Concerns surrounding Trump’s tariffs have continued to weigh on sentiment this week, with Wall Street indices currently on track for a fourth week lower. His threat of raising Canda’s tariffs to 50% from 25% on steel and aluminium provide further evidence that he more than happy to send the stock market lower, which much unlike his first term. Treasury Secretary Scott Bessent has already warned traders that there is no “Trump put”, and they are finally taking notices.

As things stand, Nasdaq 100 futures are amid their worst 4-week run since April 2022, with a high-to -low range of -12.3%. This places it comfortably within the ‘technical correction’ bracket, defined as a -10% move from a close high. These metrics alone make me favour a bounce for the Nasdaq 100 over the near term, although further out I suspect new lows await. And that a move back to a record high could be way off.

Previous corrections have generally fallen within the 7.5% - 10% range on a closing basis, so the fact that it currently sits at -12.3% suggests it could be a deeper correction or a technical bear market (defined as a -20% move). Further, the weekly RSI (14) is not yet oversold and is confirming the move lower, which leaves plenty more downside for prices. Moreover, asset managers have been shying away from longs and ramping up shorts in recent weeks.

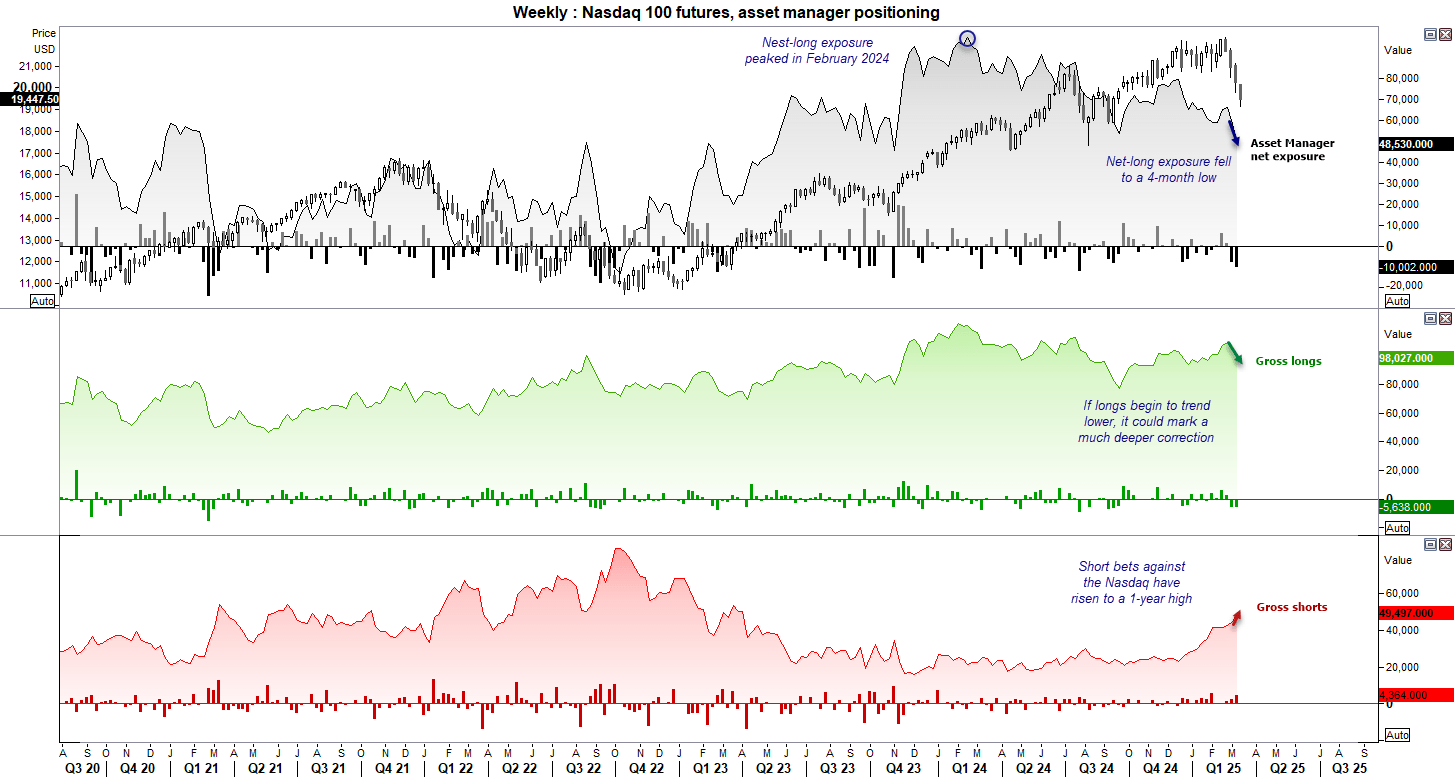

Nasdaq 100 futures (NQ) positioning – COT report

Being long Nasdaq was all the rage last year, although asset managers were slowly reducing their net-long exposure from February 2024. However, they have really ramped up their bets against it this year, with gross-short exposure reaching a 1-year high. While gross longs remain elevated, they have been trimmed the past two weeks. And if we see the closure of longs pick up pace, chances are we’re in for a much deeper correction for the Nasdaq and risk in general.

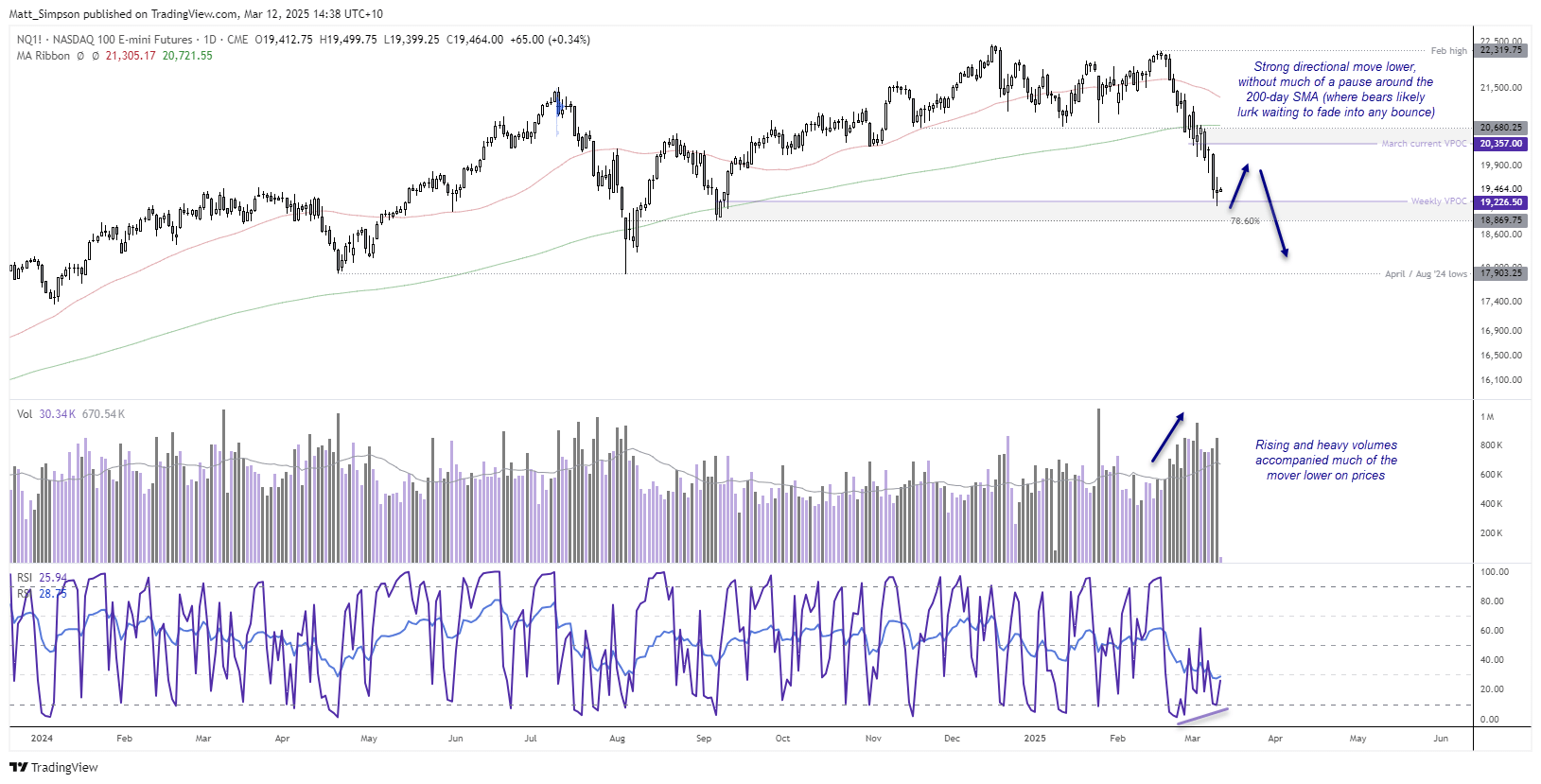

Nasdaq 100 technical analysis:

The decline from the Nasdaq’s February high has effectively been in one straight line. Not even the 200-day SMA prompted much of a bounce before its losses resumed. Volumes were rising during the decline towards and below the 200-day SMA to show bearish initiation as opposed to longs simply covering.

However, a Doji found support around the 19,226 VPOC (volume point of control) on Tuesday and bullish divergences are forming on the daily RSI (2) and RSI (14) so suggest a bounce could be due over the near term, but with trade headlines dominating sentiment we should also be on guard for a move down to the 19k handle or 18,869 swing low, near the 78.6% Fibonacci level.

For risk to truly bounce likely requires a reversal of Trump’s tariffs, and that semes unlikely. Bu should he loosen his grip on Canada’s eye-watering tariffs, perhaps we could see a move back towards 20k. But I suspect bears are waiting to reload into any such bounce, and a move to 18k near the April / August 2024 lows seem likely.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge