US futures

Dow future -0.40% at 41818

S&P futures -0.3% at 5594

Nasdaq futures -0.3% at 19200

In Europe

FTSE 0.55% at 8630

Dax 1.2% at 22435

- The mood remains cautious ahead of Trump’s tariffs tomorrow

- Manufacturing PMIs & JOLTS job opening data due

- Tesla rises after falling 35% in Q1

- Oil is unchanged with tariffs in focus

Caution ahead of Trump's tariffs & US data

US stocks are edging lower but trade in a quiet range on Tuesday, following sharp declines across the first quarter of this year, as recession worries weighed ahead of Trump's tariff announcements tomorrow.

Wall Street indices fell across March and Q1 on concerns that Trump's trade tariffs could slow economic activity and fuel inflation, potentially leading the US economy into a stagflationary period.

The S&P 500 declined 5% in the first quarter of 2025, while the Nasdaq fell by over 10% during that period, and the Dow Jones dropped 2%.

Today, the mood remains cautious ahead of President Trump's trade tariff announcements on April 2. The so-called Liberation Day will be followed by the implementation of a 25% tariff on autos starting April 3, as Trump seeks to address what he considers unfair trade balances impacting the US.

These measures from Trump could significantly impact global trade dynamics, raising concerns of an economic slowdown. Goldman Sachs raised its US recession expectations to 35% from 20% previously.

In addition to tariffs, attention will also be focused on economic data, including JOLTS job openings and ISM manufacturing PMI data. Expectations are for the ISM manufacturing PMI to fall below 50 to 49.5 from 50.3 in February, suggesting that could activity contracted. Meanwhile, the prices paid subcomponent is expected to rise to 65 from 62.4, indicating a stagflationary picture.

JOLTS job openings are expected to fall to 7.63 million from 7.7 million. The data comes ahead of Friday's nonfarm payroll report, which could provide further clues about the health of the US economy.

Corporate news

Tesla is rising after tumbling 35% in Q1. The EV maker is expected to report deliveries later this week, with forecasts indicating a sharp decline in Europe.

Nvidia is starting Q2 on a more positive note after dropping 20% in Q1 after the emergence of DeepSeek disruptor.

PVH Corp, which owns Tommy Hilfiger and Calvin Klein, posted strong Q4 earnings and revenue.

UltraBeauty is rising by over 1.5% after Goldman Sachs upgraded its stance to "buy" from "neutral," stating that the beauty industry could see sales normalizing from here.

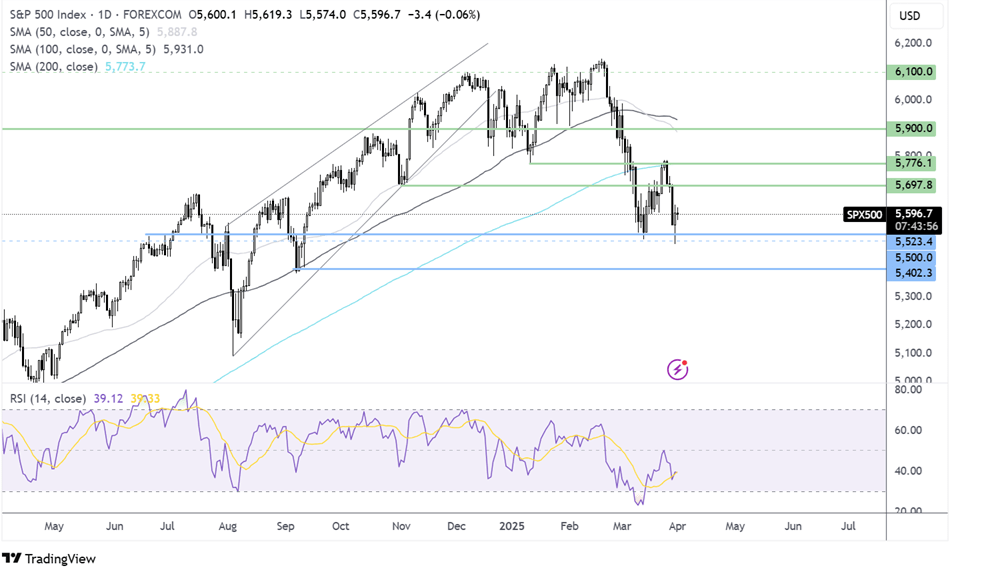

S&P 500 forecast – technical analysis.

The S&P 500 failed to rise above the 200 SMA rebounding lower before finding support below 5500. The price has recovered to around 5600 . The long lower wick on yesterday’s candle suggests that there was little selling demand at the lower level. Sellers would need to close below 5500 to extend the bearish trend. Any recovery would need to retake the 200 SMA at 5770 for buyers to take control and form a higher high.

FX markets – USD rises, EUR/USD falls

The USD is rising modestly as the market shows little interest in the currency. The USD has missed out on safe-haven flows and struggles with uncertainty over the outlook for interest rates. Data this week could provide some direction.

The EUR/USD is falling after eurozone inflation eased to 2.2% YoY from 2.3%, in line with forecasts and supporting the view that the ECB will cut rates again by 25 bps in April. Jitters are showing ahead of tomorrow’s announcement.

The GBP/USD is falling in nervous trade ahead of tomorrow’s trade announcement. The government stated that it hopes tariffs will be reversed through an economic deal. Separately, UK grocery inflation rose 3.5% YoY.

Oil steady as investors wait for tariff clarity

Oil prices are holding steady at a 5-week high as the market weighed up secondary tariffs on Russia which could limit supply, against concerns over the demand outlook ahead of Trump’s trade tariff announcement.

Trump threatened tariffs on countries that buy Russian oil should Russia’s President Putin stand in the way of a ceasefire with Ukraine. This could limit supply.

However, other trade tariff policies by Trump, which will be announced tomorrow, could slow global and US growth, weighing on the oil demand outlook.

Any gains in oil could be limited near term given that OPEC+ is expected to increase supply in April.