It has been a quite day in the FX space with the dollar remaining in a holding pattern following this week’s mixed data and the Fed’s dovish-leaning policy meeting, where Chairman Jerome Powell downplayed economic risks and didn’t appear too concerned about the impact of tariffs. Powell attempted to shore up market confidence, asserting that the economy remains resilient and that long-term inflation expectations are well-anchored—despite the University of Michigan’s latest survey painting a less reassuring picture. He even suggested that the inflationary impact of Trump’s tariffs could prove to be merely transitory. Meanwhile, the Bank of England also kept rates unchanged with just one policymaker voting for a cut. The GBP/USD forecast will be in focus again with UK CPI and the Fed’s favourite inflation measure to come in the week ahead, along with global PMIs.

Week ahead: Global PMIs, UK CPI and US Core PCE Price Index

- Global PMIs - Monday, March 24

We will get the latest Purchasing Managers’ Indices from around the world on Monday, with European ones likely to garner most of the attention. Let’s see if Trump’s trade war has already impacted business activity around the world. In Europe, Manufacturing PMIs have been improving ever so slightly, but still remain below the expansion threshold of 50.0. The recent upsurge in major Eurozone indices such as the DAX suggests investors are expecting recovery to gather pace in the months ahead, as the impact of the big German fiscal stimulus measures come into play.

- UK CPI - Wednesday, March 24

The annual pace of UK inflation climbed to 3.0% last month, which was more than expected and represented a sizeable jump from the 2.5% recorded the previous month. As such, only one member of the Bank of England’s monetary policy committee voted for a rate cut last week, with the other 8 voting to hold rates. It would take a big downward surprise in UK inflation to cause sterling to weaken, given that the UK is seen to avoid Trump’s trade tariffs, keeping the GBP/USD holding near 1.30 handle. Headline CPI is expected to cool to 2.9% this month.

- US Core PCE price index - Friday, March 28

Both the CPI and RPI measures of inflation came out weaker-than-expected earlier this month, while UoM survey showed rising inflation expectations at an alarming rate. But now the focus turns to the Fed’s favourite inflation measure – the core PCE Price Index. Fed Chair Powell said long-term inflation expectations are anchored and that price hikes stemming from Trump’s tariffs could be transitionary. Meanwhile’s the softer CPI print was primarily concentrated in services, meaning it may not translate directly into a lower PCE Price Index. Another +0.3% m/m reading is expected.

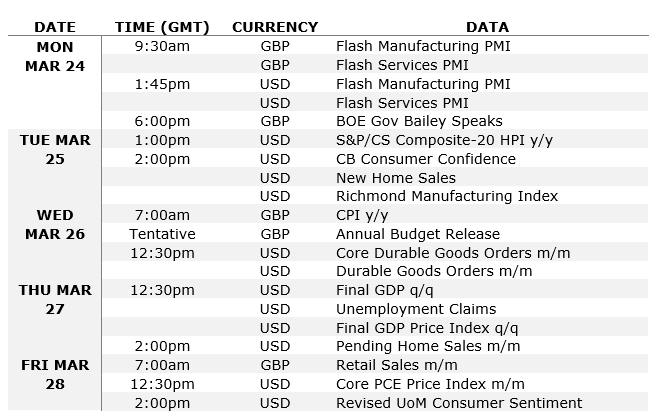

Economic calendar for GBP/USD forecast

Here’s the full calendar for the week ahead, relevant only for the GBP/USD pair:

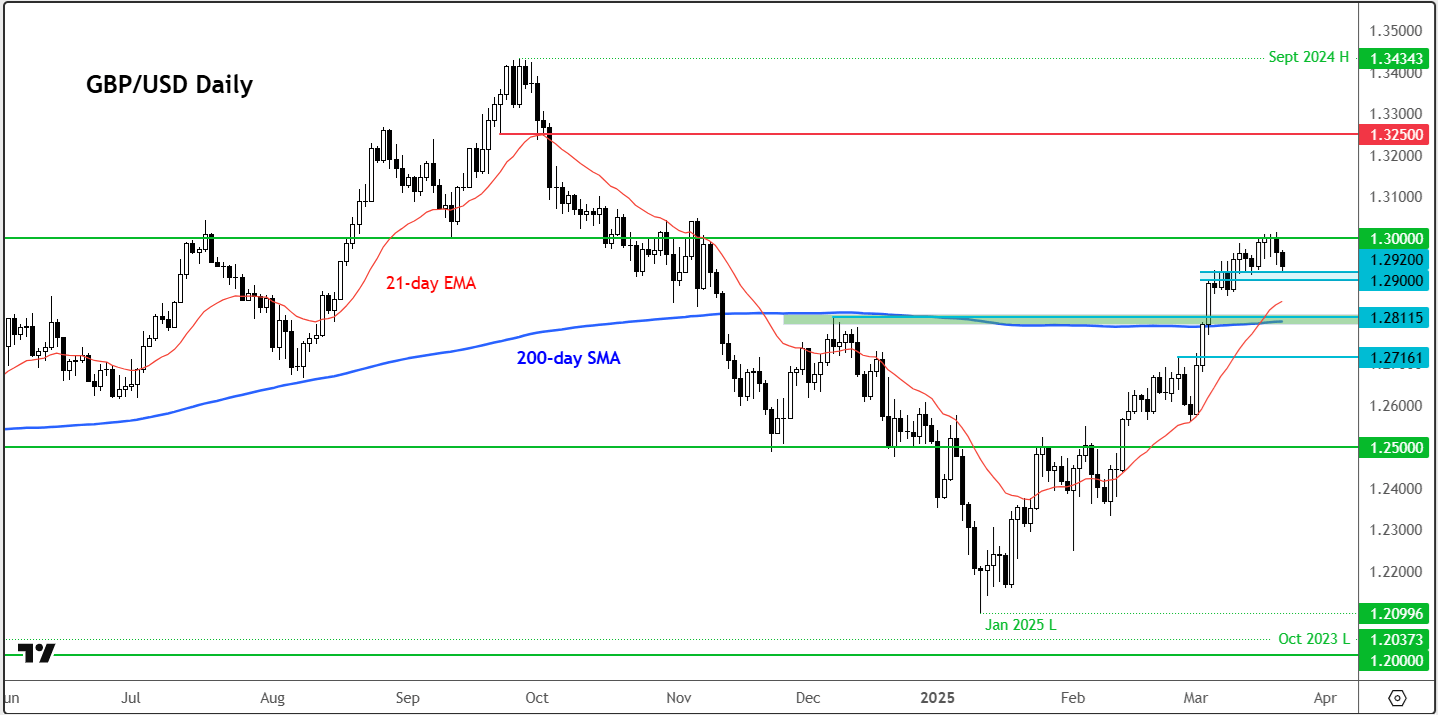

Technical GBP/USD forecast: Key levels to watch

Source: TradingView.com

The technical GBP/USD forecast remains bullish despite its recent loss of momentum. The higher highs and higher lows ever since the middle of January means dip-buyers will be keen to step in on the back of any short-term weakness – until the trend reverses. Key short-term support is seen between 1.2900 to 1.2920 area. Below that 1.2800-1.2810 is the next key support where prior resistance meets the 200-day average. Resistance comes in at 1.30, the psychologically-important level, with subsequent bullish targets being the next round handles like 1.3100 and 1.3200.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R