Key Events:

- Canadian Retail Sales

- Next Week:

o EUR and US Flash Manufacturing and Services PMI

o US and Canadian GDP

o Trade War developments

EURUSD Outlook

Following the prolonged weakness in the US Dollar Index—driven by market fears and declining confidence amid escalating trade wars—Wednesday’s FOMC meeting marked a pivotal turning point. The resulting shift pushed the EURUSD down nearly 140 points from its November 2024 highs near 1.0954 to a low of 1.0814, where the pair found fresh support on the charts.

The upcoming flash manufacturing and services PMI data, scheduled for Monday, pose typical volatility risks for the pair. These risks may be amplified by growing concerns over Trump’s developing tariff policies and corresponding retaliations. Manufacturing PMIs remain below the 50-expansion threshold, while services PMIs are still holding above it. Markets are closely watching February’s figures for signs of shifting sentiment, given the recent decline in overall economic confidence.

USDCAD Outlook

Following the Bank of Canada's rate cut to 2.75%—its first since 2022—this week’s Canadian CPI data revealed a notable jump. CPI m/m rose to 1.1%, marking its highest level since July 2022. Meanwhile, median CPI y/y climbed to 2.9% (last seen in March 2024), and trimmed CPI y/y matched July 2024 highs at 2.9%.

Amid rising inflation, economic uncertainty, and tariff risks, the BOC stated on Thursday that it will adopt a flexible policy approach—focusing less on targeting a specific outlook and more on strategies adaptable to various scenarios—while avoiding forward guidance until trade tensions and the broader economic picture stabilize.

Technical Analysis: Quantifying Uncertainties

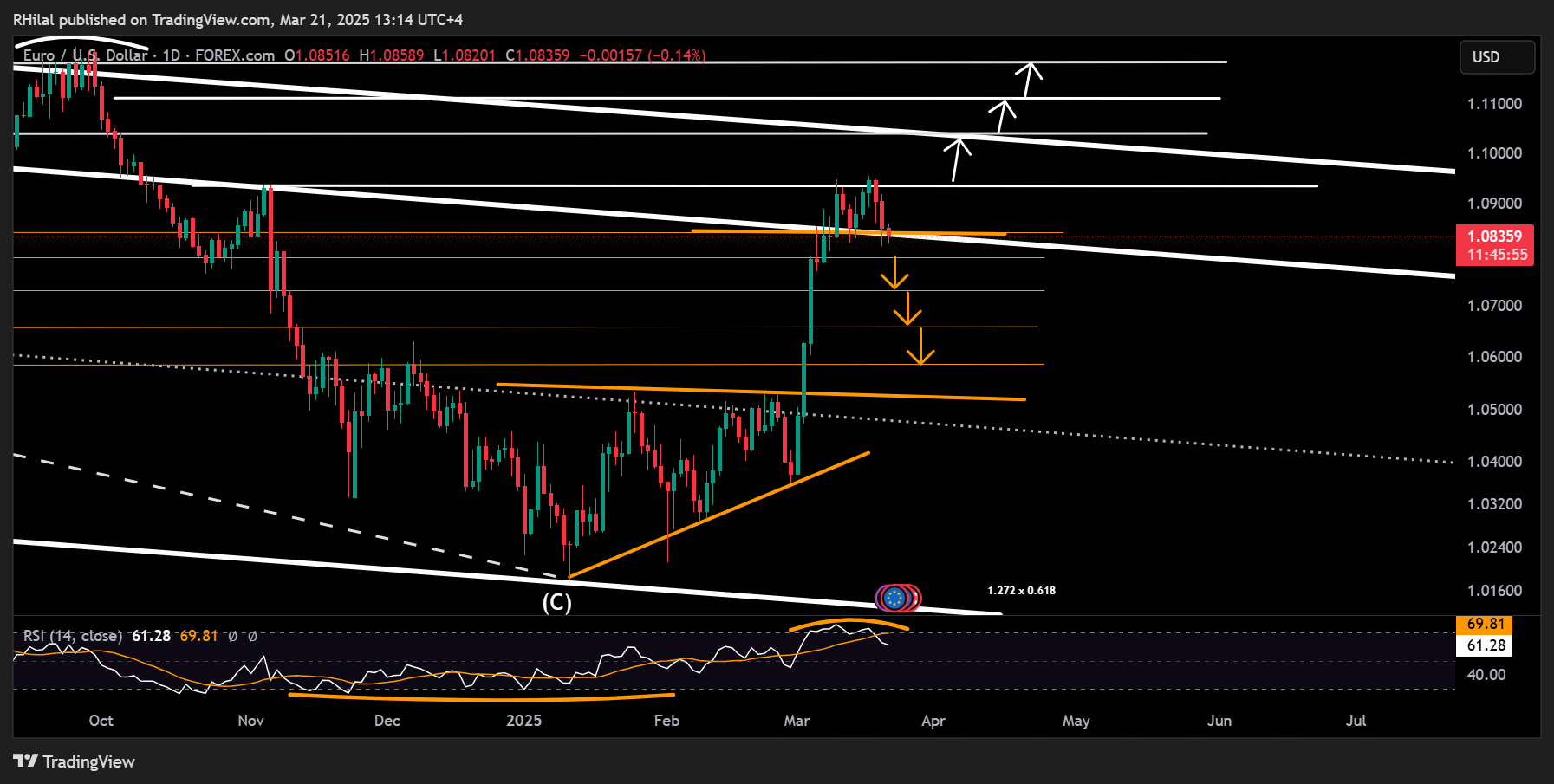

EURUSD Forecast: Daily Time Frame – Log Scale

Source: Tradingview

Momentum on the 3-day time frame has reversed from overbought levels previously seen in 2024. A decisive break below 1.0790 may trigger a retracement toward 1.0730, 1.0620, and potentially 1.0580.

On the upside, the pair is currently holding above the 1.08 support level and the trendline connecting lower highs from July to December 2023. A rebound is possible, especially given the oversold conditions on the 4-hour chart, potentially pushing EURUSD back toward 1.0950.

If momentum builds, the next resistance targets lie at 1.1040 and 1.11, aligning with the upper boundary of the long-term descending parallel channel on the monthly chart, in place since 2008.

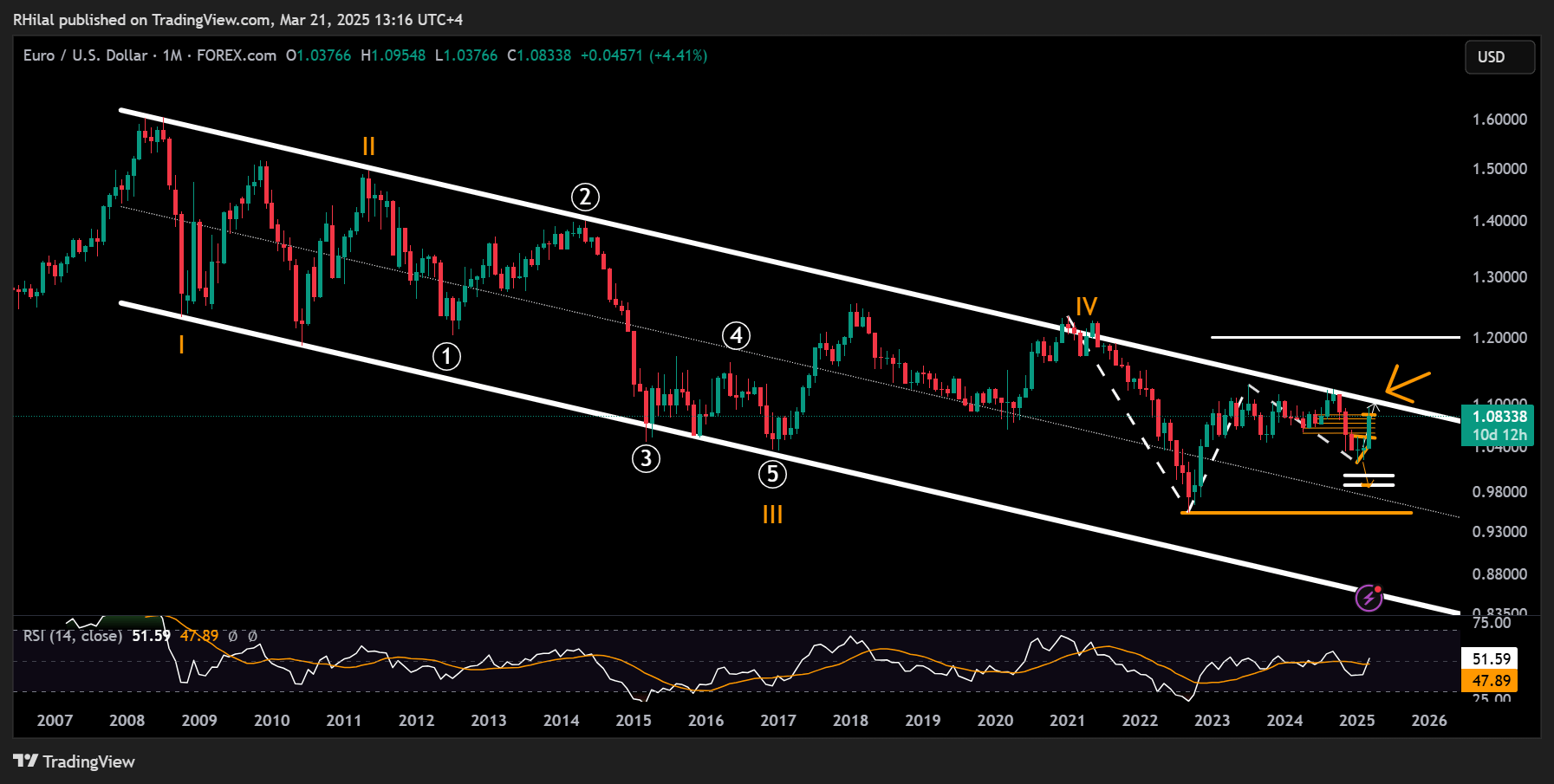

EURUSD Forecast: Monthly Time Frame – Log Scale

Source: Tradingiew

Possible resistance levels aligning with the upper channel boundary include 1.1040, 1.11, and 1.1220. A sustained break above 1.1220—surpassing both the 2024 highs and the upper border of the long-term downtrend—would signal a potential shift toward a longer-term bullish outlook for the euro against the dollar.

However, for now, reversal risks remain, and further confirmation is needed.

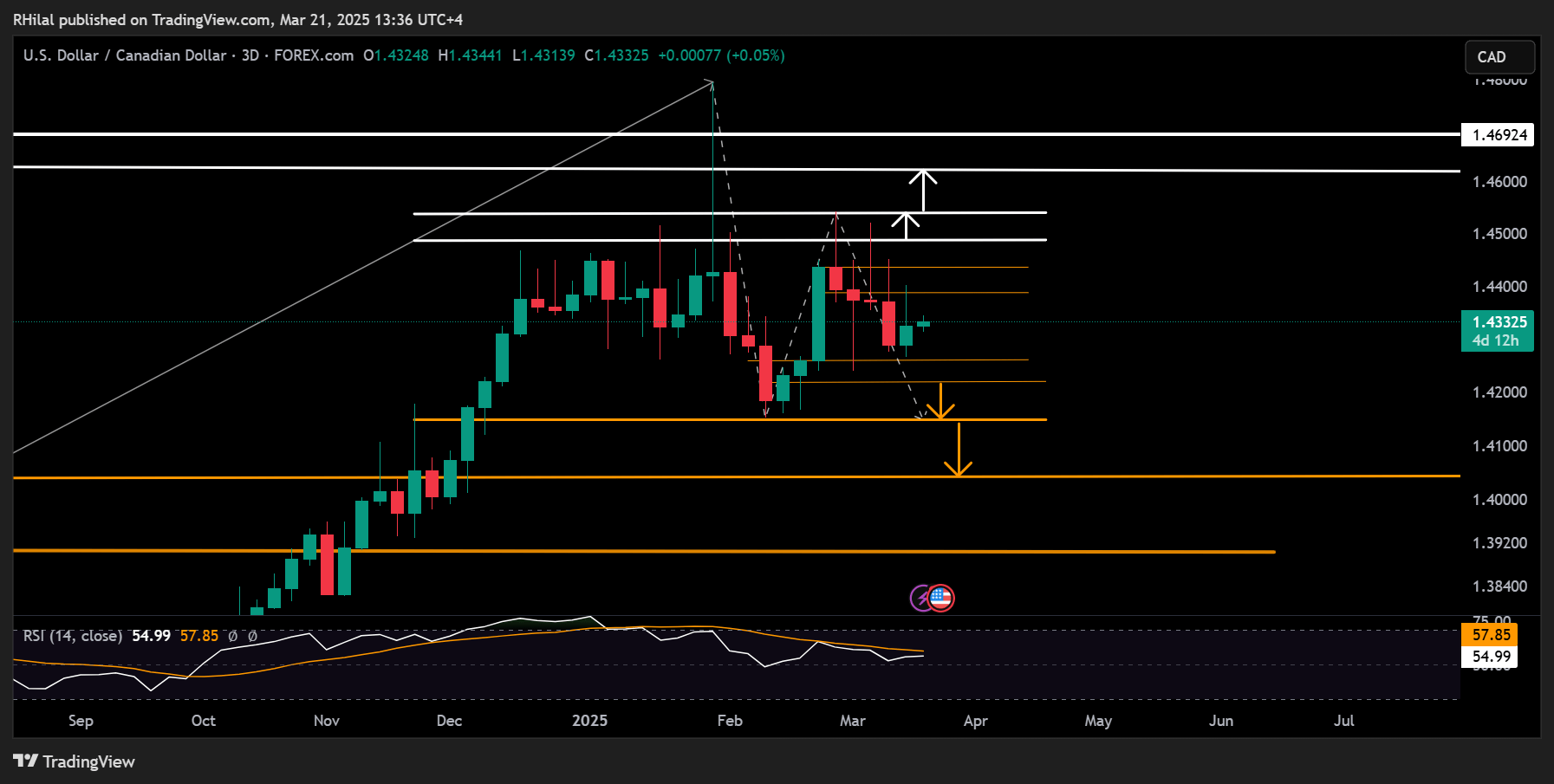

USDCAD Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

The USDCAD chart shows a key resistance zone between 1.4490 and 1.4540, extending from December 2024 to March 2025. A clean break and hold above this range would suggest renewed bullish strength for the dollar against the Canadian dollar, with the next upside targets at 1.4620 and 1.47.

Conversely, if the pair fails to break above this resistance and falls below the 1.4260 support, a deeper retracement may follow. Key downside levels to watch include 1.4220 and 1.4150. A confirmed break below these could open the door for a more extended downturn, targeting 1.4040 and 1.39.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves