- EUR/USD forecast remains lifted by Germany’s historic spending shift

- Dollar steadies after a dovish Fed meeting and mixed US inflation signals

- Market focus turns to US Core PCE Index this week

The EUR/USD turned lower after initially starting the session on the front-foot. With US market rebounding sharply, this helped to lift the USD/JPY sharply higher and that in turn caused the dollar index to rise, even if some commodity currencies like the CAD rose against the greenback. Risk appetite improved on reports that Trump’s tariffs will be more targeted than initially thought, helping to reduce the appetite for safety to send gold prices lower. Today’s global PMI data were mixed, with US and UK services sectors doing particularly well compared to expectations, while German and French manufacturing PMIs improved more than expected, albeit remained below the expansion level of 50. Despite this, the EUR/USD forecast remains bullish in our view in light for Germany’s historic spending shift that was approved last week.

Week ahead: Will this week’s data drive EUR/USD higher?

Monday’s global PMI releases didn’t offer a clear directional bias for the paid, as we had mixed data from both sides of the pond, but ultimately it was the stronger US services PMI that did the trick for the dollar. The services PMIs from the Eurozone, on the other hand, were far from impressive. This fresh read on business activity has dampened the mood somewhat after the recent rally on the back of Germany’s fiscal largesse.

But this week could prove pivotal for the EUR/USD forecast and the unimpressive services PMI data out of the Eurozone may only limit the euro’s strength temporarily, given the recent improvement in sentiment towards European assets.

Much also hinges on Friday’s Core PCE release out of the US. The greenback ended last week in consolidation mode, hovering after a rather uninspiring week marked by mixed economic data and a slightly dovish Federal Reserve. Chair Jerome Powell struck a reassuring tone, downplaying inflation risks from fresh tariffs and reiterating the resilience of the US economy. While the University of Michigan’s inflation expectations survey triggered some jitters, Powell dismissed this as noise, suggesting tariff-driven inflation might prove fleeting.

All eyes now turn to Friday’s core PCE print – the Fed’s inflation barometer. Powell’s optimism will be tested as markets await confirmation that inflation pressures remain contained. It is expected to print another +0.3% m/m reading, similar to the previous month. If correct, that will see the year-over-year rate climb to 2.7% from 2.6% the month before.

Germany’s fiscal revolution bolsters EUR/USD forecast

But the euro is likely to find continued support on any short term dips after Germany approved a landmark spending package in a significant break from its long-standing fiscal conservatism, last week. Worth €500 billion, this stimulus is designed to reignite Europe’s largest economy and ramp up military expenditure. For years, Berlin has been a staunch advocate of fiscal prudence; now, the taps are firmly turned on.

The scale of this investment in infrastructure and defence could well be a game-changer, potentially buoying German GDP and adding a layer of inflationary pressure – both supportive for the medium-term EUR/USD forecast.

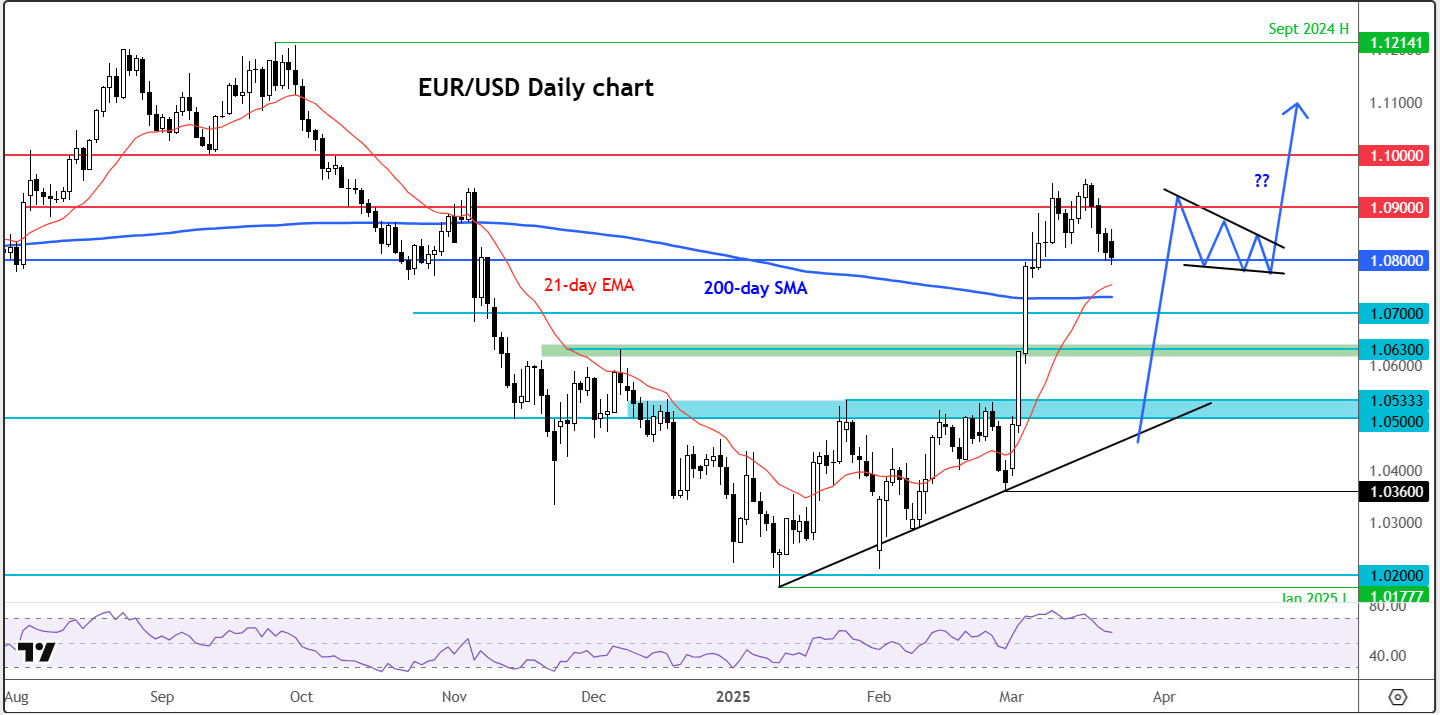

Technical EUR/USD forecast: a potential rally to +1.10 still on the cards

Source: TradingView.com

Technically speaking, the EUR/USD lost momentum after it gave up some ground last week but at around 1.0800 area it is still holding within striking distance of the 1.10 mark. The bulls will need to defend the 1.08 region to keep the upward momentum intact. Should this level give way, support can be found at 1.0730 – the 200-day moving average – followed by 1.0700 and 1.0630.

On the topside, resistance sits at 1.0900 and 1.0950, with the key psychological barrier at 1.1000 looming large. The coming days could determine whether we see a fresh leg higher or a deeper pullback.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R