The EUR/USD looks poised to remain relatively well-supported in the near term. In the US, weakening data and trade uncertainty has undermined the dollar, while over in Europe, attention has been on fiscal stimulus measures and defence spending commitments from Germany. Meanwhile, expectations are growing that the European Central Bank could signal a pause in its easing cycle at its 17 April meeting. Against this backdrop, it is difficult to be bearish on the EUR/USD forecast.

Can the euro rise further this week?

Well, there are a few key events could lend the euro a helping hand. First, any breakthrough between Trump and Putin on Ukraine ceasefire talks should be euro-positive, as we have seen in recent weeks. Then there is the Germany’s lower house pushing through reforms to the debt brake while green-lighting a substantial fiscal stimulus package that includes a €500 billion infrastructure fund. If the bill is passed, then the markets could well take another boost from this, having already rallied sharply in recent weeks. That, in turn, could keep the single currency on the front-foot. Meanwhile, ECB President Christine Lagarde could potentially nudge market expectations towards a pause in April when she speaks on Thursday – with markets pricing in a coin flip for a pause or cut for that meeting.

Weakening US data is boosting the EUR/USD forecast

A flagging US dollar, weighed down by underwhelming economic data, has lent support to the EUR/USD forecast. Should this trend continue, the pair could well remain on the front foot. Today’s focus was on US retail sales for February, which came in weaker.

Amidst all the stop-start drama surrounding this year’s US tariff saga, one nagging worry continues to cast a shadow over US interest rates and equities – the prospect of a cooling US consumer. There’s a growing sense that the belt-tightening may have begun. With uncertainty lingering over how the new administration’s economic agenda and labour market policies will play out, households appear increasingly inclined to pocket their cash rather than splash it.

All eyes, then, were on today’s US retail sales print for February. The market was pencilling in a 0.6% month-on-month rebound following January’s sharp 0.9% fall in headline retail sales. But as it turned out, sales rose only modestly – by 0.2% m/m – and last month’s print was revised lower to -1.2% m/m. Core sales printed +0.3% m/m as expected, although the prior month was revised lower to -0.6% from -0.4%. However, it was not all bad news: the control group measure of retail sales was much stronger than expected at 1.0% vs. +0.3% eyed.

On top of retail sales, the Empire State Manufacturing Index came in weaker at -20.0 vs. -1.9 eyed.

With these figures underwhelming, we could well see US yields slip lower, and the dollar take another knock.

FOMC seen holding steady

This week there is trifecta of central bank decisions: Bank of Japan, Bank of England and the Federal Reserve. While significant policy shifts are not a given, any dovish surprises could cause the dollar to move. As far as the EUR/USD forecast is concerned, the one to watch is the Federal Reserve. The Fed is tipped to keep rates steady on Wednesday. Yet should Jerome Powell and company signal a tilt towards cuts sooner than expected, the dollar could weaken, underpinning the EUR/USD. Traders will dissect every line of the Fed’s policy statement, economic projections, and Powell’s press conference for clues.

The Fed’s meeting comes after softer-than-expected CPI and PPI prints pressured the greenback further. Then came Friday’s disappointing University of Michigan consumer sentiment survey, which fell to 57.9 from 64.7, missing forecasts of 63.1. This marks the third consecutive month of declines in consumer confidence, likely driven by growing anxieties over Trump’s trade manoeuvres and their drag on economic optimism. Of particular note was the sharp rise in inflation expectations—jumping from last month’s 4.3% to a hefty 4.9% in March. The UoM data suggests that, despite easing headline inflation figures, price pressures are bubbling beneath the surface, just as consumer confidence is taking a knock. Stagflation.

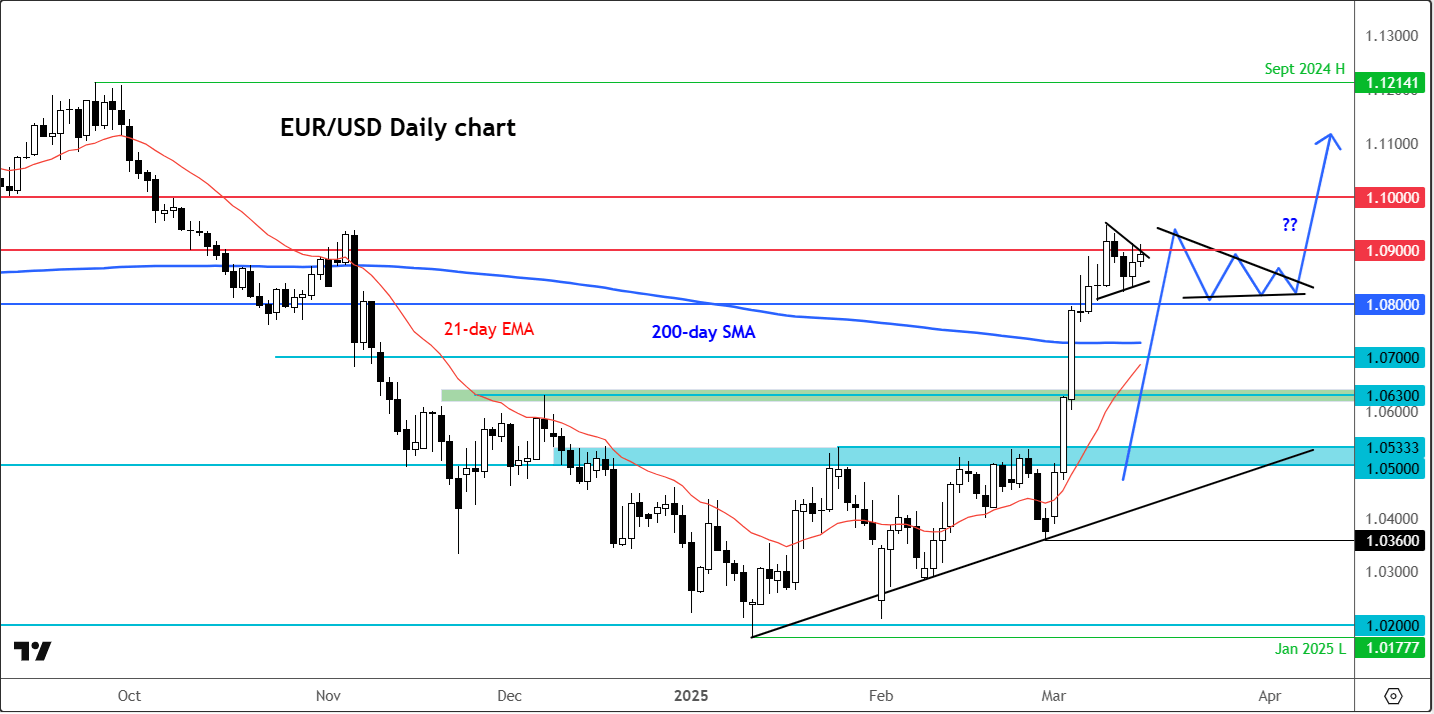

Technical EUR/USD forecast: Key levels to watch

Source: TradingView.com

Following the recent upsurge in the EUR/USD exchange rate, it has broken lots of resistance levels but in the process, it has also pushed the momentum indicators to the overbought levels. The fact that the pair has been consolidating in the last 3-4 sessions means those overbought conditions are being worked off through time rather than price action, which is always a bullish sign. The EUR/USD appears to be residing inside a triangle continuation pattern. So, all told, it looks like the path to 1.10 has now been cleared, if it can now post a decisive close above 1.0900 handle. Support comes in around 1.0850, 1.088 and then the 200-day average at 1.0730.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R