US Dollar Outlook: USD/CHF

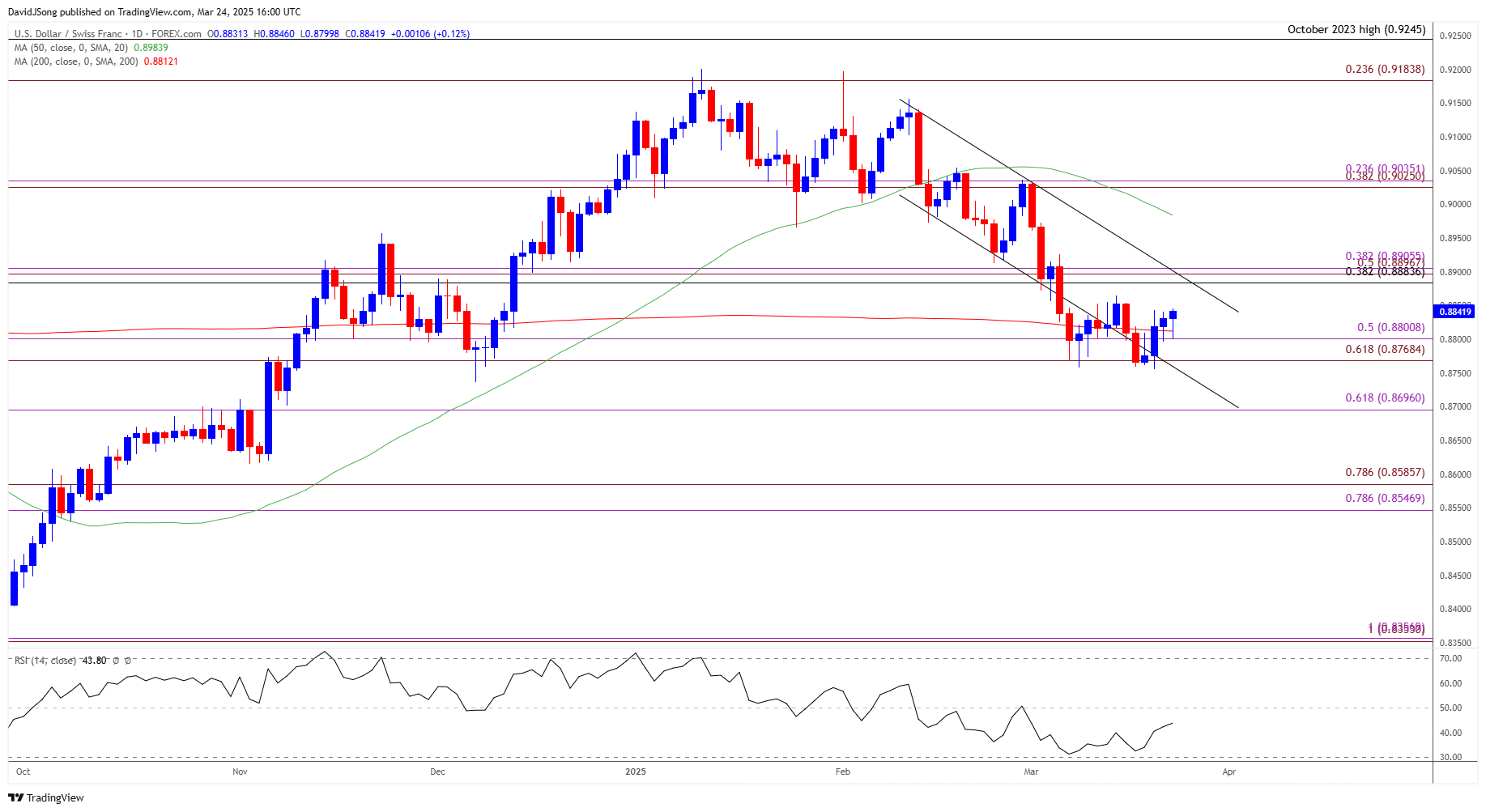

USD/CHF approaches channel resistance as it attempts to extend the rebound from the monthly low (0.8756), with the recent recovery in the exchange rate keeping the Relative Strength Index (RSI) above 30.

US Dollar Forecast: USD/CHF Approaches Channel Resistance

USD/CHF may threaten the descending channel from earlier this year as it stages a four-day rally, and the RSI may show the bearish momentum abating as it moves away from oversold territory.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

As a result, USD/CHF may further retrace the decline from the monthly high (0.9031), but the rebound in the exchange rate may turn out to be temporary as the 50-Day SMA (0.8984) establishes a negative slope.

With that said, USD/CHF may continue to track the descending channel as long as it holds below the moving average, and the exchange rate may stage additional attempts to test the December low (0.8736) should it pull back ahead of channel resistance.

USD/CHF Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CHF Price on TradingView

- USD/CHF approaches channel resistance after failing to test the December low (0.8736), with a break/close above the 0.8880 (38.2% Fibonacci retracement) to 0.8910 (38.2% Fibonacci extension) zone raising the scope for a move towards the monthly high (0.9031).

- Need a break/close above the 0.9030 (38.2% Fibonacci extension) to 0.9040 (23.6% Fibonacci extension) region to open up the February high (0.9197), but USD/CHF may struggle to retain the rebound from the monthly low (0.8756) should it continue to track the descending channel from earlier this year.

- Lack of momentum to break/close above the 0.8880 (38.2% Fibonacci retracement) to 0.8910 (38.2% Fibonacci extension) zone may push USD/CHF back towards the 0.8770 (61.8% Fibonacci extension) to 0.8800 (50% Fibonacci extension) region, with a breach below the December low (0.8736) bringing 0.8700 (61.8% Fibonacci extension) on the radar.

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Breakout Looms on Trump Tariffs

EUR/USD Post-Fed Weakness Pulls RSI Back from Overbought Zone

Gold Price Rally Pushes RSI Back into Overbought Territory

AUD/USD Fails to Test February High Ahead of Fed Rate Decision

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong