The SPX has accumulated a decline of more than 7.0% since its last recorded peak on February 19, when it reached the 6,150-point zone. The strong downward trend has been reinforced by growing global tensions due to the new tariffs imposed by the White House and concerns about a potential employment slowdown in the short term.

Tariffs Continue to Impact the Market

Last week, President Donald Trump’s administration officially imposed a 25% tariff on all imports from Canada and Mexico. Although negotiations remain a possibility, for now, this measure will be in effect for the short term. Additionally, a 10% tariff was announced on Chinese products, and later this week, a 25% tariff on steel and aluminum is expected to be formalized, according to Commerce Secretary Howard Lutnick.

A key aspect is that Trump himself acknowledged that there is a transition period for these tariffs, stating that the ultimate goal of his plan is to "bring wealth back to the United States." Some analysts interpret this statement as an admission that his policies may be negatively impacting the economy in the short term.

Meanwhile, affected countries have begun implementing retaliatory tariffs. China, for example, has announced immediate tariffs on U.S. agricultural products. This escalation in trade tensions has increased concerns that the new trade war could be prolonged.

The SPX has experienced significant declines in recent sessions due to a loss of investor confidence. The new tariffs could increase production costs for U.S. companies that depend on imports from China and other countries. Additionally, the expected rise in domestic product prices in the U.S. could eventually lead to a decline in consumption, fueling pessimism in the markets.

U.S. multinational companies now face a combination of higher operational costs, reduced domestic demand (due to higher prices), and a loss of confidence in the economy. This uncertainty has weakened corporate return expectations, intensifying the bearish pressure on the SPX. If tariffs continue to impact the economy, the selling trend is likely to persist in the short term.

What About Employment?

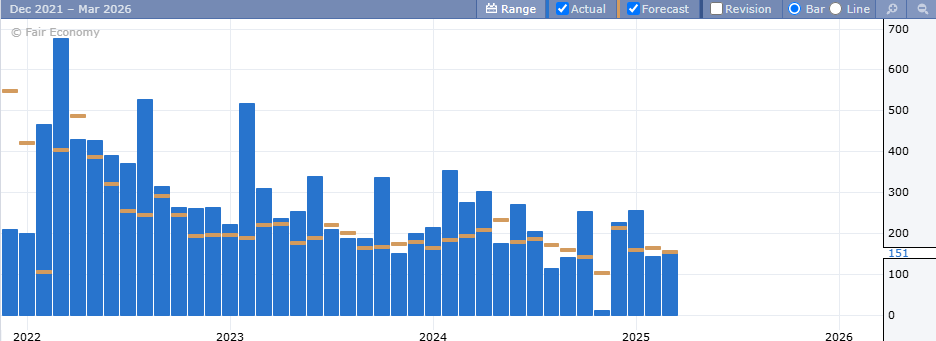

The NFP report published on Friday showed the creation of 151,000 new jobs, below the expected 160,000. Although this figure remains higher than the previous report of 125,000, a clear downward trend in employment has been observed since February 2024, when job creation reached levels near 353,000.

Source: ForexFactory

This decline in job growth suggests that the labor market trend has deteriorated in recent months, reaching levels not seen since 2022. This situation is concerning for stock markets, as lower job creation reduces consumer spending, directly affecting corporate earnings and indexes such as the SPX.

If the downward employment trend continues with no signs of recovery, the selling pressure on the SPX is likely to persist.

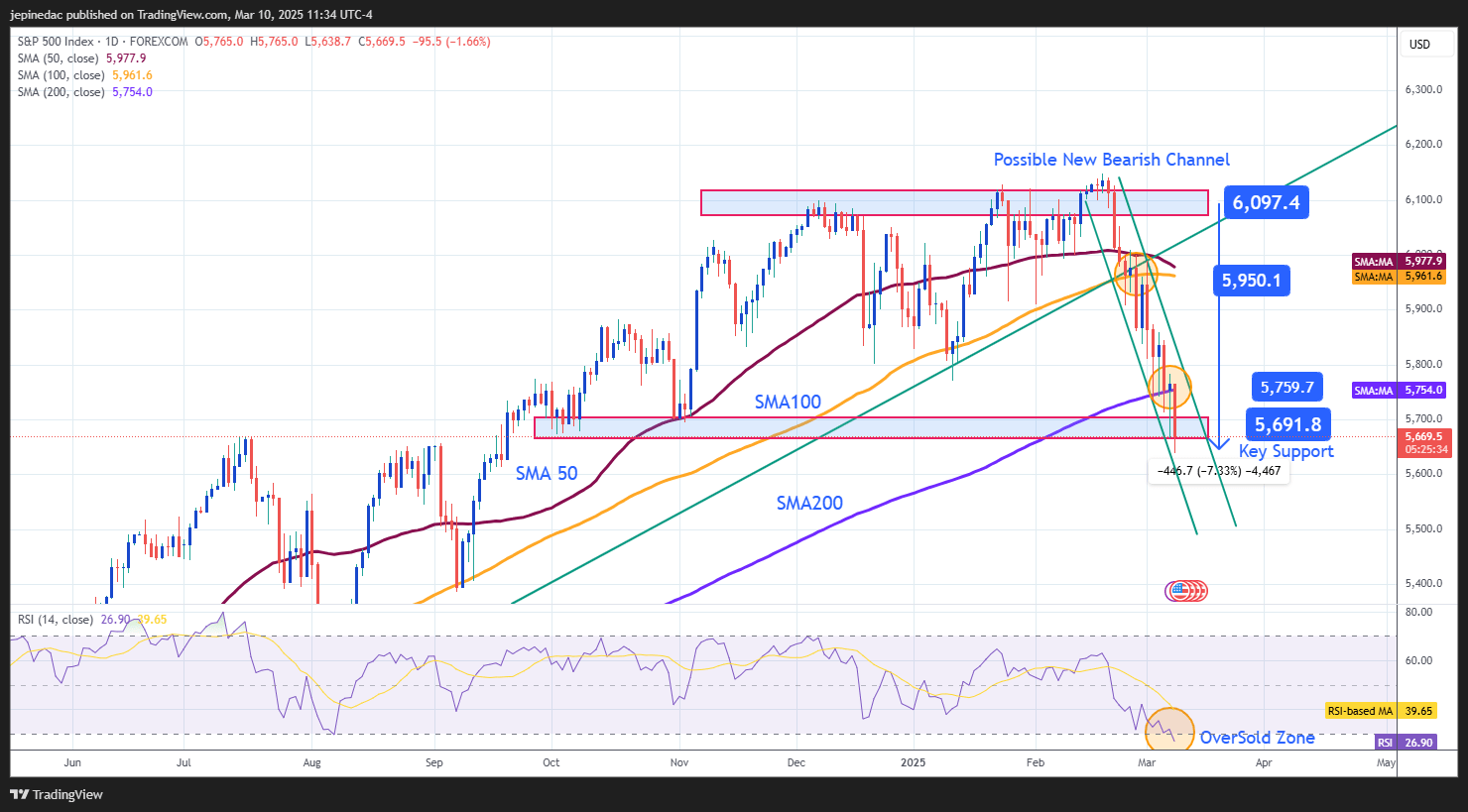

S&P 500 Technical Outlook

Source: StoneX, Tradingview

- New Potential Downward Channel: Since February 18, the SPX has begun to develop a new short-term bearish channel, breaking below the 50-period and 100-period simple moving averages and, more recently, the 200-period simple moving average.

The strong downward pressure has pushed the SPX to test a key support level, which could trigger short-term bullish corrections.

- RSI (Relative Strength Index): The RSI maintains a steep negative slope and has crossed the oversold threshold at 30. This suggests an imbalance between buying and selling pressure over the last 14 sessions, which could lead to short-term bullish corrections.

Key Levels:

- 5,690 points – Crucial Support: This level represents the lowest point since October last year and is the most significant barrier within the current bearish channel. If the price breaks below this level, the downward trend could accelerate, with stronger bearish pressure in the short term.

- 5,760 points – Near-Term Resistance: This level coincides with the 200-period moving average and could act as a barrier for potential bullish corrections in the upcoming sessions.

- 5,950 points – Key Resistance: Located at the convergence of the 100-period and 50-period moving averages, along with the previous upward trendline. If the price returns to this level, the bullish bias could be reactivated, although the struggle between buyers and sellers might lead to a prolonged consolidation phase.

Written by Julian Pineda, CFA – Market Analyst