US futures

Dow future -0.3% at 41710

S&P futures -0.5% at 5652

Nasdaq futures -0.8% at 19664

In Europe

FTSE 0.45% at 8717

Dax 1% at 23360

- Federal Reserve two-day meeting begins

- US recession fears remain

- Nvidia falls ahead of CEO Huang’s speech

- Oil rises amid escalating Middle East tensions

FOMC 2-day meeting begins & Nvidia under the spotlight

US stocks are opening lower after modest gains yesterday, as the mood remains cautious at the start of the Federal Reserve two-day meeting and ahead of Nvidia CEO Huang’s speech later today.

The Fed's two-day meeting will conclude tomorrow. The central bank is widely expected to leave interest rates unchanged amid sticky inflation and heightened uncertainty over the economic impact of U.S. President Trump's trade policies. The wait-and-see mode gives the Fed time to assess the policies' impact on growth and inflation.

Attention will be on the new economic projections, which will offer key evidence as to how policymakers view the likely impact of Trump's policies on the economy.

Investors will be watching closely to see if the Fed softens its hawkish stance amid growing concerns over US recession.

In addition to the Fed meeting, attention will also be on a call between President Trump and Russian leader Vladimir Putin regarding a potential ceasefire in the Ukraine war. Signs of a deal and the prospects of easing of Russian sanctions could help boost global equities.

Meanwhile, gold has risen to a fresh all-time high of $3030 up, 14% so far this year, and its 14th record reached in 2025. Safe-haven flows are boosting gold amid uncertainty over the US economic outlook and rising tensions in the Middle East.

Corporate news

Nvidia is falling 0.4% ahead of CEO Jensen Huang's keynote speech at the chipmaker’s GTC conference in California. Investors will be monitoring Huang’s thoughts over the path ahead at a time when competition in the AI space intensifies. The focus on Nvidia comes as tech stocks have come under pressure over the past month owing to rising concerns over Trump's trade policies, macroeconomic uncertainty, and risk of sentiment. However, the fundamental demand that continues to drive AI remains solid, and today's speech could bring this back to the forefront of investors' minds.

Adobe is trading lower after the computer software firm is expected to provide further insight into its AI strategy in a meeting with analysts.

Tesla is set to open a further 3% lower, extending its decline after dropping for eight straight weeks amid concerns CEO Elon Musk's political activities are damaging the brand.

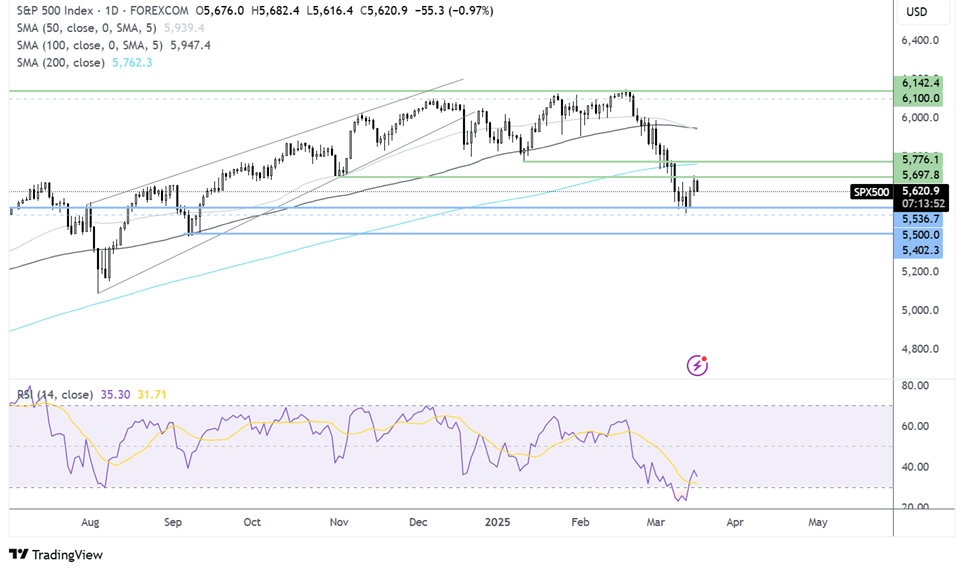

S&P 500 forecast – technical analysis.

The S&P 500’s recovery from the 5504 2025 low ran into resistance at 5700, the November low. Buyers would need to retake this level to bring the 200 SMA into view at 5775. Support is seen at 5550 and 5500. A break below here creates a lower low.

FX markets – USD holds steady, GBP/USD falls

The USD is holding steady as it continues to hover around 5 5-year low owing to rising concerns over the US economic outlook. The Federal Reserve interest rate decision will be announced tomorrow the Fed is expected to leave rates on hold.

EUR/USD is holding steady ahead of a key vote in Germany on fiscal reform, which would see defence spending excluded from the debt limit and the establishment of a €500 billion infrastructure investment plan. Germany’s ZEEW's economic sentiment rebounded higher in March as increased spending optimism boosted morale.

GBP/USD is falling after briefly rising above 1.30. The pound is drifting amid a quiet day on the economic calendar and ahead of Thursday's Bank of England rate decision. Meanwhile, Chancellor Rachel Reeves is set to unveil welfare spending cuts ahead of next week's spring statement.

Oil rises on Middle East tensions

Oil prices rise for a third straight day, lifted by the rising risk premium amid escalating geopolitical tensions in the Middle East and after China plans to increase economic stimulus.

President Trump vowed to continue an assault on Yemen's Houthi, until they end their attacks on ships in the Red Sea, which has raised the risk premium on oil.

Meanwhile, China's plans to revive consumption, upbeat retail sales, and fixed asset investment growth are also lifting oil prices. Crude oil throughput in China, the world's largest oil importer, rose 2.1% in January and February compared to a year earlier, helped by a new refinery and Lunar New Year holiday travels.

However, gains could be limited after the OECD warned that Trump's trade tariffs would slow growth in the US, Canada, and Mexico, hurting the global energy demand outlook.