Key Events This Week

- Chinese CPI drops to -0.7%, fueling concerns over a global economic slowdown

- US JOLTS Job Openings (Tuesday)

- US CPI and Fed Rate Projections (Wednesday)

- BoC Rate Decision and Press Conference (Wednesday)

- UK GDP and US Preliminary Consumer Sentiment (Friday)

GBP/USD Rebounds Below the 1.30 Barrier Ahead of US CPI

Following the US Dollar's decline due to trade war concerns and weaker-than-expected payroll data, GBP/USD rallied to 1.2945, 55 pips below the psychological 1.30 level. This area aligns with the 0.618 Fibonacci retracement of the September 2024 – January 2025 downtrend.

Markets remain in wait-and-see mode amid high volatility and weakening USD, which dropped to a low of 103.45 on the US Dollar Index (DXY). From a momentum perspective, a rebound may occur this week unless JOLTS and CPI data reinforce inflation concerns, strengthening the USD once again.

UK GDP, currently at a seven-month high of 0.4%, needs further positive momentum to confirm an uptrend above the 1.30 mark, especially amid the ongoing trade war uncertainties.

However, US economic indicators and trade war developments remain key drivers for market sentiment this week.

USD/CAD Holds Above 1.43 Ahead of BoC Rate Decision

The Bank of Canada (BoC) is expected to cut rates from 3% to 2.75% on Wednesday, reaching levels last seen in July 2022. The BOC decision and press conference coincides with the release of the US CPI report, increasing volatility risks for USD/CAD. The pair is currently holding above the key 1.43 level.

In February, Canadian employment remained flat, with the unemployment rate steady at 6.6% and only 1,100 jobs added alongside harsh winter conditions. Additionally, the ongoing trade war risks may impact upcoming economic reports.

Technical Analysis: Quantifying Uncertainties

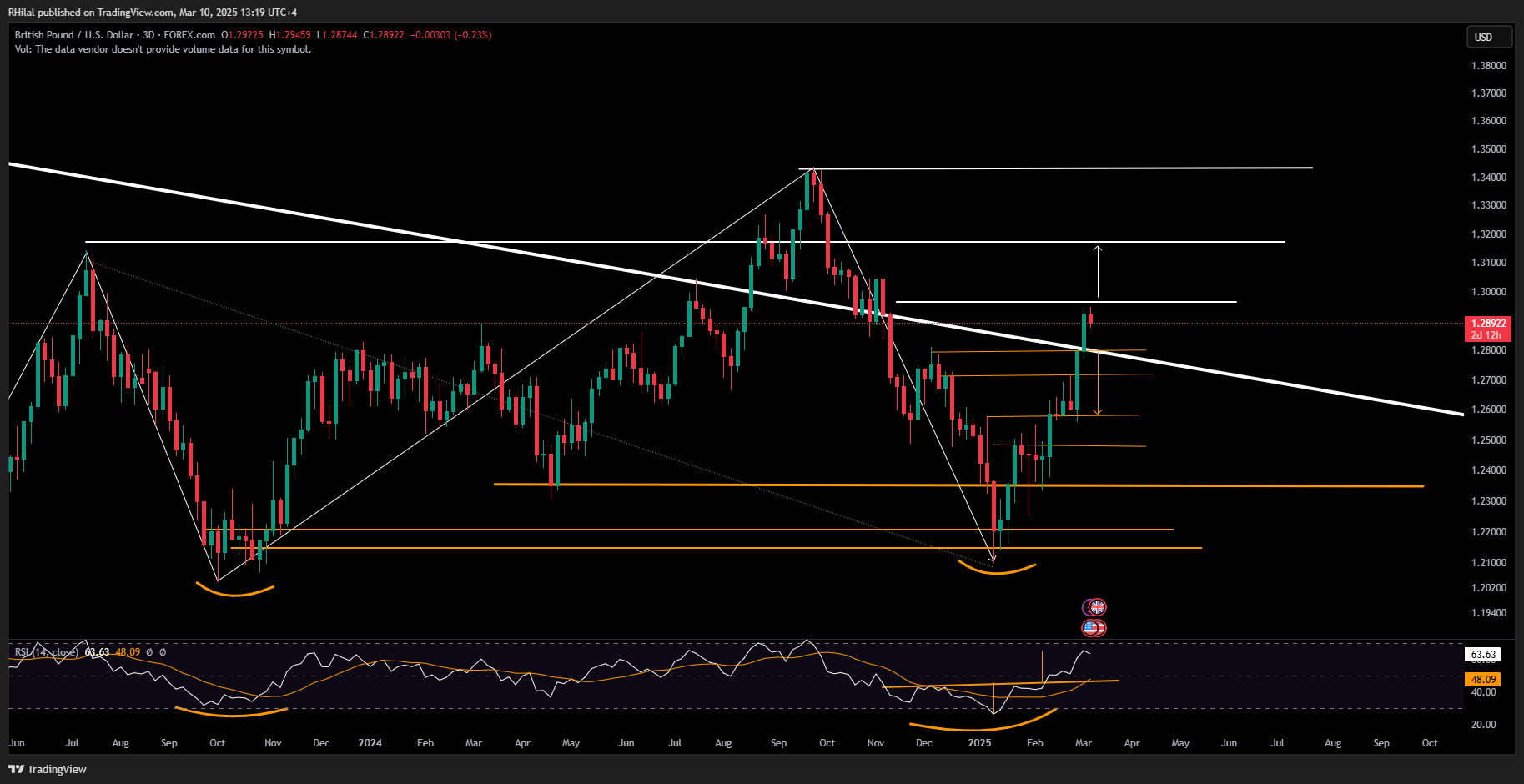

GBPUSD Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

After reaching the 0.618 Fibonacci retracement level of the September 2024 – January 2025 downtrend at 1.2945, GBP/USD is currently in rebound mode, eyeing key support levels at 1.28, 1.27, and 1.2520. A decisive close above 1.2950 could trigger a move toward resistance levels at 1.3020 and 1.3150.

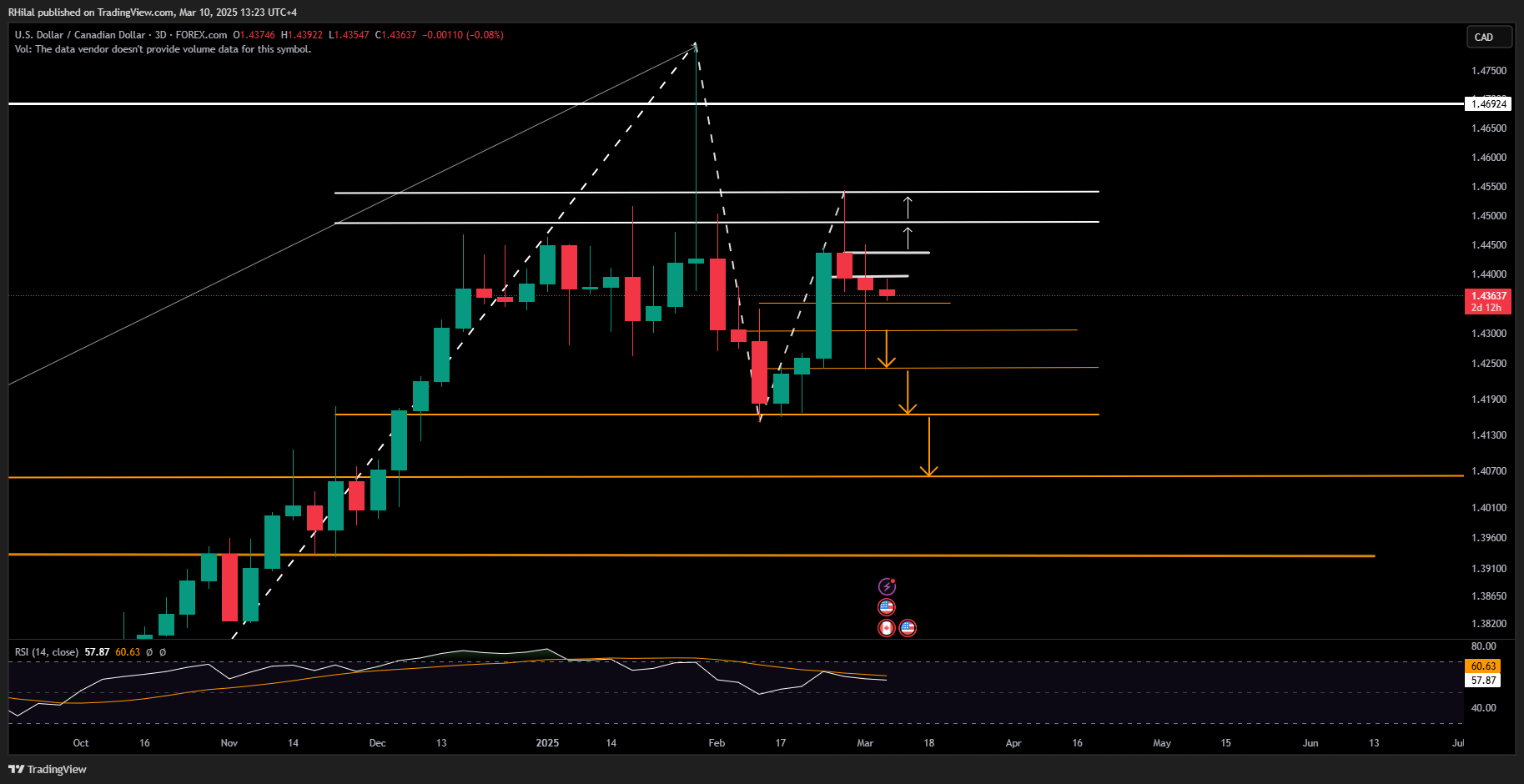

USDCAD Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

USD/CAD remains below its 2024 highs, but its strong rebound above 1.43 signals market indecision. The Relative Strength Index (RSI) leans neutral-to-bearish. A clean break below 1.4340 could push the pair lower toward 1.43, 1.4240, and 1.4160, potentially confirming a deeper bearish trend.

On the upside, a close above 1.44 could extend gains toward resistance levels at 1.4440, 1.4490, and 1.4540, setting the stage for a longer-term uptrend.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves