- ASX 200 SPI futures deeply oversold, but bulls need a signal to confirm a squeeze

- Iron ore futures up nearly 1%, closing in on key resistance at $102.25–103.20.

- Momentum shifting, but key tests ahead for both SPI and iron ore bulls.

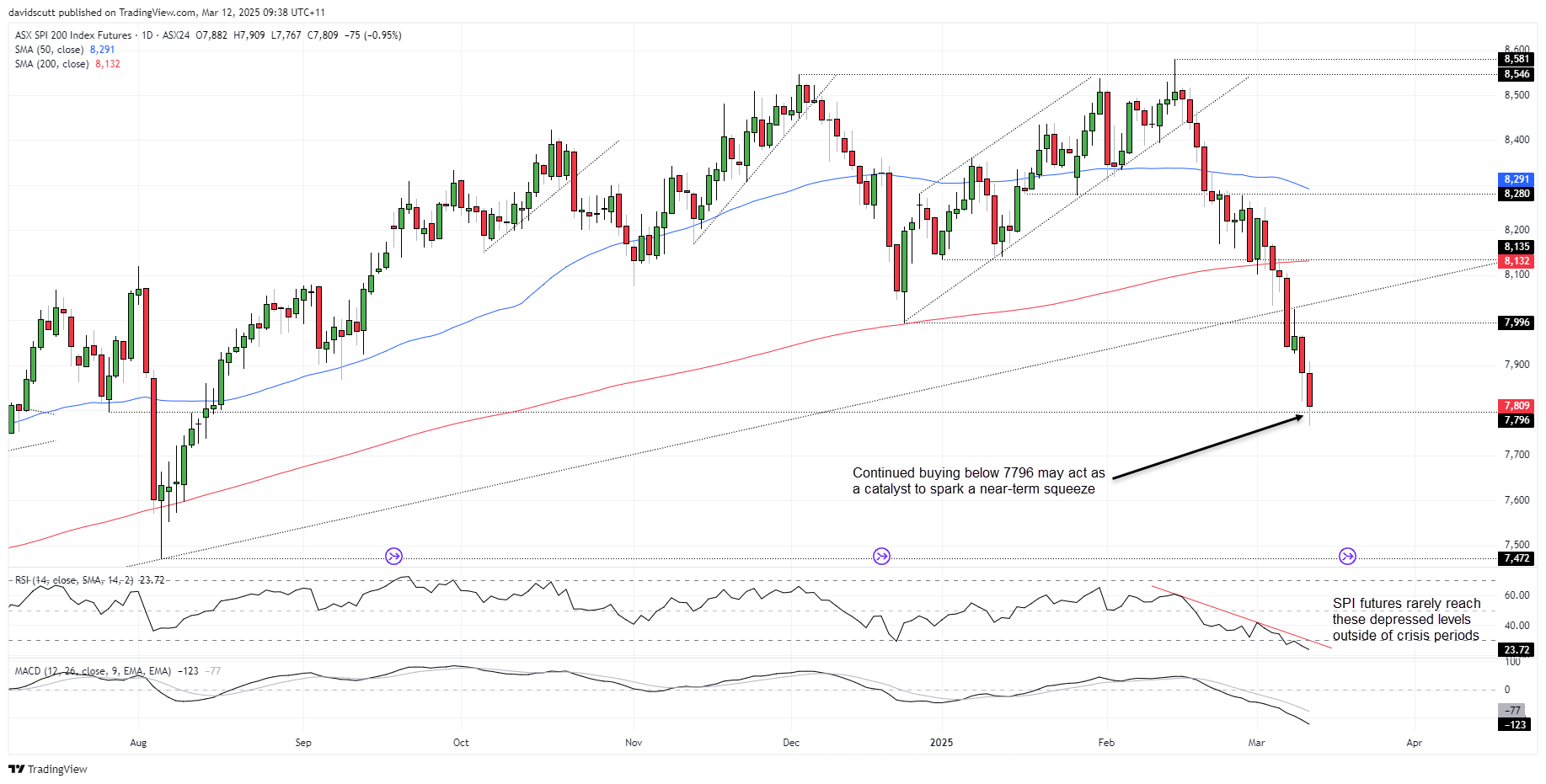

ASX 200 SPI Futures Oversold, Squeeze Risk Grows

Source: TradingView

ASX 200 SPI futures are so oversold on the daily timeframe that you can’t help but notice, especially when looking back over recent years. The only time an RSI reading this low didn’t spark some form of bounce was during the height of the pandemic panic in early 2020.

But being oversold alone isn’t enough to trade against the prevailing strong bearish trend, putting extra emphasis on Wednesday’s price action. To get bullish and position for a countertrend squeeze, we need a price signal for confirmation.

I’m watching 7796—the price dipped below this level in low-volume trade during the night session before reversing back above. It’s only a minor level, but beneath it there’s not much for bulls to hang their hat on until 7600, where buyers stepped in last year.

Depending on the price action around the open at 9:45 am AEDT, if bulls defend 7796 again, the risk of a squeeze increases, similar to what we saw on Tuesday.

Longs could be considered above the level with a stop beneath the session low for protection. 7900 is one potential target, with 7996 and former uptrend support around 30 points higher alternative options for those seeking greater risk-reward.

A clean break and close below 7796 would invalidate the squeeze setup. Unless accompanied by fundamentally bearish news, flipping short after recent declines would be risky.

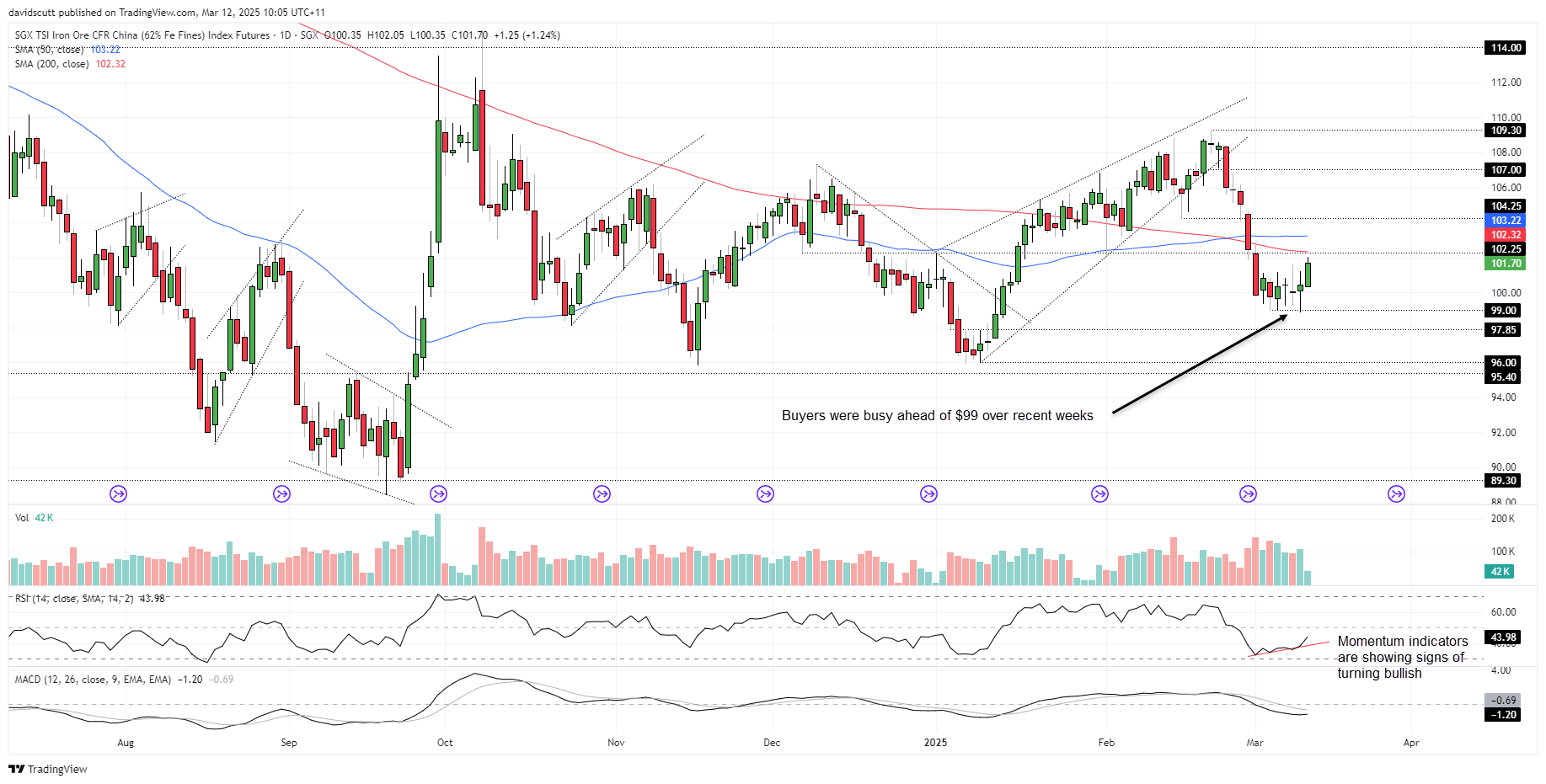

SGX Iron Ore Eyes Topside Hurdles

Source: TradingView

Potentially working in bulls’ favour, iron ore futures in Singapore had a solid session overnight, lifting nearly 1% to $101.70—leaving it within touching distance of a key zone between $102.25–103.20. This area encompasses the 200-day moving average, horizontal resistance, and the 50-day moving average.

With bulls nibbling on dips towards $99 over the past two weeks, momentum signals are starting to shift bullish, with RSI (14) now trending higher. While MACD continues to trend lower, it’s beginning to curl higher, suggesting it may soon confirm the signal. That would improve the prospects for a topside break if it happens.

Above the 50-day moving average, levels of note include $104.25, $107, and the February swing high of $109.30.

If resistance between $102.25–103.20 holds, support may be found at $99, $97.85, and $95.40.

-- Written by David Scutt

Follow David on Twitter @scutty