After falling to the $65 per barrel zone, WTI has rebounded by more than 4% over the last five trading sessions. Currently, the market remains in a neutral stance, awaiting negotiations between the United States and Russia to reach a solid peace agreement regarding the conflict in Ukraine. This event is likely to be a key catalyst for price movements in the short term.

Peace Negotiations

Although efforts have been made to maintain constant dialogue, the United States has taken an aggressive stance to push for a quick resolution to the Ukraine conflict. Recently, Donald Trump's administration imposed new sanctions on Russia’s oil, gas, and banking sectors, limiting their access to U.S. payment systems. These sanctions also restrict other countries from purchasing Russian oil directly, which could be leading to a global supply contraction by hindering the distribution of Russian crude.

The sanctions are intended to pressure Russia into agreeing to a ceasefire within 30 days, aiming for a more stable peace agreement in the short term.

A phone call between Trump and Putin is scheduled for tomorrow, with the primary objective of negotiating the previously mentioned ceasefire. This discussion could be pivotal for the direction of the war, as Russia insists on dividing assets and territory within Ukraine as a condition for achieving peace.

If negotiations progress toward a diplomatic resolution, it is possible that the sanctions imposed by the U.S. and the European Union on Russian oil trade will be lifted, allowing a recovery in crude supply. This could increase downward pressure on WTI, which has been in a bearish trend in recent weeks.

On the other hand, if the Trump-Putin meeting fails to yield expected results, the conflict could persist, maintaining market uncertainty. In this scenario, sanctions would continue restricting supply, potentially driving oil prices higher. Recent movements have halted WTI’s decline around $67 per barrel, suggesting that the market remains focused on the outcome of negotiations.

Currently, the evolution of the conflict and the responses from both governments stand as the key factors shaping the direction of crude oil prices in the coming sessions.

What About Production?

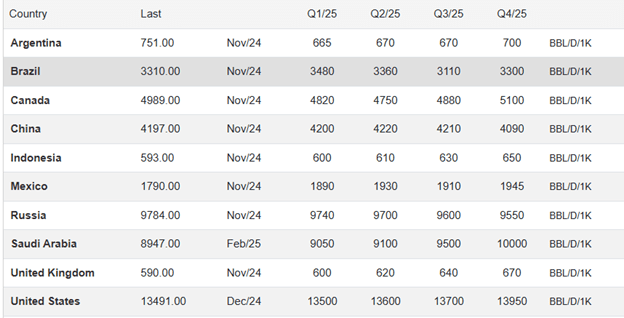

According to Trading Economics projections, an increase in crude production is expected from the United States and Saudi Arabia, both of which are key players in the global oil supply.

In December 2024, U.S. oil production reached 13.4 million barrels per day. However, with the new strategies implemented by the Trump administration, production is expected to rise to 13.9 million barrels per day by the end of 2025, potentially disrupting the global supply balance.

On the OPEC side, the trend follows a similar path. Saudi Arabia, which recorded a production of 8.9 million barrels per day in February 2025, is projected to increase output to 10 million barrels per day by the end of the year, a substantial rise that underscores the cartel’s pro-production stance.

Crude Oil Production Forecast 2025/2026

Source: TradingEconomics

The expectation of a sharp increase in global production has been the main driver behind WTI’s bearish trend in recent weeks. If this oversupply trend continues, selling pressure on crude oil could intensify in the long term, as an excess supply coupled with stable demand may weaken confidence in high oil prices.

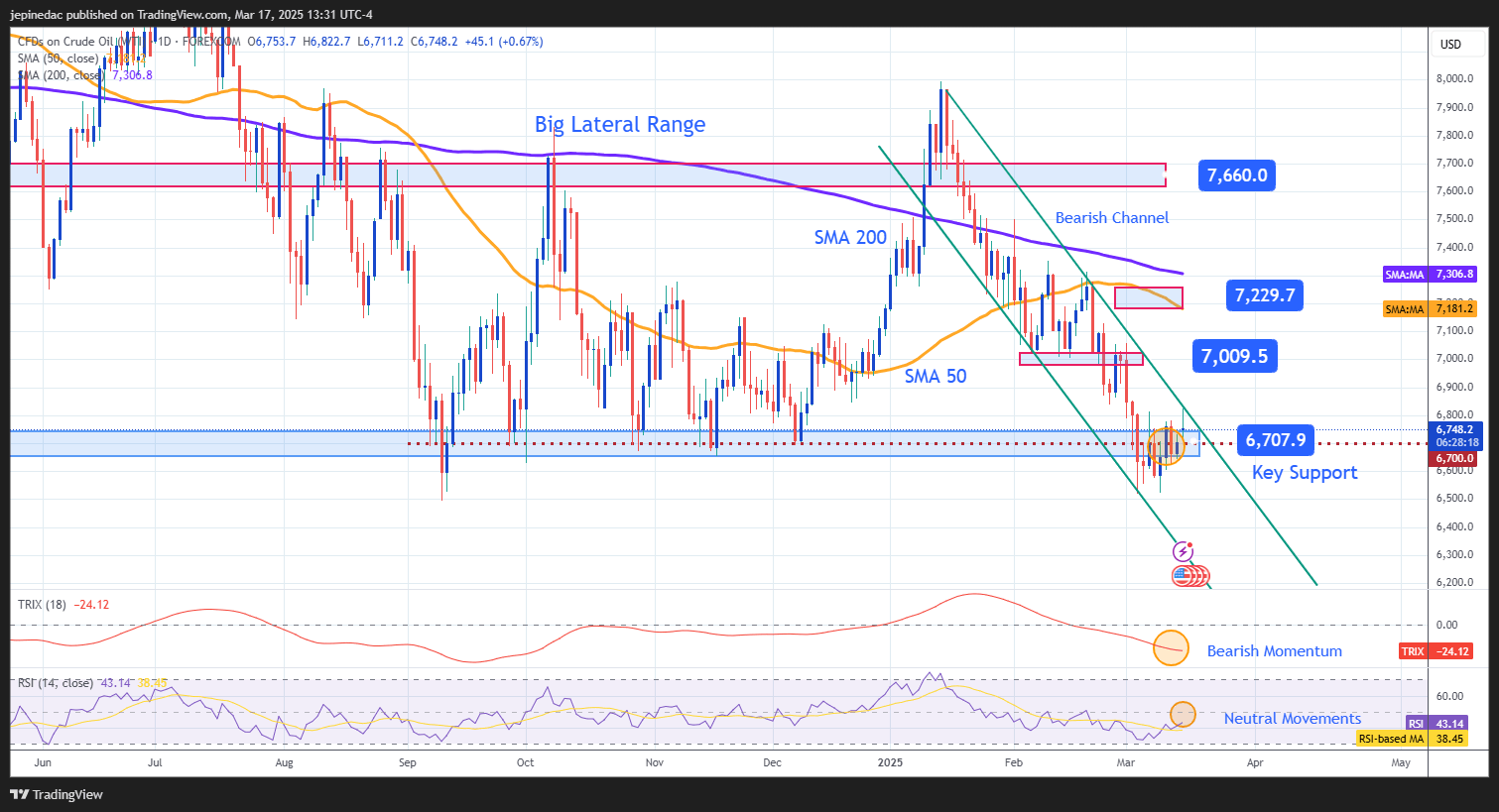

WTI Technical Forecast

Source: StoneX, Tradingview

- Large Sideways Range: WTI continues to trade within a sideways channel, with $76 as resistance and $67 as support. This formation has demonstrated resilience in recent price action, as support has temporarily halted selling pressure. So far, this sideways range remains the most significant structure for crude oil, as recent price fluctuations have not resulted in a definitive breakout.

- RSI: After approaching the oversold zone at 30, the RSI now shows a slight upward slope, moving closer to the neutral 50 level. This suggests that the market remains within a key support zone and, as long as the RSI hovers around 50, neutral sentiment could persist in upcoming sessions.

- TRIX: The TRIX line continues oscillating below the neutral 0 level, indicating that the primary trend remains bearish. In the short term, a small downward channel has formed, with its main barrier at the support level of the sideways channel. If TRIX continues declining, this could signal a reactivation of selling pressure, increasing the likelihood that the price will once again test support at $67 per barrel.

Key Levels:

- $72 – Major Resistance: Coincides with the zone marked by the 50- and 200-period simple moving averages. If the price consistently surpasses this level, it could reinforce a bullish bias, keeping the sideways range as the dominant structure in the coming months.

- $70 – Near-Term Resistance: A psychological barrier in the short term. If the price hovers near this level, it could jeopardize the current bearish formation, opening the door for a new bullish move.

- $67 – Critical Support: Represents the lowest price zone within the sideways channel. If WTI breaks below this level, the sideways structure could collapse, paving the way for a stronger short-term bearish trend.

Written by Julian Pineda, CFA – Market Analyst