Wall Street staged a respectable bounce following Powell’s somewhat dovish tone, but—as we’ve seen in recent sessions, the gains could not hold for too long. The Fed Chair’s remarks did little to inspire early European trade, with markets and futures on both sides of the Atlantic drifting lower. Not the most upbeat start to the day, but let’s see whether dip-buyers make an appearance later on. After all, recent price action has shown signs of base-building, helped by softer inflation prints and a flicker of optimism surrounding Ukraine peace talks. Tech also lent a hand yesterday, with the likes of Amazon and Alphabet managing to defend key levels at $190 and $160, respectively. Thus, while volatility remains elevated, there are tentative signs the market could be inching towards recovery, though confirmation of a bottom remains elusive – for now. So, the S&P 500 outlook remains uncertain, meaning traders are continuing to take it from one level to the next.

Powell downplays risks ad Trump calls for lower rates

Jerome Powell was his usual self at the FOMC press conference and he tried to instil confidence in the markets by suggesting the economy is doing well and long-term inflation expectations are anchored, despite recent data from the University of Michigan’s survey suggesting otherwise. He even went on to say that price hikes stemming from Trump’s tariffs could be transitionary.

Meanwhile, the US President Donald Trump took to social media to call for lower rates from the Fed, almost similar to what Turkiye President Erdogan was doing - calling for lower borrowing costs despite high inflation and we saw how that turned out for their currency and stock markets. Anyway, Trump’s post did little to help markets, at least initially anyway. Let’ see if stocks will rebound once Wall Street gets underway later. In case you missed it, this is what Trump posted:

“The Fed would be MUCH better off CUTTING RATES as U.S. Tariffs start to transition (ease!) their way into the economy,” Trump said in a post on Truth Social. “Do the right thing. April 2nd is Liberation Day in America!!!”

Worst of the selling over?

Despite weakness in US futures, the broader tone is certainly calmer after a turbulent month that saw the S&P 500 flirt with correction territory. Still, traders remain wary of Trump’s tariff agenda and its potential drag on global growth, all while stoking inflation fears. As such, profit-taking on rallies has been the order of the day, keeping the S&P 500 outlook cautious. Yet, with markets showing greater resilience of late, dip-buyers may feel emboldened as equities gravitate towards key support zones.

Technical S&P 500 forecast

Source: TradingView.com

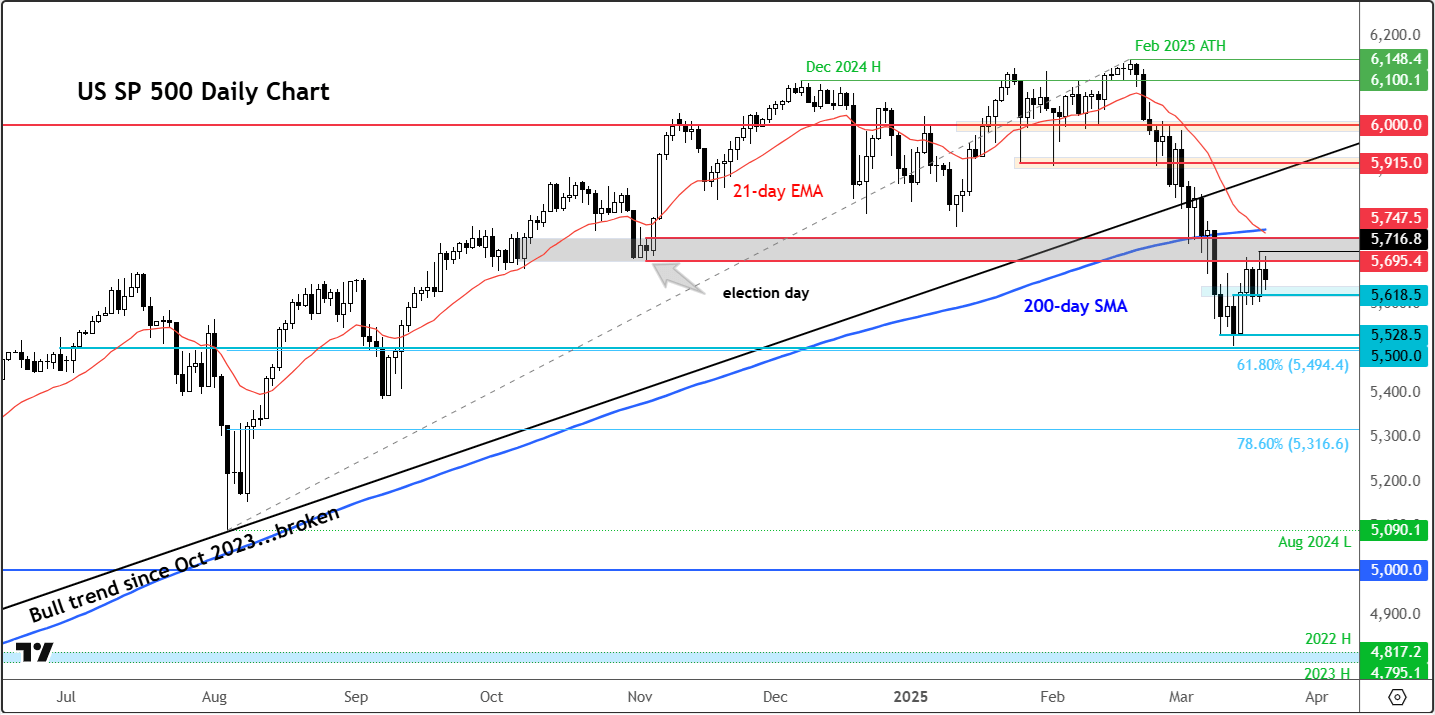

The S&P 500 has found resistance right where it had to: in the lower end of the key 5695-5747 range. This area was support and the base of the rally that began on the election day. It marks a key psychological area – especially for Trump and his ego. If markets were to rise back above this zone, this will be a sign that the markets are still trusting in his economic policy of boosting spending and cutting taxes, without causing inflation to surge. So, a decisive move back above here would be key.

The other key support and resistance levels are shown on the chart. On the downside, 5618-5620 is an interim support area to watch, below which the next key area is around 5,500.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R