US Dollar Outlook: USD/CHF

USD/CHF may continue to track the descending channel from earlier this year as it gives back the rebound from the monthly low (0.8758).

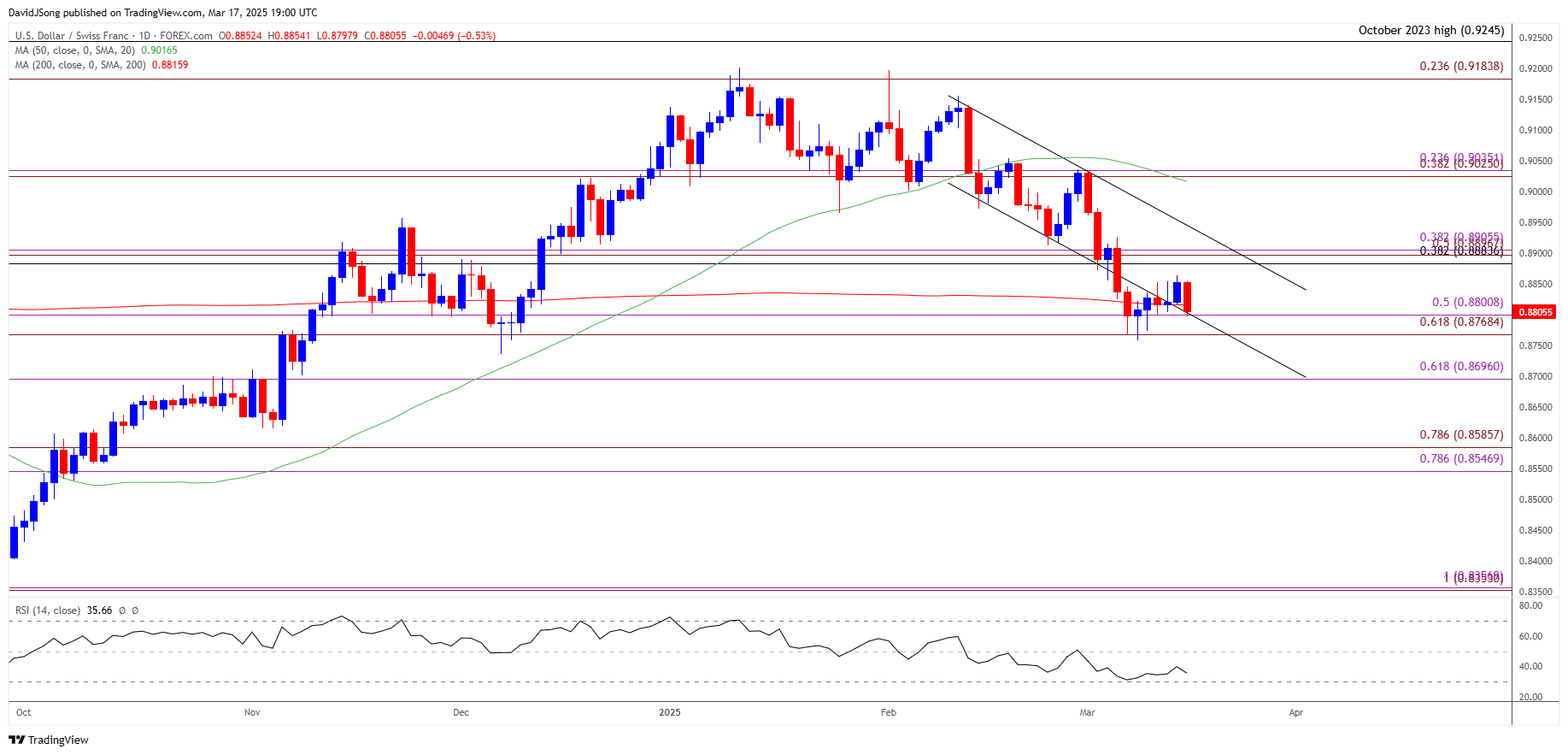

USD/CHF Falls to Channel Support Ahead of Fed Rate Decision

USD/CHF falls to channel support as it struggles to retain the advance from the previous week, and the exchange rate may stage another attempt to test the December low (0.8736) as it snaps the recent series of higher highs and lows.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, a further decline in USD/CHF may push the Relative Strength Index (RSI) back towards oversold territory, but the Federal Reserve interest rate decision may sway the exchange rate as the central bank is expected to keep US interest rates on hold.

US Economic Calendar

The Federal Open Market Committee (FOMC) is anticipated to retain the current policy as the transition in US trade policy clouds the outlook for economy, and more of the same from the central bank may generate a bullish reaction in the US Dollar as Chairman Jerome Powell insists that ‘we do not need to be in a hurry to adjust our policy stance.’

With that said, USD/CHF may threaten the descending channel should the Fed endorse a wait-and-see approach, but the exchange rate may struggle to retain the rebound from the monthly low (0.8758) if the FOMC shows a greater willingness to further unwind its restrictive policy.

USD/CHF Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CHF Price on TradingView

- USD/CHF bounces along channel support as it gives back the advance from last week, with a break/close below the 0.8770 (61.8% Fibonacci extension) to 0.8800 (50% Fibonacci extension) region bringing the December low (0.8736) back on the radar.

- A break/close below 0.8700 (61.8% Fibonacci extension) opens up the November low (0.8615), but lack of momentum to break/close below the 0.8770 (61.8% Fibonacci extension) to 0.8800 (50% Fibonacci extension) region may keep USD/CHF within the monthly range.

- USD/CHF may threaten the descending channel from earlier this year should it break/close above the 0.8880 (38.2% Fibonacci retracement) to 0.8910 (38.2% Fibonacci extension) zone, with the next area of interest coming in around the monthly high (0.9031).

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Coils Ahead of Reciprocal Trump Tariffs

EUR/USD Rebounds Ahead of Weekly Low to Keep RSI in Overbought Zone

USD/JPY Rebound in Focus with BoJ Expected to Hold Interest Rate

Gold Record High Price Pushes RSI Towards Overbought Zone

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong