As European markets headed for the close Wall Street shares were trading higher, led by the Nasdaq 100 as tech shares got a boost, following the late day bounce yesterday. However, with risk sentiment remaining fragile following a bruising last few weeks, and a day before Donald Trump’s highly anticipated tariff announcement on Wednesday, it remains to be seen whether the gains could hold heading deeper into the US session. With the exact scope of these measures still uncertain, you would imagine that investors remain cautious, reluctant to take on greater exposure to riskier assets. So, despite the apparent reversal pattern we have seen since yesterday, the Nasdaq 100 forecast remains highly uncertain in the near term outlook.

Will the selling resume later?

While markets were firmer for now, but as the session progresses, we could see European futures and US stocks retreat again from their highs. That’s because, the trend on US indices has been quite bearish lately and a day ahead of Trump’s announcement of Tariffs, traders will be unwilling to take on too much risk. Last week’s sell-off was particularly brutal for Wall Street, with technology stocks bearing the brunt of investor unease. The S&P 500 fell another 2% on Friday following the announcement of new levies on imported vehicles. Volatility carried into Monday, as early losses gave way to a late-session rebound, softening the blow, before markets rose a little further in the first half of Tuesday’s session. But it could be the calm before the storm: further downside could be in store for stocks.

Curiously, the US dollar—typically a safe haven in times of market turmoil—failed to rally last week, instead sliding as investors pivoted towards gold, the yen, and the euro. The shift signals growing concerns over the resilience of the US economy, exacerbated by Donald Trump’s increasingly protectionist policies.

Nasdaq 100 forecast: "Liberation Day" tariffs ahead

Now, all eyes are on Trump’s next move: a sweeping new set of tariffs set to be unveiled on Wednesday, an occasion he has proudly dubbed "Liberation Day." Trump hopes that higher tariffs will fuel domestic industry and create jobs, and boost stock market. But so far, the stock markets have not responded how he had hoped. Investors fear tariffs could stoke inflation while simultaneously dragging on economic growth—a toxic combination for an already fragile market.

It is not just uncertainty about Trump’s latest measures, but also retaliatory measures from affected nations which could inject further volatility into financial markets, exacerbating uncertainty.

Trump’s so-called "reciprocal tariffs" are intended to counteract foreign levies on US exports. The White House insists these measures will "level the playing field," but critics warn they could provoke retaliation, suppress global trade, and ultimately impede economic growth.

These new tariffs follow earlier duties on steel, aluminium, and imports from China, Mexico, and Canada. This latest round is expected to target nations with substantial trade surpluses against the US, with tariffs ranging from 10% to as high as 50% on hundreds of products.

The European Union and Canada remain firmly in Trump’s sights, with additional tariffs threatened should their economic policies be deemed unfavourable to US interests.

With uncertainty mounting, one thing is clear: market volatility is here to stay, and the Nasdaq 100 forecast remains clouded by the unpredictable nature of trade policies and economic headwinds. The coming weeks will be pivotal in shaping the next phase of market direction.

Stagflation concerns remain in place

Meanwhile, economic concerns were highlighted again as fresh data pointed to a weakening US economy, today. Not only did the ISM Manufacturing PMI come in weaker (at 49.0 compared 50.3 expected) we also had a softer JOLTS Job Openings print (7.57 million vs. 7.69 million expected).

The latest data follows last week’s mixed bag calendar. Strong figures in Durable Goods Orders, the final Q4 GDP estimate, and Pending Home Sales offered some encouragement last week. However, softer readings in New Home Sales, Consumer Confidence, and Manufacturing PMI paint a more concerning picture. It was Friday’s Core PCE index—the Federal Reserve’s preferred inflation gauge—that truly rattled investors, as it came in higher. Adding to concerns, the University of Michigan’s inflation expectations survey surged to 5.0%. With Trump’s tariffs yet to fully filter through economic data, Fed Chair Jerome Powell’s assurances that inflation remains contained will face a stern test in the weeks ahead.

The Nasdaq 100, which has ridden high on the artificial intelligence boom, is now showing signs of fatigue. Like the broader market, the index is contending with the twin headwinds of slowing growth and rising inflation. Should economic data continue to falter, markets may begin pricing in a Federal Reserve rate cut sooner than currently anticipated.

Key Data: Non-Farm Payrolls

Once the latest tariffs are announced this week, attention will then shift to retaliatory measures. But from a data point of view, the March non-farm payrolls report on Friday could also trigger some volatility. February’s employment data was underwhelming, with just 151K jobs added versus expectations of 160K. More troublingly, the household survey indicated a sharp decline of 588K jobs, nudging the unemployment rate up to 4.1% from 4.0%. With leading survey data already deteriorating, another weak print could amplify recession fears and increase pressure on the Fed to adopt a more dovish stance. Additional key data releases this week include ISM PMIs, JOLTS Job Openings, and ADP private payrolls.

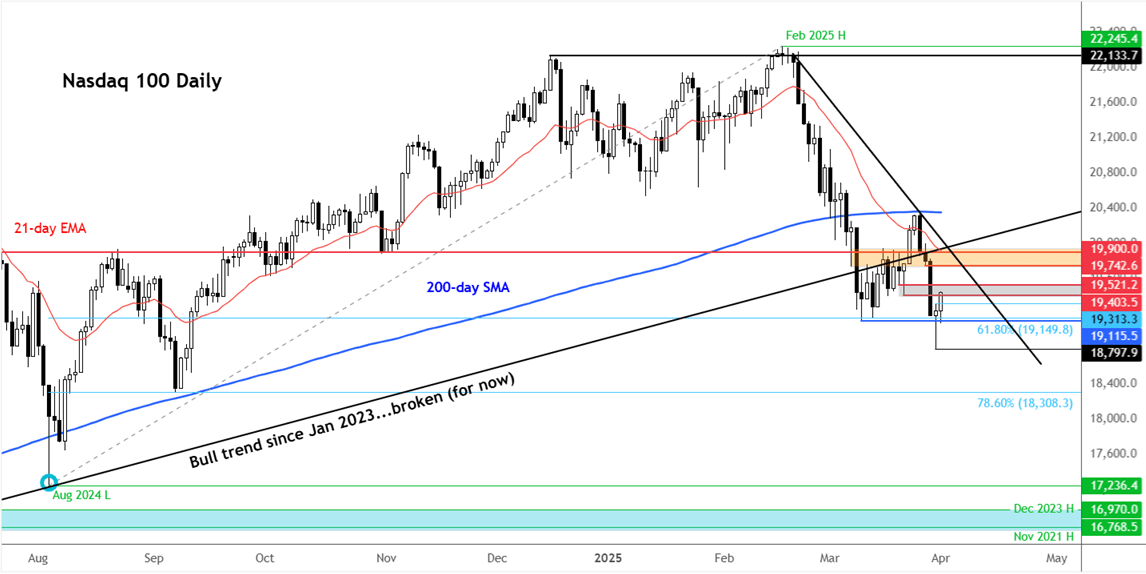

Technical Nasdaq 100 forecast: key levels to watch

Source: TradingView.com

Following an oversold bounce, the major indices like the Dow Jones and S&P 500 have arrived at key resistance area. As far as the Nasdaq 100 itself is concerned, well the tech heavy index is now testing key resistance in the 19400-19520 range, an area marked in grey on the chart. This zone was old support and with the trend being bearish, it could now turn into resistance. The index was testing this zone at the time of writing. Short-term support levels to watch include Monday’s high of 19313, when the index formed a hammer candle. The index needs to hold above this level to maintain the short-term bullish bias. But in the likely event we go back below it, and stay below it, then that would put the bulls who bought this latest drop, in a spot of bother. Their stops will be resting below today’s low and some below Monday’s low of 18797. Those are the next downside targets in the near-term.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R