Crude Oil Technical Forecast: WTI Weekly, Daily & Intraday Trade Levels

- Oil erase January breakout- prices plunge nearly 10.4% off monthly high

- WTI now testing confluent support- risk for price inflection into close of the month

- Resistance 74.55/75, 75.57, 77.15/55 (key)- Support 71.89-72.45, 71.33 (key), 69.05

Crude oil prices are up just 2.9% despite a monthly range of more than 12.5% as the WTI bears attempt to ease the January breakout. A reversal off technical resistance now shifts the focus to a critical support pivot near the 2025 yearly open- risk for possible exhaustion / price inflection ahead. Battle lines drawn on the weekly, daily, and 240min WTI technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this crude oil setup and more. Join live on Monday’s at 8:30am EST.Oil Price Chart – WTI Weekly

Chart Prepared by Michael Boutros, Technical Strategist; WTI on TradingView

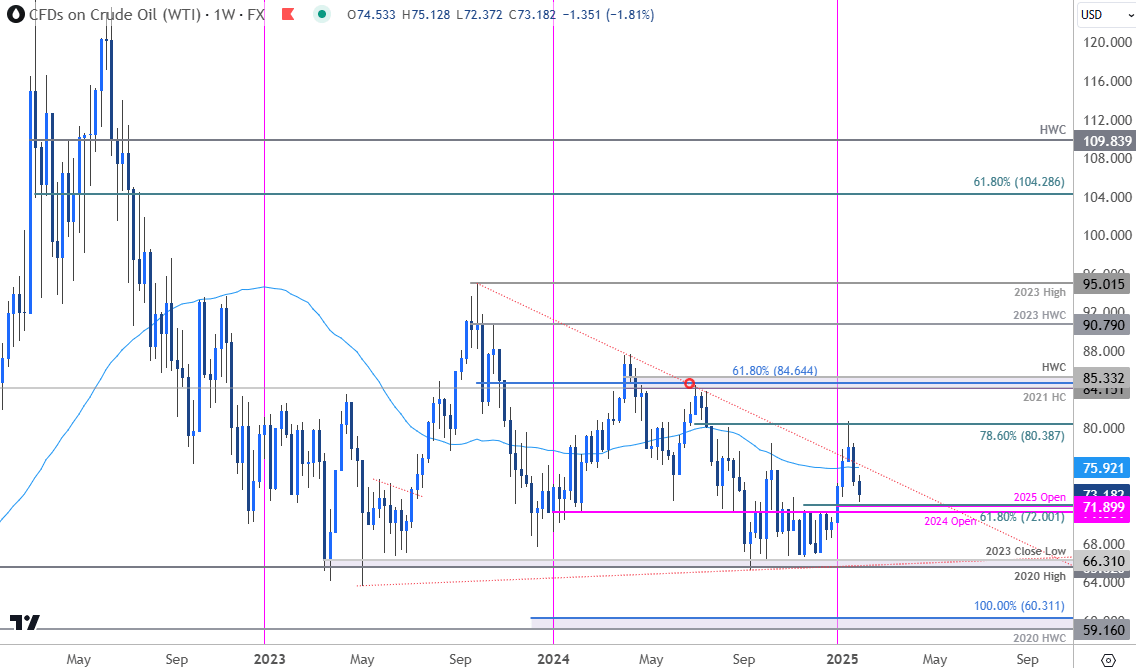

Technical Outlook: In my last Oil Price Forecast, we noted that WTI was, “threatening a breakout of a six-month downtrend and keeps the focus higher while within this multi-week pitchfork. From a trading standpoint, losses should be limited to 71.33 IF price is heading higher on this stretch with a close above 73.91 needed to fuel the next major leg of the advance.” Oil prices ripped higher the following week with a four-week rally extending more than 17.7% off the late-December lows.

The advance reversed sharply off Fibonacci resistance mid-month at 78.6% retracement of the July decline at 80.39 with WTI plunging nearly 10.4% off the highs. The decline is now approaching key support at the origin of the January breakout around the 2024 & 2025 yearly opens- looking for possible price infection into this zone in the days ahead.

Oil Price Chart – WTI Daily

Chart Prepared by Michael Boutros, Technical Strategist; WTI on TradingView

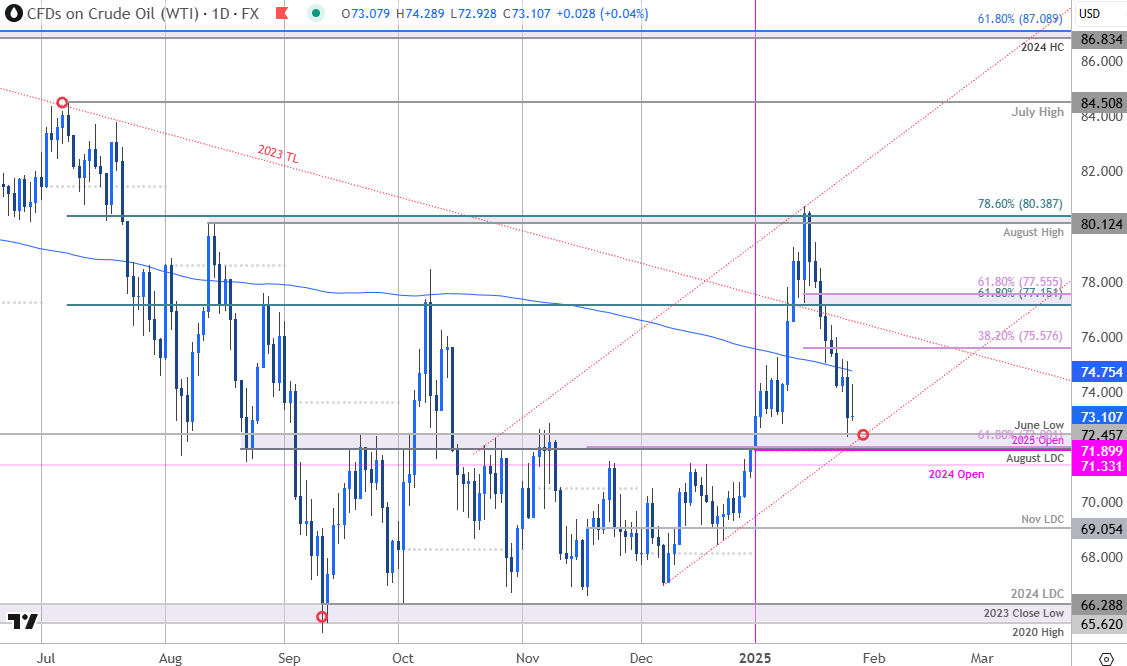

A look at the oil daily chart shows the magnitude of this recent decline with the December trendline further highlighting near-term support here at 71.89-72.45- a region defined by the objective 2025 yearly open, the August low-day close (LDC), the 61.8% retracement of the November rally, and the June swing low.

Ultimately, a break / close below the 2024 yearly open at 71.33 would be needed to invalidate the December uptrend / suggest a more significant high is in place. Losses below this threshold would threaten another bout of accelerated declines towards the November LDC at 69.05 and critical support at the 2020 high / 2023 close low / 2024 LDC at 65.62-66.29- look for a larger reaction there IF reached.

Oil Price Chart – WTI 240min

Chart Prepared by Michael Boutros, Technical Strategist; WTI on TradingView

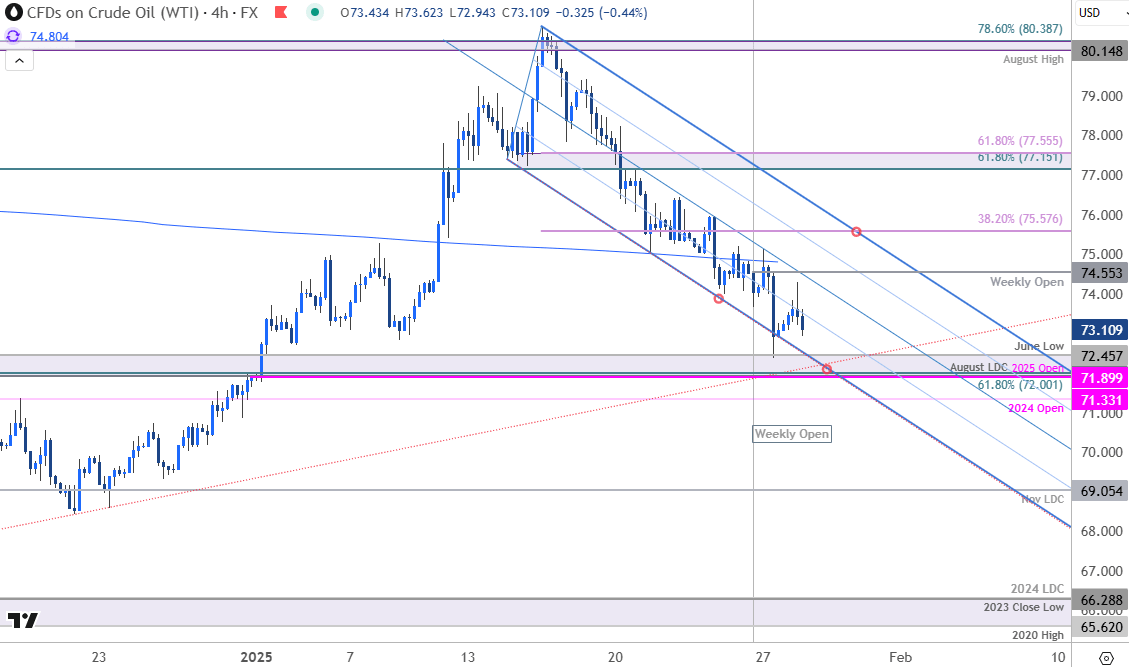

A closer look at oil price action shows WTI trading within the confines of a descending pitchfork extending off monthly highs with the lower parallel further highlighting near-term support here. Initial resistance is eyed with the objective weekly open / 200-day moving average at 74.55/75 with near-term bearish invalidation now set to the 38.2% retracement at 75.58. Ultimately a breach / close above the 61.8% retracement at 77.55 would be needed to threaten uptrend resumption.

Bottom line: Oil has plunged into confluent support at the objective yearly open- looking for a reaction here with the bears vulnerable while above the December trendline. From a trading standpoint, rallies would need to be limited to 75.58 IF price is heading lower on this stretch with a close below 71.33 needed to fuel the next leg of the decline. Watch the weekly close for guidance here.

Active Weekly Technical Charts

- Euro (EUR/USD)

- Canadian Dollar (USD/CAD)

- Japanese Yen (USD/JPY)

- British Pound (GBP/USD)

- Gold (XAU/USD)

- US Dollar Index (DXY)

- Australian Dollar (AUD/USD)

- Swiss Franc (USD/CHF)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex