US futures

Dow future 0.03% at 41519

S&P futures 0.04% at 5640

Nasdaq futures -0.1% at 19733

In Europe

FTSE 0.45% at 8671

Dax 1.7% at 23070

- US retail sales rise 0.2% MoM vs 0.7% forecast

- US slowdown worries linger

- The Fed or Trump needs to pivot to lift sentiment & stocks

- Oil rises after China plans to boost consumption

US retail sales add to evidence of weaker data

US stocks are struggling at the start of the week, extending losses from the previous week. Concerns over the impact of Trump's trade tariffs on the economy still weigh heavily, and US retail sales com in below expectations.

The three main indices on Wall Street closed higher on Friday but fell sharply across the week, with the Dow Jones experiencing its largest one-week drop since 2023, down 4.4%. Meanwhile, the S&P500 briefly joins the NASDAQ in correction territory.

Over the weekend, U.S. Treasury Secretary Scott Bessent said there are no guarantees that the US economy will avoid a recession this year. His comments come after U.S. President Donald Trump refused to rule out the prospect of a recession earlier this month.

Today, US retail sales rose by less than expected at 0.2%, recovering from a downwardly revised -1.2% pullback in the previous month. Expectations had been for a 0.7% rise. Delving into the report, spending at restaurants and bars, the only service sector category in the report, declined by the most in a year. These figures add to evidence that consumer spending is weakening as tariff risks reignite inflationary pressures and stall economic growth. Both households and companies are cautious as consumer sentiment sours and as signs of an economic slowdown build.

Data on Friday showed that Michigan sentiment soured to a 2.5-year low whilst five-year inflationary expectations rose by the most since 1993

The data comes ahead of the Federal Reserve's interest rate decision on Wednesday. The central bank is widely expected to leave rates unchanged at 4.25 to 4.5%. Trump's flip-flopping over trade tariffs against its major trading partners, coupled with threats of further tariffs, is a point of uncertainty for the markets.

Rising uncertainty over the US economic outlook adds to fears of recession. The market will be watching closely for the Fed's comments on these worries. Either the Fed or Trump would need to pivot for a solid recovery to take place.

Corporate news

PepsiCo is set to open modestly lower after the soft drinks giant said it would buy prebiotic soda brand Poppi for 1.95 billion as it expands into the healthier soda category.

Nvidia will be in focus this week as the annual GTC event takes place. CEO Jensen Huang will deliver a keynote speech on Tuesday at 10 a.m. EST, discussing AI, robotics, and accelerated computing. Nvidia may unveil its GGB300 AI chip.

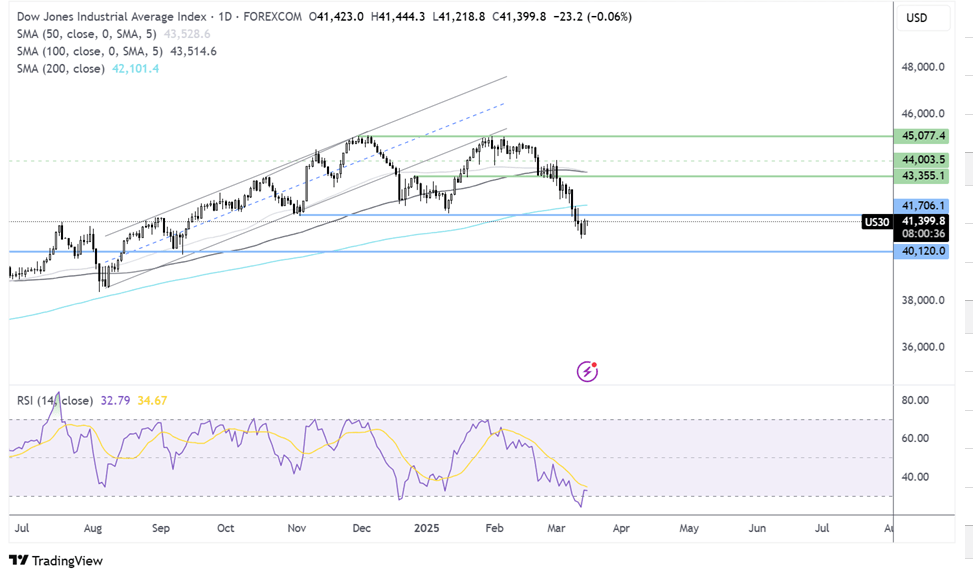

Dow Jones forecast – technical analysis.

The Dow Jones fell sharply from its record high of 45k at the end of January, trending lower, taking out the 200 SMA before running into resistance at 40,660. The price has corrected higher from this low, bringing the RSI out of oversold territory. However, there are no signs of a reversal for now. Sellers would look to take out 40,660 support to extend the bearish trend towards 40k. Meanwhile, buyers would need to rise above 41,750, the January and November low to negate the downtrend. Above here the 200 SMA at 42k comes into focus.

FX markets – USD falls, GBP/USD rises

The USD is falling as it continues to hover around a five-month low. Concerns over the outlook for the US economy are rising ahead of the Fed rate decision later this week.

EUR/USD is rising to 1.09 amid USD weakness and a cautious mood ahead of tomorrow’s vote in Germany on changes to the constitution to adjust fiscal reforms. These changes would enable the government to borrow more to increase defence spending.

GBP/USD is rising towards 1.30 amid USD weakness and ahead of the BoE rate decision on Thursday. The central bank is expected to leave rates unchanged at 4.5% amid a mixed outlook for the economy with higher inflation and weak growth.

Oil rises after China plans to boost consumption

Oil prices are rising for a third straight day, booted by China’s plans to boost domestic consumption and after the US pledged to keep attacking Yemen's Houthi rebels.

Over the weekend, China unveiled a series of measures to revive consumption, including raising wages, increasing pensions, and creating incentives for childbirth. Data from China was also better than expected, supporting sentiment.

Still, gains could be capped by uncertainty of the impact of Trump’s trade policies on global growth and therefore the oil demand outlook.

Expectations that OPEC+ will increase supply from next month could also keep gains limited.