The price of gold hit the $3,000 per ounce mark for the first time ever on Friday, before easing a tad on profit taking around that anticipated level. Investor appetite for the safe-haven asset grew, as they sought protection from economic uncertainty triggered by US President Donald Trump's tariff war. Traders will keep a close eye on the ongoing trade war between the US and much of the world for potential market signals. In the coming week, three major central banks are set to announce rate decisions, though it remains uncertain whether any significant policy shifts will occur. Should any of them adopt a more dovish stance than expected, it could provide further support for the gold forecast. On the other hand, a major de-escalation in the trade war or progress in peace talks between Russia and Ukraine could dampen gold’s appeal as a safe haven, shifting investor interest toward risk-sensitive assets like equities.

UoM consumer sentiment drops and inflation expectations rise

Beyond trade war uncertainties, gold has also benefited from a weaker US dollar, driven by soft US economic data. If this trend of weaker data persists, gold could extend its gains.

Last week, we had weaker CPI and PPI inflation data, keeping the pressure on the greenback against most major currencies. Then on Friday, we had a weaker-than-expected University of Michigan consumer sentiment survey, which came in at 57.9 vs. 64.7 previously, and missing expectations of 63.1. This is now the third month of back to back drops in consumer sentiment, no doubt due to heightened concerns over the impact of Trump’s trade policies on economic confidence. This closely watched survey, which polls around 420 respondents on current and future economic conditions, also provides insights into inflation expectations, asking respondents where they expect prices to be 12 months in the future. Well, after having spiked last month to 4.3% from 3.3%, we saw yet another big jump in consumer inflation expectations to 4.9% in March. Signs of persistent price pressures are building despite the headline CPI and PPI inflation easing.

Big central bank meetings could further impact gold forecast

Three big central bank rate decisions are coming up next week, although it remains to be seen whether there will be any major policy changes. If any of these central banks turn out to be more dovish than expected, this could help keep the gold forecast positive.

Speculation has been mounting over the Bank of Japan’s next move as strong wage growth and inflation fuel expectations of further policy tightening. The key focus of the March 19 meeting will be on future policy guidance. A recent Bloomberg survey of 52 economists suggests the next rate hike could come between June and September. However, there’s a growing minority—13% of those surveyed, up from 4% previously—who now anticipate a move as soon as May 1.

Meanwhile, the US Federal Reserve is widely expected to keep rates unchanged at its March 19 meeting. However, any indication of an earlier-than-expected rate cut could weaken the dollar. The Fed must weigh the effects of tariffs on inflation, along with the broader uncertainty they create, as well as recent signs of softness in US economic data. Market participants will closely scrutinize the policy statement, economic projections, and Fed Chair Jerome Powell’s press conference for any shifts in outlook.

Across the Atlantic, the Bank of England is poised to keep rates at 4.5% in its March 20 meeting amid persistent inflation concerns. While markets overwhelmingly expect a hold this month, expectations for rate cuts in 2025 have been rising. There is now a 77% chance of a cut in May and a 55% likelihood in August—significantly more aggressive than January’s outlook. However, with UK inflation climbing to 3.0% in January from 2.5% in December, these expectations may prove overly optimistic.

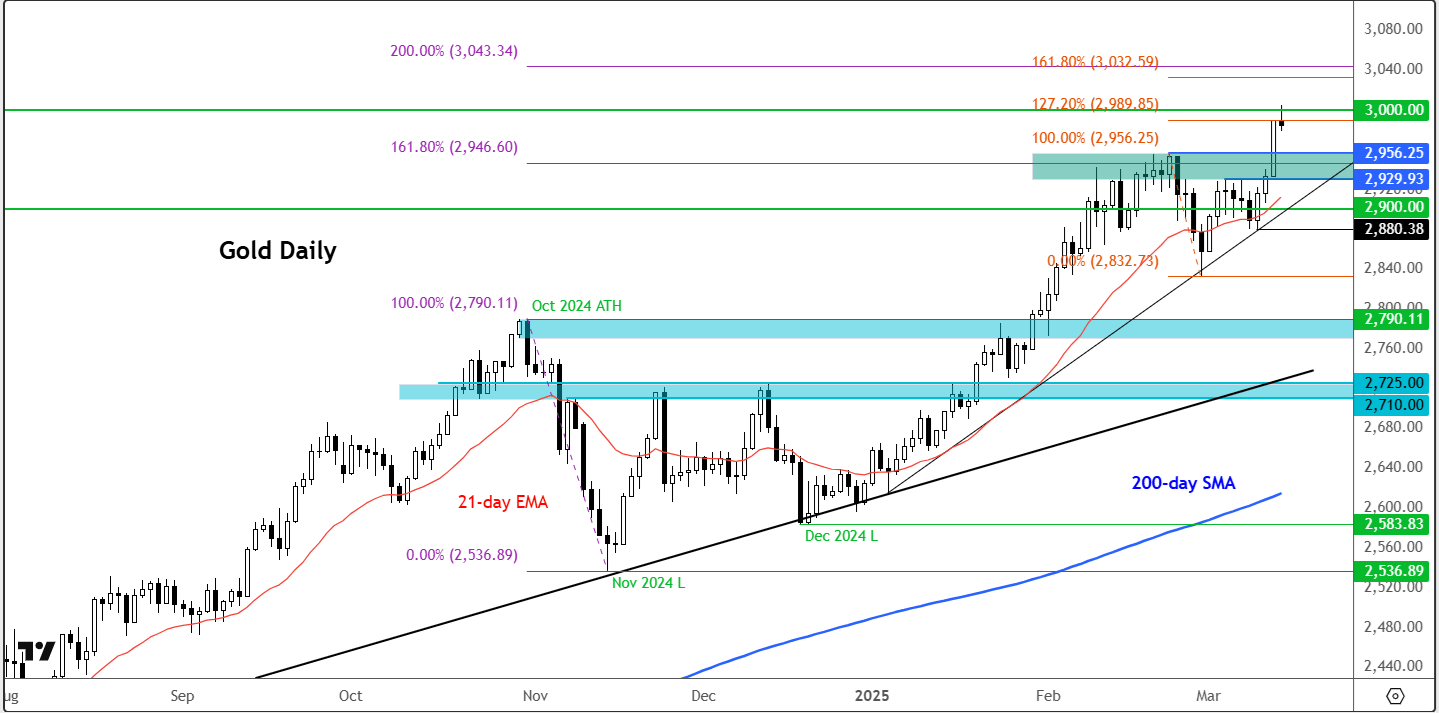

Technical gold forecast: key levels to watch

Source: TradingView.com

From a technical perspective, well it is quite simple: the path of least resistance on the gold chart remains to the upside as long as the market maintains its structure of higher highs and higher lows. Key support now comes in at $2,929–$2,956, an area that had previously acted as resistance. The short-term bullish trendline established since the start of the year now serves as a crucial threshold—if broken, especially below the recent low of $2,880, it would signal a potential trend reversal. Only in that scenario will the technical gold forecast turn bearish.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R