Key Events:

- Rate cut sentiment resurfaces as concerns over economic growth and declining oil prices dominate market headlines

- Federal Reserve (Fed) and Bank of Japan (BOJ) are expected to hold rates next week

- Price trends show tentative rebounds amid extreme momentum conditions

- Gold maintains its safe-haven status above $2,900 but struggles to rally beyond $2,950

US Dollar Analysis

Markets have reached extreme overbought and oversold conditions, with US indices and global currencies reflecting limited rebounds as trade war policies continue to unfold. Major monetary policy decisions are due next week, with both the Fed and BOJ set to announce their stances.

While economic growth risks remain prominent—especially as oil prices hit a three-year low—Fed rate cut expectations for May and June are rising once again. However, for March, both the Fed and BOJ are expected to hold rates, given current market volatility.

Meanwhile, Trump is scheduled to meet with Ontario leadership in Washington today to discuss trade war developments. The outcome could either ease tensions with a peace deal or escalate market turbulence through further tariff disputes.

Gold Analysis

Gold charts are currently battling bearish technical forecasts on higher time frames, as investors seek its safe-haven appeal amid ongoing trade war uncertainty. The $2,955 record high remains a critical level—potentially signaling either a double-top reversal or a breakout toward the next major milestone at $3,000. However, geopolitical stability remains a risk factor, as peace deals could erase recent gains above $2,800.

Technical Analysis: Quantifying Uncertainties

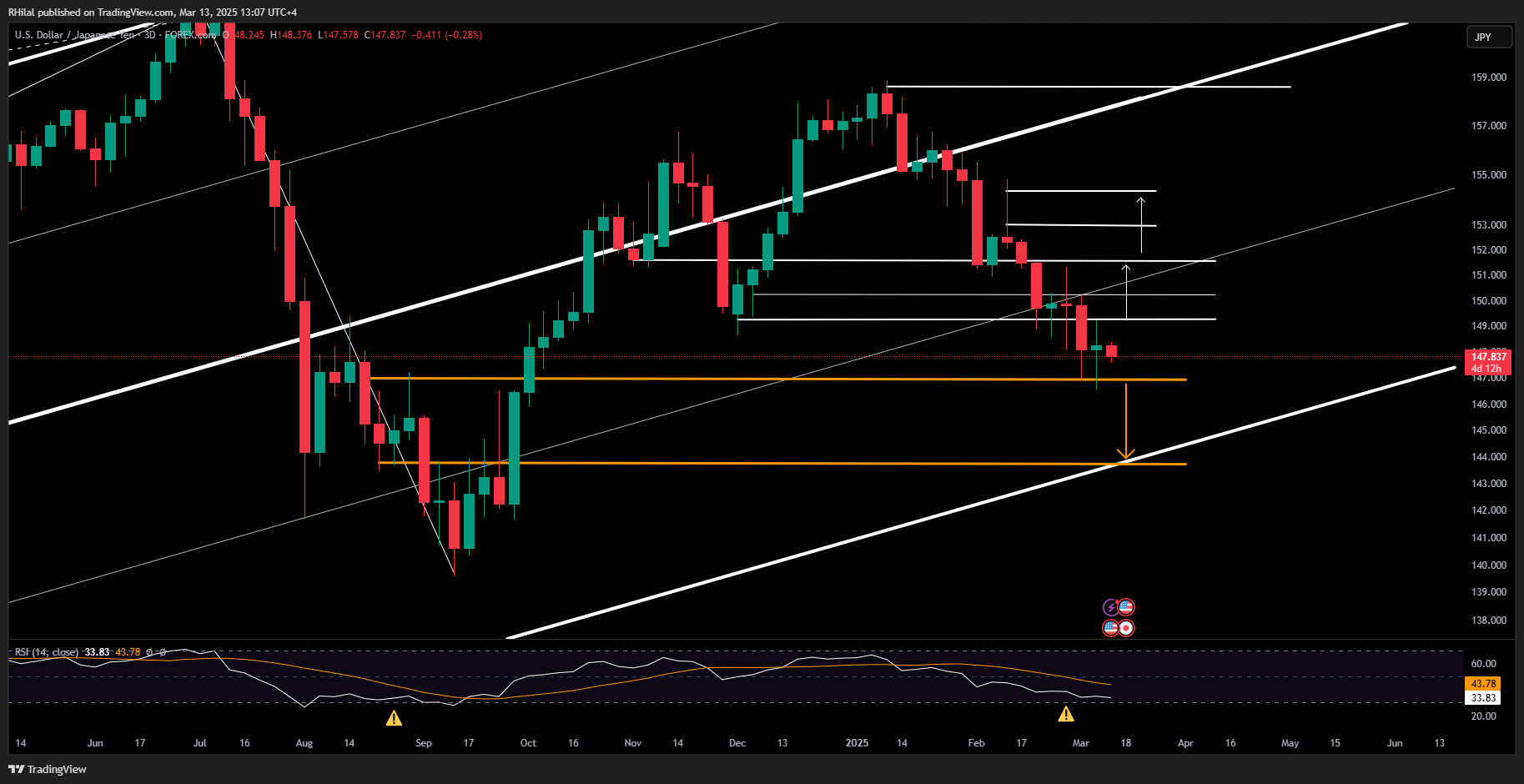

USDJPY Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

Following the US Dollar Index’s decline, holding above its November 2024 lows at 103.30, USDJPY has dropped toward the 0.618 Fibonacci retracement level of its uptrend between September 2024 and January 2025, settling at 146.90.

As the RSI on the 3-day time frame revisits oversold levels last seen in September 2024, when the pair dropped to 139.60, reversal risks may be emerging.

If USDJPY extends its decline below 146.90, the next major support lies at the 0.786 Fibonacci retracement level at 143.70. Conversely, if 146.90 holds, the trend could recover toward 149.00, 150.20, and 151.50, before potentially confirming a longer-term rebound.

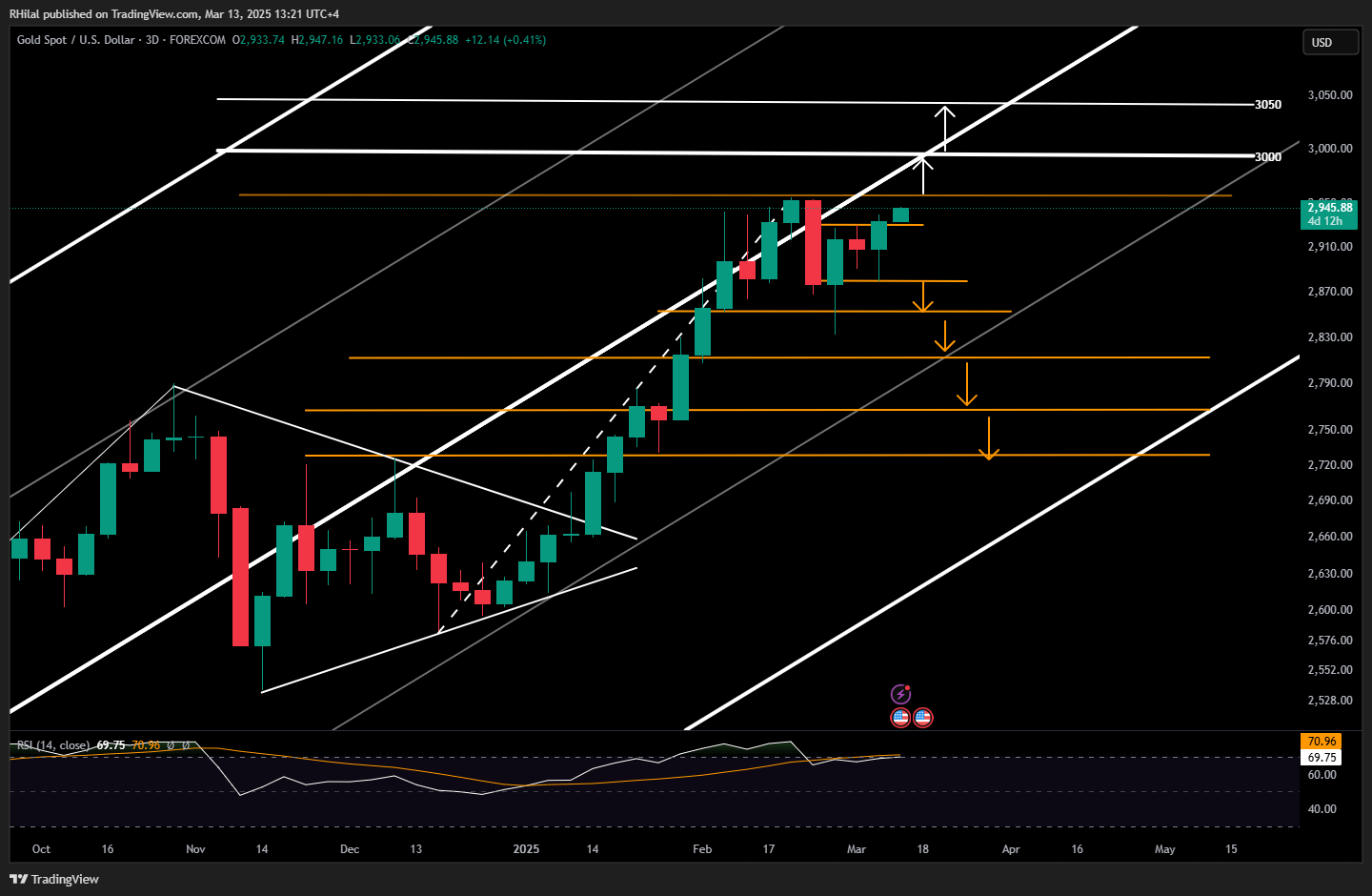

Gold Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

As gold retests the $2,955 record high, a bearish engulfing pattern at these levels raises the likelihood of a double-top formation—aligning with the overbought Relative Strength Index (RSI) readings across daily and monthly time frames.

- If gold holds above 2,960, it could break out toward 2,990, 3,000, and 3,050.

- On the downside, a drop below 2,930 and 2,900 could bring 2,850, 2,800, 2,760, and 2,720 into focus, allowing for a deep momentum reset before a potential continuation of its long-term uptrend.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves