US futures

Dow future -0.60% at 41294

S&P futures -0.93% at 5524

Nasdaq futures -1.25% at 19023

In Europe

FTSE -1.15% at 8555

Dax -1.42% at 22122

- Stocks extend losses after Trump’s weekend trade comments

- Recession worries & trade jitters hit risk sentiment

- The USD remains flat, & Gold hits a record high

- Oil inches higher on Trump's Russia threats

Trade fears send stocks lower

US stocks are poised for a weaker open, with the Nasdaq 100 dropping to its lowest level since September amid concerns that President Trump's trade tariffs will negatively impact the US economy.

Over the weekend, U.S. President Trump announced that reciprocal tariffs, which will be unveiled this week, will apply to all nations. “Liberation Day” on April 2nd is when Trump will announce a massive tariff plan as a way of protecting the diverse economy from unfair global competition.

Global stocks have fallen sharply, and gold prices have risen to new record highs following Trump's comments at the weekend. Investors are concerned that the forthcoming and extensive tariff plans could harm the global economy, fueling recession fears.

While a decent amount of negativity had already been priced in, markets appear to be bracing for the worst. The three major indices are set to book quarterly declines, with the S&P 500 and the Nasdaq in correction territory. Meanwhile, the CBOE volatility index, known as Wall Street's fear gauge, rose to a two-week high.

Goldman Sachs has increased its probability of a US recession to 35% from 25%, citing uncertainty stemming from Trump's tariffs. Data from last week showed that the core PCE, the Fed's preferred gauge of inflation, rose to 2.8%, while consumer spending was notably weak.

In addition to the tariffs, attention will also be focused on the ISM business activity surveys, the US nonfarm payroll report, and speeches from several U.S. central bankers.

Corporate news

Tesla is falling 4.4% ahead of unveiling its Q1 deliveries later this week, with investors bracing for a possible drop in EV sales.

Apple is falling 0.8% after it was hit with a €150 million fine by French antitrust regulators.

US auto stocks are continuing to fall, with General Motors, Ford, and Stellantis down by over 1% as tariffs on automobiles imported into the US take effect on Wednesday.

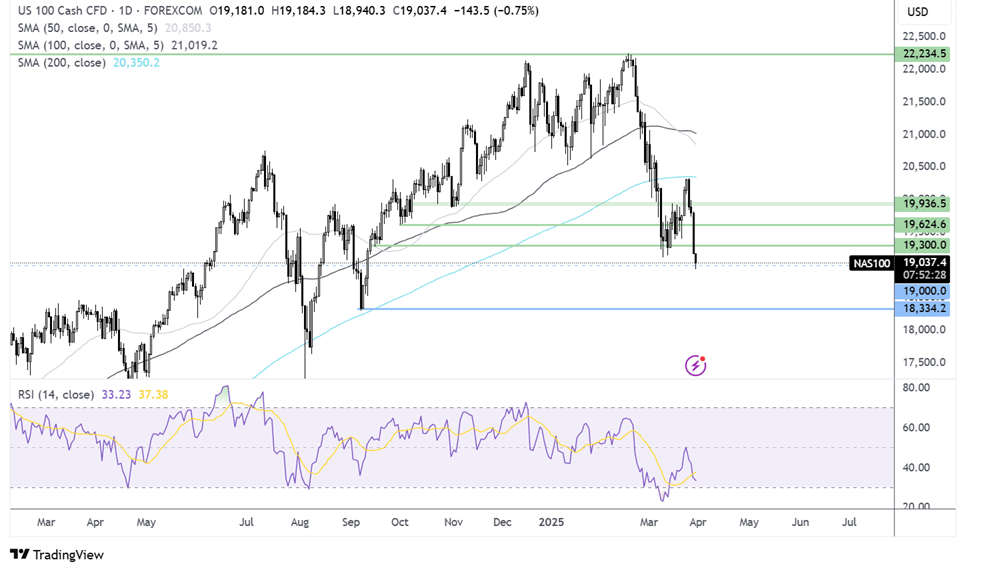

Nasdaq 100 forecast – technical analysis.

The Nasdaq faced rejection at the 200-day simple moving average (SMA) and has fallen sharply lower, taking out several key supports and creating a lower low. Sellers, supported by the RSI below 50, will look to extend the bearish move below 19k towards 18,300, the September low. Any recovery would need to rise above 19,300 to stabilize. However, a rise above the 200 SMA at 20,330 is needed for bulls to take control.

FX markets – USD is flat, GBP/USD holds steady

The USD is holding steady as fears over Trump’s tariffs are being played out in the stock and bond markets. The USD is not benefiting from safe-haven flows. Fears of stagflation are limiting the USD ahead of a busy week for US economic data.

The EUR/USD is falling towards 1.08 amid risk off trade ahead of Wednesday’s tariff announcements. German inflation cooled in line with forecasts to 2.2% from 2.3%. The ECB is widely expected to cut rates again in April by 25 basis points.

The GBP/USD is unchanged below 1.30. The pound is supported because Trump’s trade tariffs are expected to have a minimal impact on the UK outlook, given the balanced trade between the two countries.

Oil rises on Russian oil threat.

Oil prices are inching higher, extending gains from last week after President Trump expressed his annoyance at Russian President Putin and threatened to impose higher tariffs on buyers of Russian oil if he considers that Putin is blocking a deal. These comments indicate a growing risk to future supply.

Separately upbeat data from China is also supporting the price. Chinese manufacturing PMI data came in stronger than expected. The manufacturing PMI rose to a 12-month high, boosted by strong orders. An improving growth outlook in the world's largest oil importer helps the demand outlook.