Key Events:

- Trump withdraws proposed 50% tariffs on Canada; USDCAD remains below 1.45

- Trump and Ontario officials to meet in Washington on Thursday

- BOC expected to cut rates by 25 bps, weighed against U.S. tariff threats

- EU retaliates against U.S. tariffs with measures worth up to 26 billion euros

- U.S. CPI release keeps markets on edge amid recession concerns

Tariff-Induced Recession Fears Weigh on Risk Appetite

The U.S. dropped its 50% tariff threat on Canadian steel and aluminum after Ontario withdrew an electricity charge against U.S. imports. However, a 25% tariff on steel and aluminum remains in place, triggering EU retaliation with tariffs of up to 26 billion euros.

While markets reacted with bearish sentiment, Trump views the tariffs as a long-term boost for the U.S. economy, hinting at potential escalation. As a result, U.S. indices hover near critical lows, with the Nasdaq above 19,000, the Dow above 41,000, and the S&P above 5,520. Meanwhile, Bitcoin remains above 79,000 as market uncertainty persists.

Strategic Bitcoin Reserves Fail to Spur a Rally

The creation of a strategic Bitcoin reserve has yet to drive prices back to record highs, as bearish sentiment prevails amid White House policies that raise concerns over economic growth, consumer spending, and inflation. Bitcoin’s price action has closely followed U.S. indices, maintaining support above 79,000 ahead of the U.S. CPI report. This release is expected to trigger broader market volatility, exacerbated by the expanding trade conflicts involving the U.S., Canada, Mexico, China, and now the EU.

BOC Decision

The BOC faces a critical decision as the Canadian dollar weakens against the U.S. dollar, approaching nine-year lows near 1.45. Inflation concerns, coupled with ongoing trade tensions—including Trump’s proposal to integrate Canada as the 51st U.S. state—have heightened economic uncertainty.

Thursday’s scheduled meeting between Trump and Ontario officials could either resolve trade disputes or escalate tensions further, keeping markets on edge.

Technical Analysis: Quantifying Uncertainties

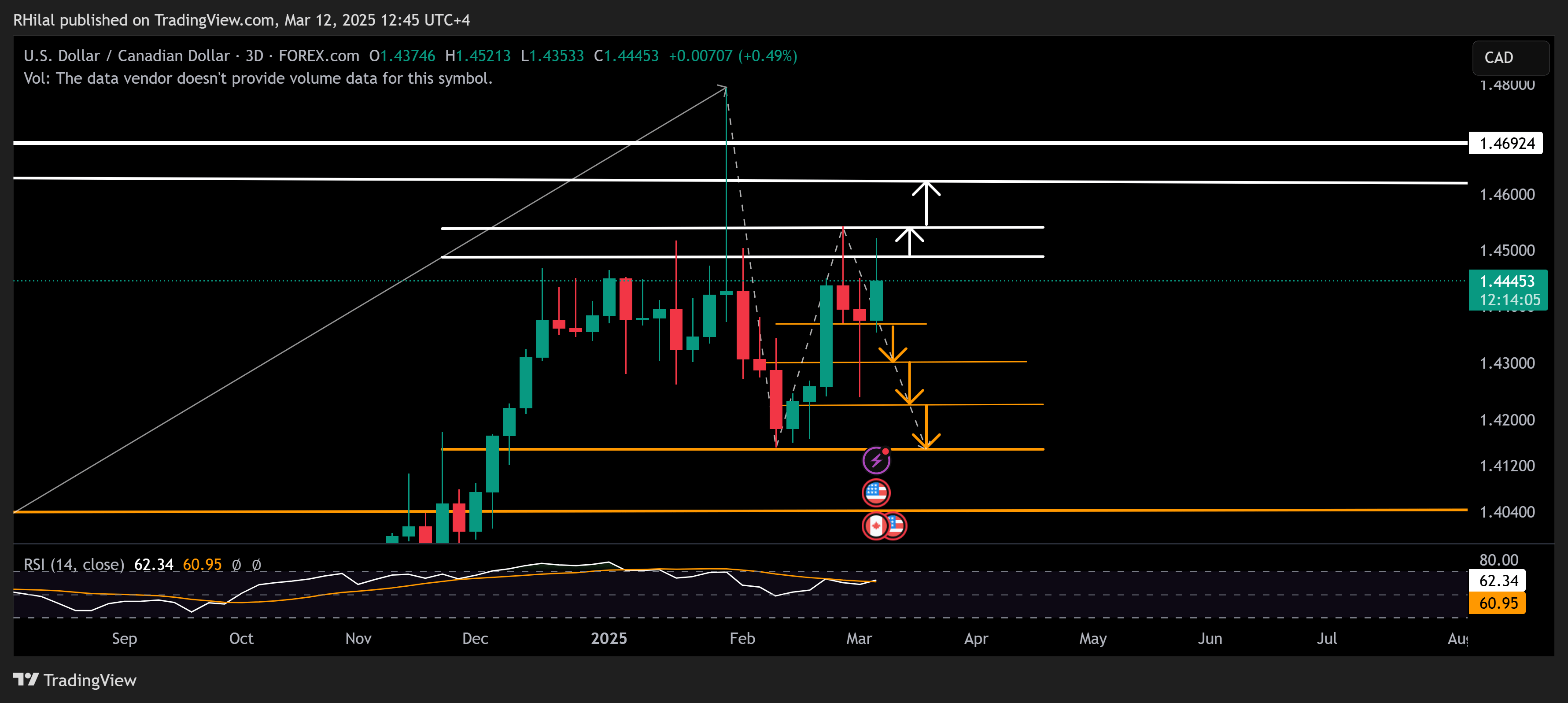

USDCAD Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

USDCAD tested 2025 highs after Trump announced the removal of 50% tariffs on Canadian steel and aluminum. However, it remains below 1.45 following Ontario’s withdrawal of energy-related countermeasures. The upcoming BOC decision and U.S. CPI report are likely to drive further volatility.

Bearish Scenario: A hold below 1.4540 could trigger a decline toward support levels at 1.4360, 1.43, 1.4220, and 1.4150

Bullish Scenario: A close above 1.4450 and 1.4540 may extend gains toward 1.4680 and 1.4840

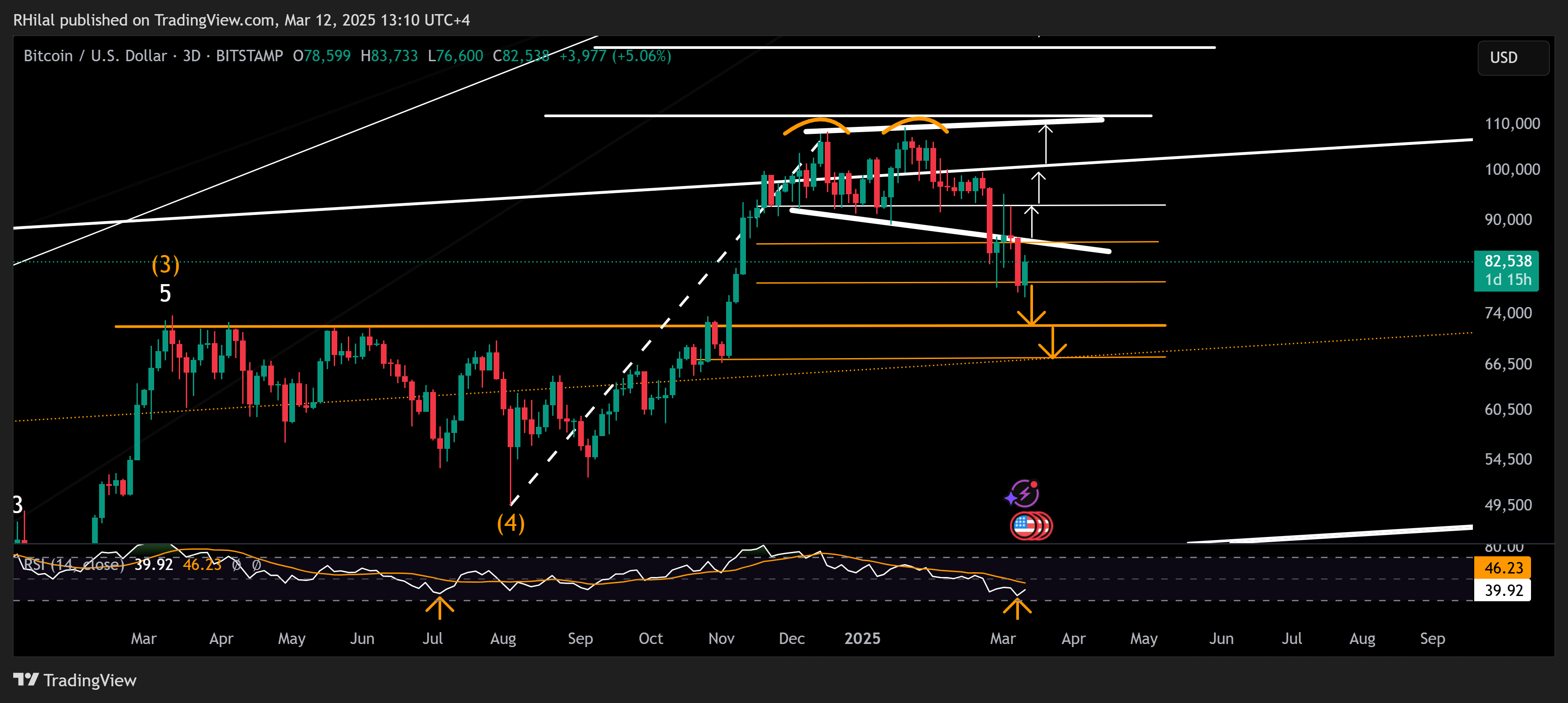

Bitcoin Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

Bitcoin has respected Fibonacci retracement levels drawn between the August 2024 low (49,577) and January 2025 high (109,350). Currently holding above 79,000, a close below this level could push prices toward March 2024 highs between 72,000 and 74,000.

- Downside Risks: A breakdown below 79,000 could see Bitcoin retesting 72,000–74,000. A close below 70,000 can drag the trend deeper towards 68,000, 62,000, and 50,000

- Upside Potential: Holding above 86,000 could extend gains toward 93,000, 100,000, and 109,000. A clean close above the record high has the potential to reach 130,000 and 150,000

Written by Razan Hilal, CMT

Follow on X: @Rh_waves