In the last two trading sessions, XAU/USD has recorded a gain of over 1.8%. The bullish bias remains intact due to market uncertainty over new tariff policies and the loss of confidence reflected in the Fear & Greed Index.

New Factors Come into Play

Gold has taken on a key role in financial markets, consolidating its position as a safe-haven asset amid the escalating trade war and rising geopolitical tensions. In times of uncertainty, investors are once again turning to gold as a reliable store of value.

This trend is particularly evident in China, where the country has once again increased its gold reserves. As of the end of February, total reserves reached $208 billion, compared to $206 billion at the end of January. The Chinese government has repeatedly expressed concerns about a potential global economic slowdown in 2025, prompting an increased allocation to gold as a long-term capital preservation strategy.

Additionally, last week, data revealed that the U.S. trade deficit remains at a record high of $131.4 billion for January, raising doubts about the short-term stability of the U.S. economy. This uncertainty has further fueled gold purchases as a hedge.

However, some factors have partially reduced geopolitical risk sentiment, such as the potential ceasefire in Ukraine, which is being promoted by the U.S. government. This has opened the door to a possible new peace agreement with Russia and has, to some extent, slowed the bullish momentum gold had maintained in recent sessions.

As a safe-haven asset, XAU/USD is highly sensitive to global political and economic events. If economic uncertainty continues to rise in the coming sessions, buying pressure on gold could return with strength.

Market Sentiment

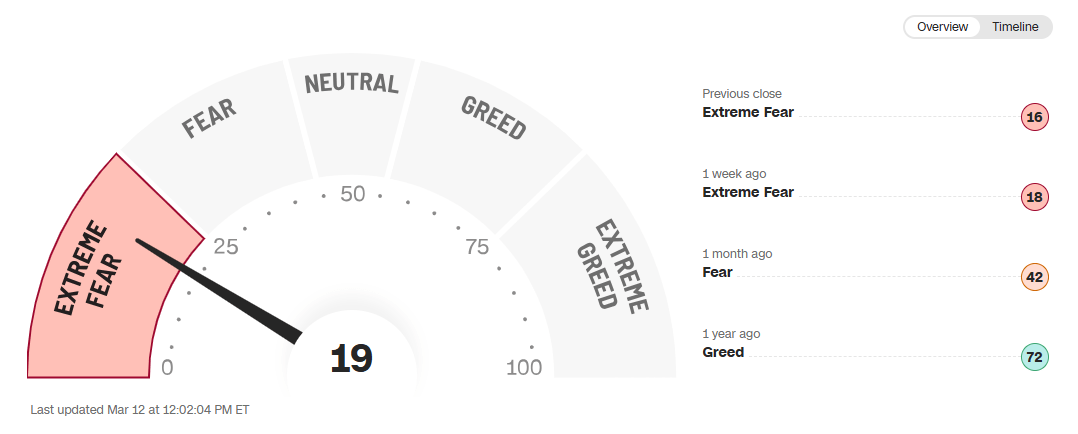

The Fear & Greed Index, published by CNN, is currently at 19, generating a strong sense of distrust in the markets. This is partly due to the escalating trade war, which is weakening positive outlooks, and for now, the index continues to hover in the "extreme fear" zone.

Source: CNN

The current index values reflect ongoing market concerns about uncertainty stemming from U.S. tariffs in recent sessions. This has increased demand for safe-haven assets, such as XAU/USD.

If the index continues to hover below 25, signaling extreme fear, demand for gold will likely remain strong. In this scenario, the bullish pressure on XAU/USD, which has dominated in recent weeks, could extend into upcoming trading sessions.

Gold Technical Outlook

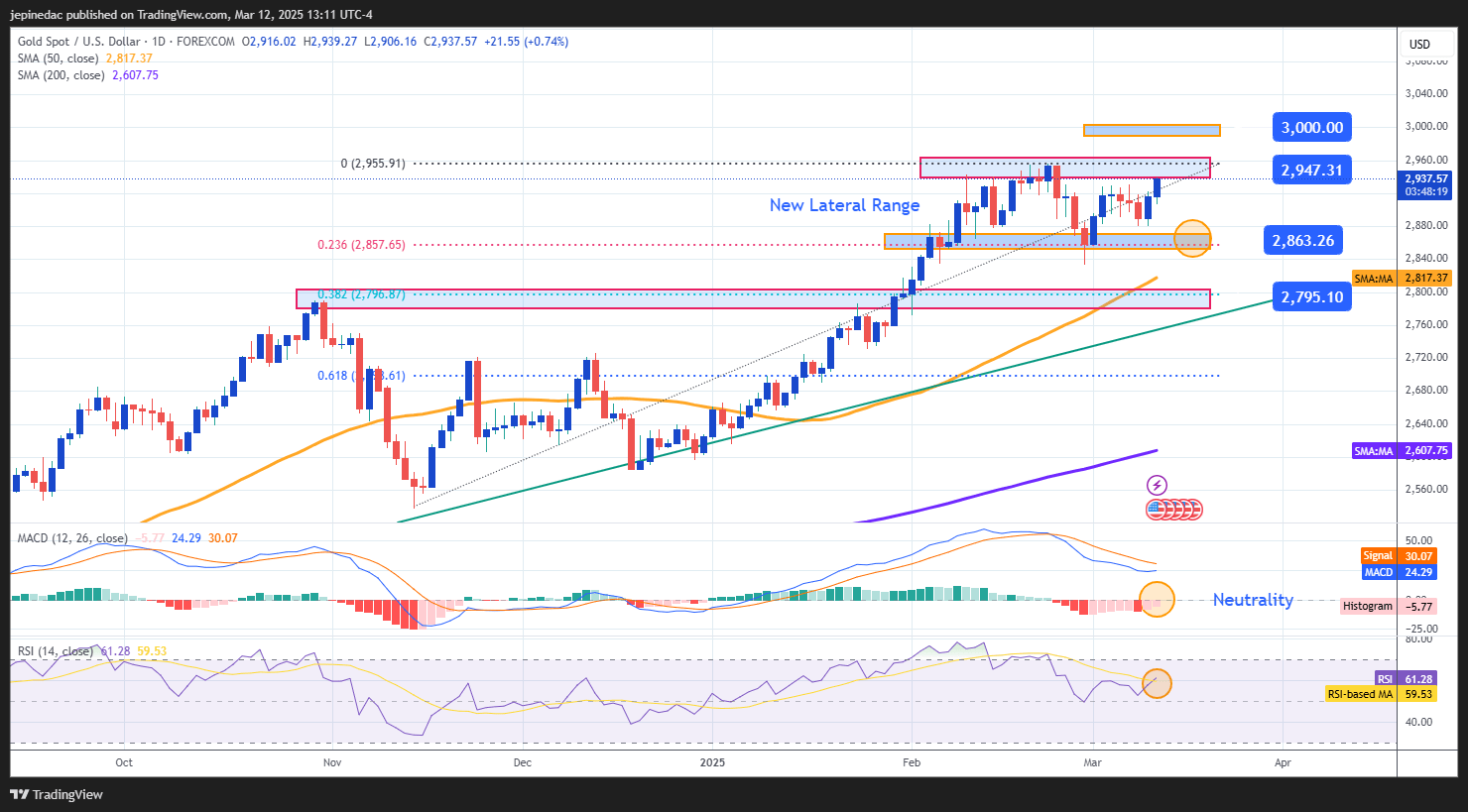

Source: StoneX, Tradingview

- Sideways Range Formation: Since February 10, gold has been trading within a sideways range, with resistance at $2,950 per ounce and support at $2,860 per ounce. Currently, bullish pressure is testing the upper barrier, which could lead to buyer exhaustion as the price approaches its all-time high recorded a few weeks ago.

- RSI: The RSI remains above 50, indicating that buying momentum has remained dominant over the last 14 periods. If the RSI line continues to rise, bullish pressure could accelerate in the short term. However, readings near 70 should be monitored, as they could signal overbought conditions, increasing the likelihood of downside corrections.

- MACD: The MACD histogram has begun to show a small upward movement, approaching the neutral zone (0). If it manages to break above this level, the MACD could indicate a sustained bullish impulse, reinforcing the upward trend in XAU/USD.

Key Levels to Watch:

- $3,000 – Tentative Resistance: A breakout above this psychological level could reinforce bullish expectations, attracting additional buying pressure in the short term and strengthening the paused upward trend from recent trading sessions.

- $2,950 – Current Resistance: This level remains the most significant short-term barrier, aligning with gold’s all-time high. If XAU/USD breaks above this level, it could invalidate the current sideways range and pave the way for further bullish pressure.

- $2,860 – Key Support: This level coincides with the 23.6% Fibonacci retracement and a recent low recorded at the end of February. A drop below this level could increase bearish pressure, threatening the long-term upward trend.

Written by Julian Pineda, CFA – Market Analyst