US futures

Dow future 0.43% at 41780

S&P futures 0.45% at 5637

Nasdaq futures 0.45% at 19560

In Europe

FTSE -0.25% at 8685

Dax -1% at 23150

- Federal Reserve is expected to leave rates unchanged

- Dot plot and economic projections will be in focus

- Tesla rises as Robotaxi makes some progress

- Oil falls on geopolitical headlines

The dot plot & economic projections in focus

US stocks are opening higher ahead of the Federal Reserve’s interest rate decision later today.

The central bank is widely expected to leave rates unchanged at 4.25% to 4.5% when it makes an announcement at 18:00 GMT (2pm ET), after also leaving rates on hold in January.

With no rate cut expected, attention will be paid to Federal Reserve chair Jerome Powell's comments, economic projections and the dot plot, which lays out the expected path for rates over the coming months and years. These tools will show investors how policymakers see Trump's trade policies impacting economic growth, inflation, and unemployment.

Due to Trump's trade tariffs, we could expect to see a slight tick higher in the inflation forecast and a modest downward revision to growth. Powell will likely stick to a hawkish tone, albeit less hawkish than previous meetings, amid rising concerns of an economic slowdown. Powell could also emphasise the uncertainty surrounding the outlook, which supports the wait-and-see stance. He will want to see hard evidence of a slowdown before adjusting policy. A more dovish sounding Fed could support stocks higher.

The market is currently pricing in 60 basis points worth of rate cuts this year, with the first cut scheduled for June.

Trump is expected to implement reciprocal trade tariffs on April 2, which could escalate trade tensions on multiple fronts.

Corporate news

Nvidia is rising following its annual GTC event, where CEO Jensen Huang announced new chips for building and deploying AI models.

Tesla is rising after the EV took a step towards launching its keenly awaited Robotaxi service in California but securing the first of several necessary approvals.

Morgan Stanley is rising on reports that the investment bank will likely cut 2000 employees later this month.

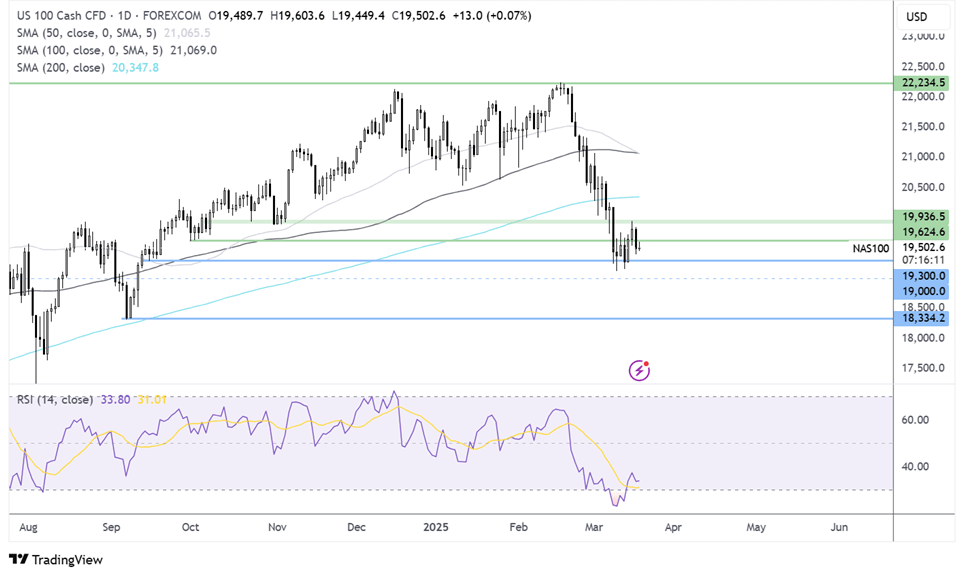

Nasdaq 100 forecast – technical analysis.

The Nasdaq has fallen sharply from its record high of 22,245 to a low of 19.115 in just three weeks. The price recovered from 19,115 and ran into resistance at 19,950 before correcting lower again. Whilst the selloff in the Nasdaq has paused, there has been no signal for a reversal yet. Sellers would need to take out 19,300 to create a lower low and extend the bearish trend towards 19000 and 18,300, the September low. Should buyers rise above 19,950, this could create a higher high and change the structure of the chart, opening the door to the 200 SMA at 20,350.

FX markets – USD rises, USD/TRY jumps 5%

The USD is rising as it extends its recovery from a 5-month low ahead of the Fed rate decision. The rise in the USD comes as it pops 5% against the TRY amid headlines that President Tayyip Erdogan’s main political rival was detained.

EUR/USD is falling after the vote in Germany, which saw the approval of a major fiscal reform be a buy the news, sell the fact event. The removal of the debt limit for defense spending and infrastructure investment plan is expected to stimulate growth. Today, a measure of inflation was downwardly revised to 0.4% MoM in February from 0.5% in the preliminary reading.

GBP/USD is falling against a stronger USD ahead of tomorrow's UK labour market data and BoE rate decision. The central bank is expected to leave rates on hold at 4.5% amid a stagflationary outlook. UK CPI rose 3%, and GBP contracted -0.1% MoM.

Oil slips with geopolitical tensions in focus

Oil prices are edging lower, extending losses from yesterday as the market weighs up geopolitical developments.

While Russia failed to agree to the 30-day ceasefire, President Putin agreed to Trump’s proposal that Russia and Ukraine temporarily stop attacks on energy infrastructure. While this in itself won't have much impact on the supply outlook, it could eventually pave the way for Russian oil supply to re-enter the market.

The markets also worry about the fallout from Trump’s tariff wars after the OECD slashed growth forecasts for the US, Canada, and Mexico.

However, the downside in oil could be limited amid rising tensions in the Middle East as Israel renews its airstrikes on Gaza and as Beijing revealed plans to boost weak consumption.