Oil prices have bounced back over 1% today, but the near-term risks still remain titled to the downside, with a real risk of WTI potentially breaking the $65 support level in the coming days. I reckon a potential drop to $60 may well be on the cards, but I don’t see prices falling much more than that, as the OPEC+ could easily reverse its plans of gradually increasing output. But for now, the crude oil outlook remains negative.

What factors have caused the slide in oil prices?

The drop in oil prices since Trump officially took office this year has been a swift one. A number of factors came into play, including the obvious one: this tariffs and concerns that it will hurt demand. We have also seen talks start over a peace process in Ukraine, although the road to peace could be a bumpy one with the war raging on and the two sides appearing to be quite distant. On top of all this, you have the OPEC+ withheld supplies coming back slowly, which is raising concerns over an oversupplied market when you consider a weaker demand outlook amid signs or concerns that the US could be heading to an economic slowdown, with recent data releases mostly disappointing.

So, a combination of these factors has been at play and prices have slumped accordingly.

Can crude oil outlook turn positive?

Well, as things stand, it appears as though there are not many bullish factors for the bulls to point to. But support could arise if the OPEC were to raise output in April and then pause for a long time – as they have done so in the past. The OPEC+ plans to increase oil production to 2.2mn barrels a day over the next 18 months. That would represent 2% of global demand. But if demand growth falters, then the group may not increase production and that could lend support to prices. What’s more, as oil is relatively demand-inelastic, unless a major global downturn emerges, the downside is likely to be limited for oil from here – and WTI could potentially bottom around the $60 area should it get there.

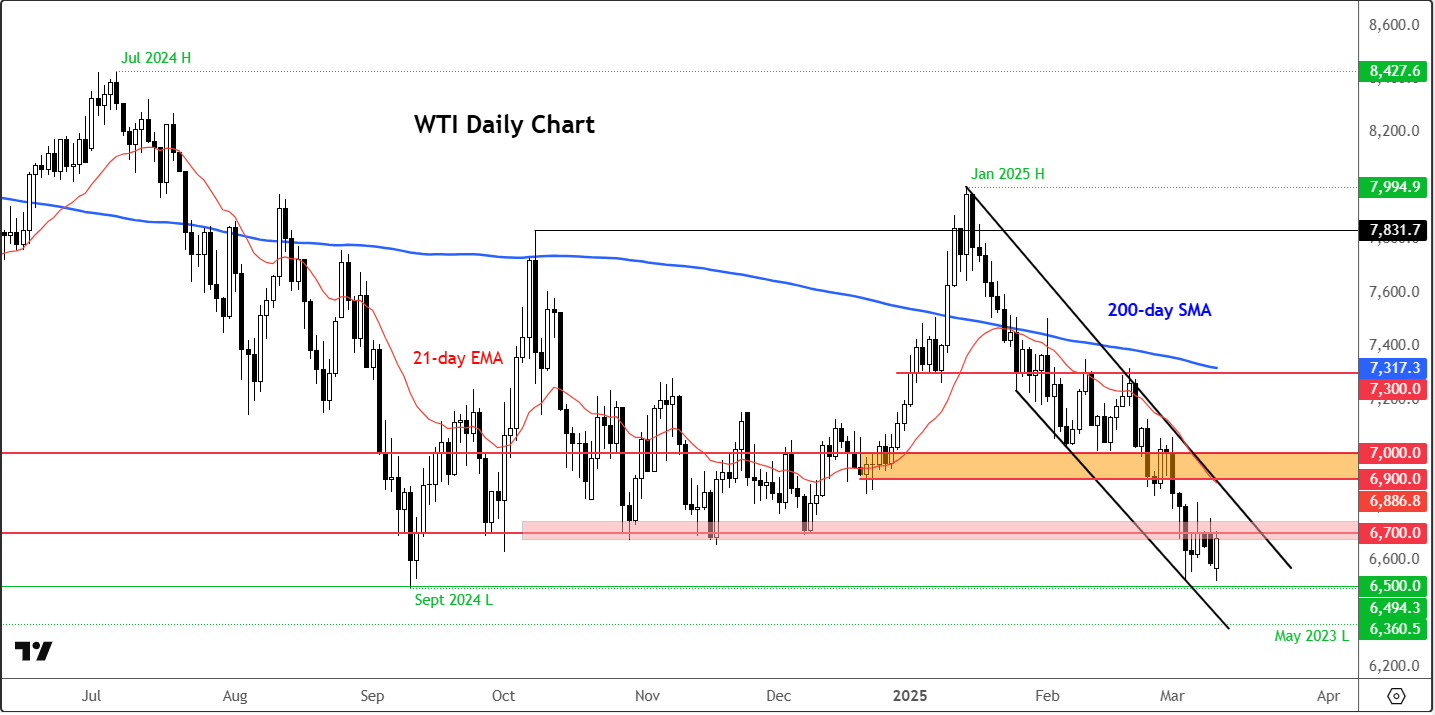

Technical crude oil outlook: WTI key levels to watch

Source: TradingView.com

For now, the key level of support on WTI remains around $65.00, which was last tested in September. Should prices break decisively lower, then the May 2023 low of $63.60 will come into focus next, followed by the next psychologically-important handle of $60.00. In terms of resistance levels to watch, well the $67.00 level is now key in so far as the short-term technical outlook is concerned. Above this, you have $68, $69 and finally $70 as the next important resistance levels to watch.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R