seen in October 2023.

The Dow’s rebound from the 40,660 low aligns with the bottom end of the duplicated channel of its respected up-trend between May 2024 and Jan 2025, strengthening positive rebound opportunities in tandem with the broader market sentiment.

Should the Dow hold above the 41,000-mark, levels 41,700, 42,600, and 43,400 may come back to play. From the downside, a clean close back below the 40,600-mark can extend losses in the direction of the double top formation’s target, aligning with possible support levels at 40,200, 39,500, and 38,700.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves