Key Events:

- EUR/USD extends to a new 2025 high above 1.09

- Dow rebounds from its 41,600-neckline

- Recession fears remain on hold ahead of U.S. CPI

EURUSD Soars Above 1.09 Ahead of US CPI

As markets anticipate the U.S. CPI release on Wednesday, alongside rising recession concerns and U.S. dollar weakness, EUR/USD has climbed above 1.09, testing key resistance levels with strong momentum.

If the pair advances beyond 1.10 and 1.1220, a longer-term bullish trend against the dollar could emerge. However, if it fails to sustain levels above 1.09, a short-term retracement may occur, allowing for a momentum recharge before the broader uptrend resumes.

Dow Holds Double Top Neckline

U.S. indices are facing significant headwinds as recession fears intensify and uncertainty surrounding Trump-era policies grows. These concerns have reinforced double top formations across the Nasdaq, Dow, and S&P 500 charts. While Nasdaq has reached its double top target, the Dow remains cautious at its neckline. Given the oversold state of the market, with momentum levels mirroring those last seen in 2022, the risk of price wicks and potential reversals is rising.

Technical Analysis: Quantifying Uncertainties

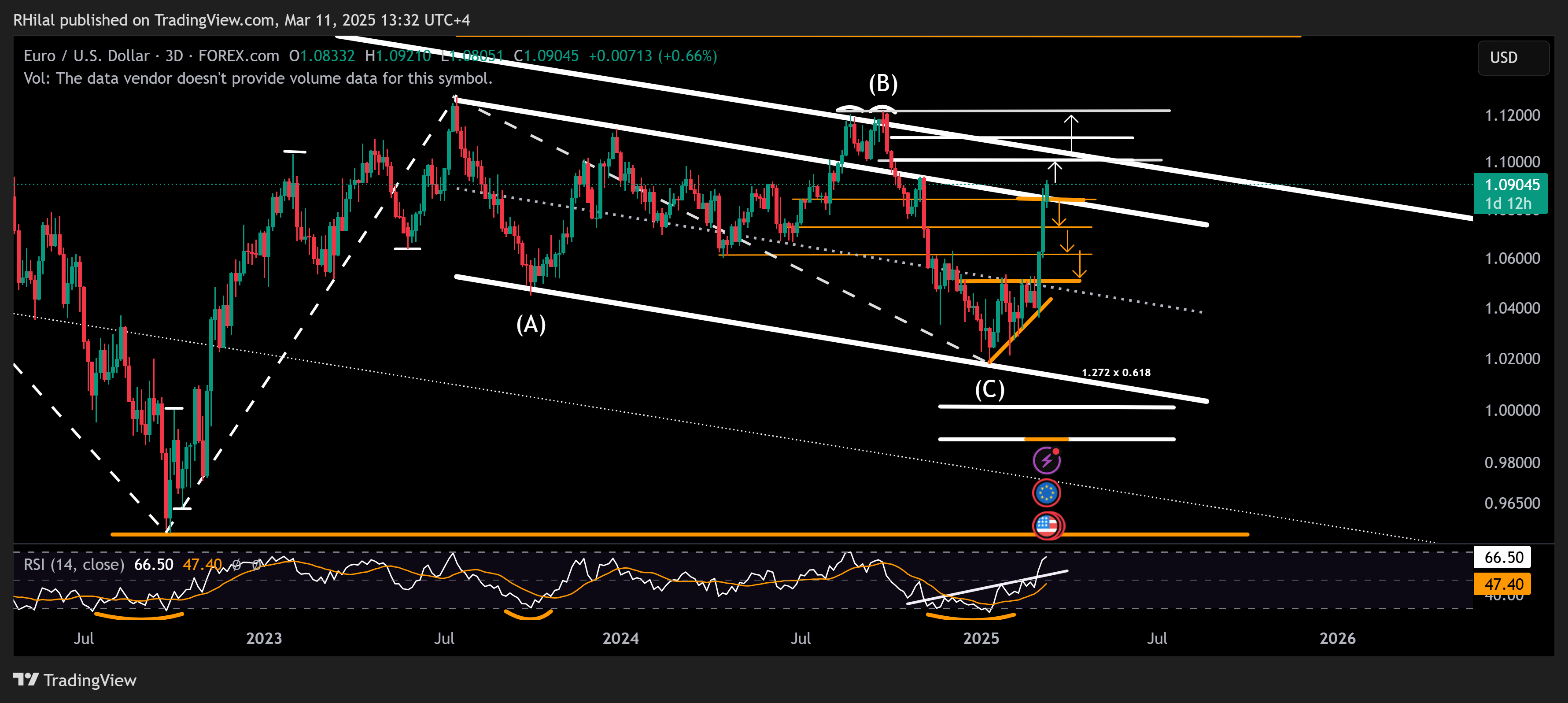

EURUSD Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

EUR/USD is currently hovering around 1.0920, just 20 pips below the November 2024 high of 1.0940. Holding above 1.0940 could extend the pair’s uptrend toward the long-term trendline connecting consecutive declining highs from 2008, aligning with the key 1.10 level. The final challenge before confirming a sustained bullish trend would be breaking above 1.1220, the 2024 high.

On the downside, if EUR/USD reverses below 1.0850, a retracement may unfold, with potential pullbacks toward 1.0730, 1.0630, and 1.0530.

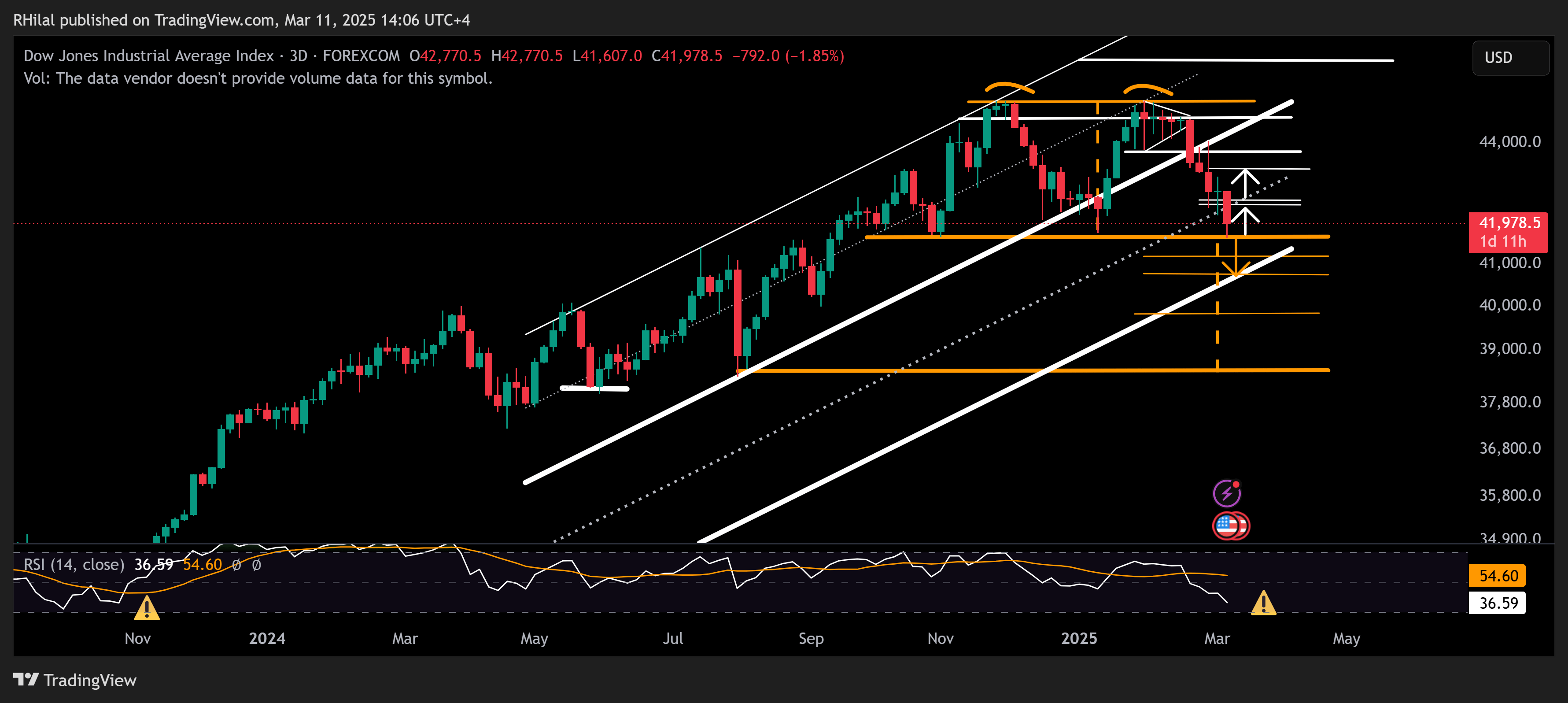

Dow Jones Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

Unlike the Nasdaq, which reached its double top target yesterday, the Dow has only tested the neckline of its respective double top formation from December 2024 to January 2025 at the 41,600 low. The Relative Strength Index (RSI) on the 3-day time frame is now hovering near oversold levels last seen in October 2023, signaling potential volatility and reversals.

A decisive close below the neckline at 41,600 could accelerate the Dow’s decline toward 40,800 and 40,200. The ultimate double top target aligns with the 50% Fibonacci retracement of the uptrend from October 2023 (32,320) to the January 2025 high (45,078), at 38,700.

On the upside, if the Dow holds above the 41,600-neckline, a bullish rebound could materialize, targeting 43,500, 43,800, and 44,600, with the potential to push toward new record highs.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves