British Pound Technical Forecast: GBP/USD Weekly Trade Levels

- British Pound trading into major pivot-zone post-BoE - poised for February breakout

- GBP/USD bears vulnerable above weekly low- U.S. Non-Farm Payrolls on tap

- Resistance 1.2494 (key), 1.2609, 1.2731/73- Support 1.2272, 1.2084-1.2114 (key), 1.1841/89

The British Pound is poised for a breakout in the days ahead with GBP/USD trading into a key pivot-zone on the heels of today’s Bank of England interest rate cut. The focus is on possible price inflection off this zone in the days ahead with U.S. Non-Farm Payrolls on tap tomorrow. Battle lines drawn on the GBP/USD weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Sterling setup and more. Join live on Monday’s at 8:30am EST.British Pound Price Chart – GBP/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

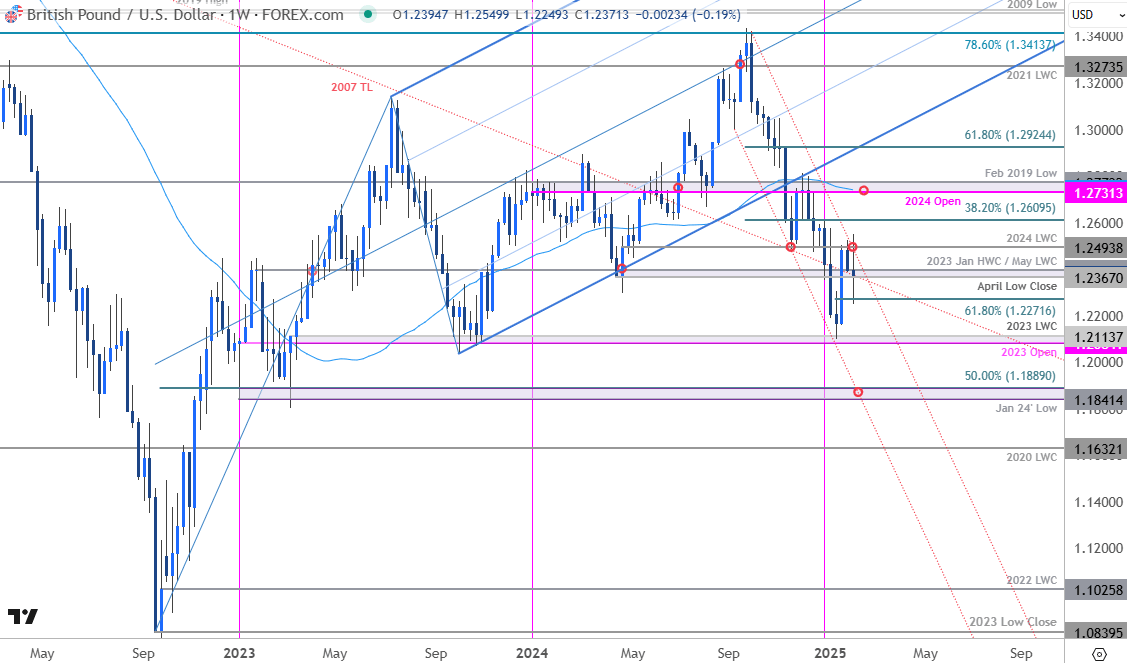

Technical Outlook: In last month’s British Pound Weekly Forecast we noted that, “A four-month sell-off takes GBP/USD into pivotal support – risk for possible inflection off this zone. From a trading standpoint, a good region to reduce short-positioning / lower protective stops- rallies should be limited to 1.2397 IF price is heading lower on this stretch…” Sterling reversed sharply higher the following week with a pivot above the 1.24-handle extending into channel resistance this week.

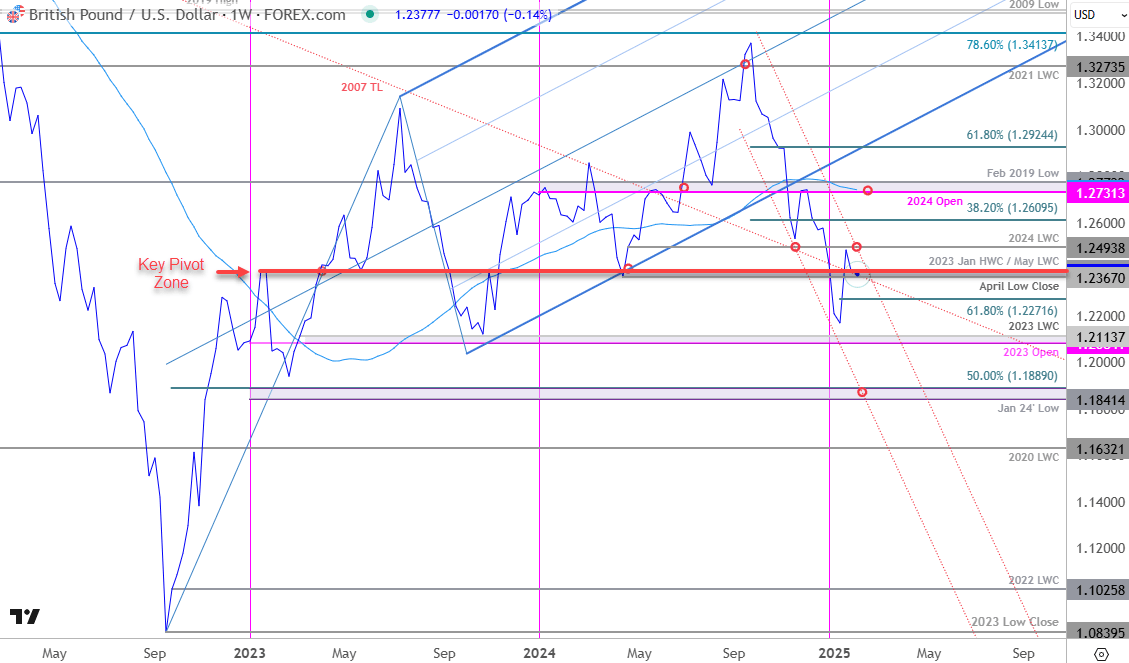

The immediate focus is on this week’s close with respect to the 1.2367-1.2397 pivot zone- a region defined by the April low-close, and the 2023 January high-week close (HWC) / May low-week close (LWC). A look at the line-chart below illustrates the magnitude of the price inflections off this zone over the past two-years – looking for a reaction here early in the month.

British Pound Price Chart – GBP/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Weekly resistance remains with the 2024 LWC at 1.2494 with a close above the September channel needed to suggest a more significant low was registered last month / a larger reversal is underway. Subsequent resistance objective eyed at the 38.2% retracement at 1.2609 and the 2024 yearly open / 55-week moving average / February 2019 low at 1.2731/73- look for a larger reaction there IF reached.

A close below this pivot zone would once again expose the 61.8% retracement at 1.2272 with key support unchanged at the 2023 yearly open / 2023 LWC at 1.2084-1.2114. A break / close below this threshold is needed to mark downtrend resumption towards the January 2024 low / 50% retracement of the 2022 advance at 1.1841/89.

Bottom line: Sterling is trading into a major pivot zone- looking for possible price inflection off the 1.2367-1.2397 range. From a trading standpoint, losses would need to be limited to this week’s low IF price is heading for a breakout on this stretch with a close above channel resistance needed to clear the way for a larger advance.

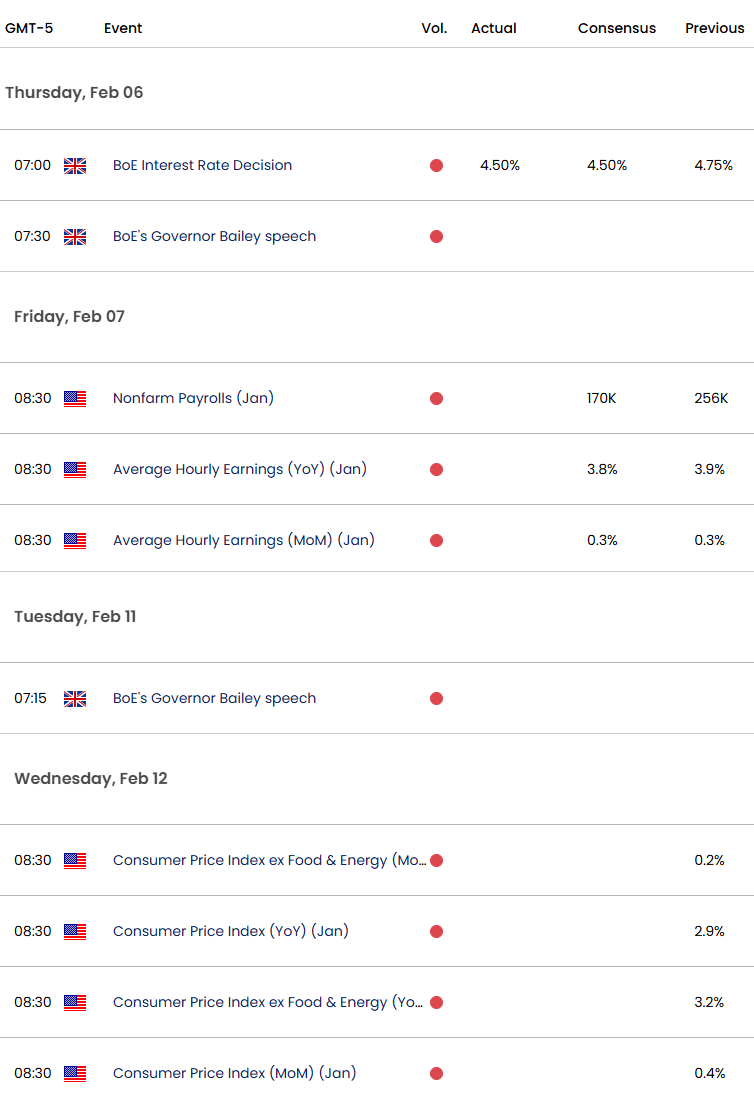

Keep in mind we get the release of US Non-Farm Payrolls tomorrow with key inflation data on tap next week. Stay nimble into the releases and watch the weekly closes here for guidance. Review my latest British Pound Short-term Outlook for a closer look at the near-term GBP/USD technical trade levels.

GBP/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Swiss Franc (USD/CHF)

- US Dollar Index (DXY)

- S&P 500, Nasdaq, Dow

- Australian Dollar (AUD/USD)

- Crude Oil (WTI)

- Euro (EUR/USD)

- Canadian Dollar (USD/CAD)

- Japanese Yen (USD/JPY)

- Gold (XAU/USD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex