US Dollar Index Technical Outlook: USD Short-term Trade Levels

- US Dollar plunges to 2025 lows as Trump announces tariff regime- DXY breaks February opening-range

- USD threat for deeper correction ahead- key technical support objectives now in sight

- Resistance 107.93-108.06, 108.50/52, 108.97 (key)- Support 106.67, 106.10/35 (key), 105.42

The US Dollar Index is poised to mark a fourth consecutive daily loss with DXY off more than 1.2% since the start of the week. A break of the February range threatens a larger decline into the close of the month with key support now in view. Battles lines drawn on the DXY short-term technical charts.

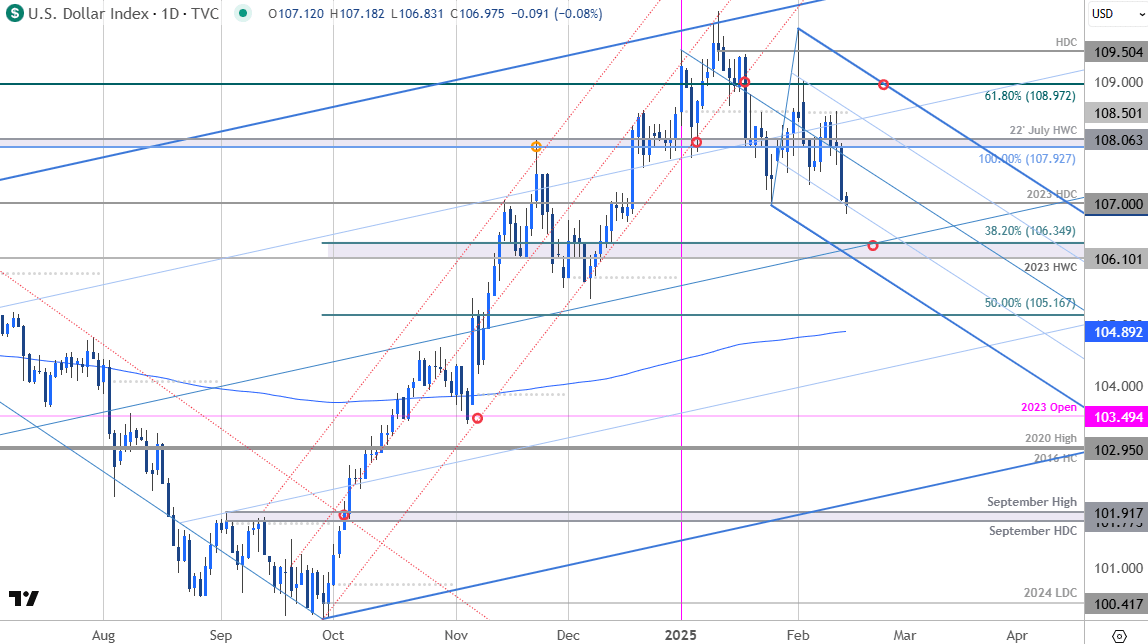

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this US Dollar technical setup and more. Join live on Monday’s at 8:30am EST.US Dollar Index Price Chart – USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Technical Outlook: In last month’s USD Short-term Outlook, we noted that DXY was, “testing support at the monthly range lows- looking for a reaction off this mark in the days ahead. From a trading standpoint, rallies should be limited to 109 IF price is heading for a deeper correction here with a break below the median-line needed to fuel the next major leg of the decline.”

The index broke lower two-days later with the losses extending more than 2.9% off the yearly high to register an intraday low at 106.97. A rebound into the February-open failed to mount the 109-handle with the subsequent reversal breaking the monthly opening-range lows yesterday- threat for a deeper decline in the greenback.

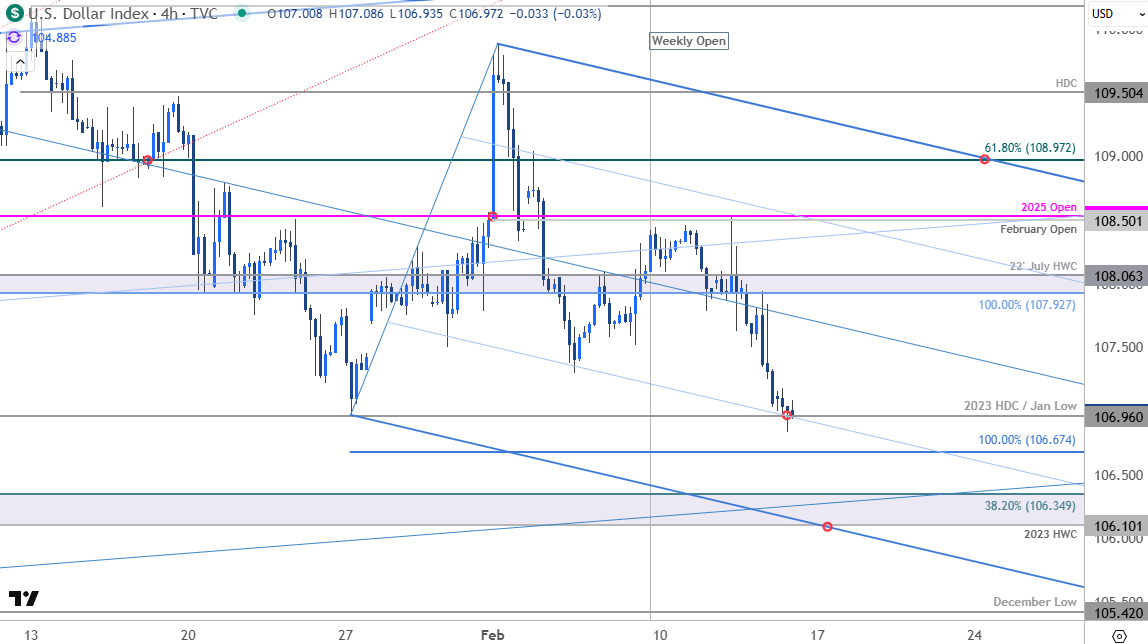

US Dollar Index Price Chart – USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Notes: A closer look at USD price action shows the index trading within the confines of a descending pitchfork with the decline now probing confluent support here near the 25% parallel / 2023 high-day close (HDC) / January low at around the 107-handle. Subsequent support rests just lower at the 100% extension of the January decline at 106.67 and 106.10/35- a region defined by the 2023 high-week close and the 38.2% retracement of the September advance.Look for a larger reaction there IF reached with a break / close below needed to suggest a more significant high was registered last month / larger trend reversal is underway.

Initial resistance is eyed at 107.92-108.06 and is backed closely by the February / January monthly opens at 108.50/52- rallies would nee to be limited to this threshold IF price is heading lower on this stretch with broader bearish invalidation se to he 61.8% retracement of the 2022 decline at 108.97.

Bottom line: A break of the February opening-range threatens further loses here for the US Dollar with confluent uptrend support seen just lower. From at trading standpoint, look to reduce portions of short-exposure / lower protective stops on a stretch towards 106- rallies should be limited to the median-line (~107.70s) IF price is heading lower on this move with close below the lower parallel needed to threaten the next major leg of the decline- watch the weekly closes here. Review my latest US Dollar Weekly Forecast for a closer look at the longer-term DXY technical trade levels.

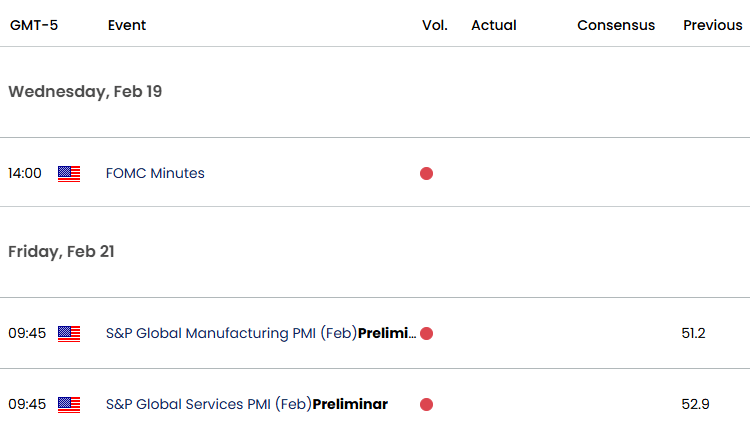

Key US Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Gold Short-term Outlook: XAU/USD Poised for Breakout on Trump Tariffs

- Australian Dollar Short-term Outlook: AUD/USD Bulls Emerge

- Euro Short-term Outlook: EUR/USD Poised for February Breakout

- Japanese Yen Short-term Outlook: USD/JPY Bulls Retreat

- Canadian Dollar Short-term Outlook: USD/CAD Crashes on Trump Tariffs

- Swiss Franc Short-term Outlook: USD/CHF Snaps Back from Support

- British Pound Short-term Outlook: GBP/USD Bulls Eye Resistance

Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex