The S&P 500 and Nasdaq 100 are on track to close lower for a third week, a bearish sequence not seen since July. I suspect the selloff is reaching a near-term exhaustion point, given both indices are now trading back above their 50-week EMAs.

And as their 3-week selloffs began with a lower could suggest that they’re in no hurry to reach a new record high in the near term. Even if history stacks the odds of new record highs heavily in their favour further out. Furthermore, market positioning of the Nasdaq 100 and S&P 500 futures markets show that bets against it are on the rise, which bolsters my case that any incoming bounce could be short lived.

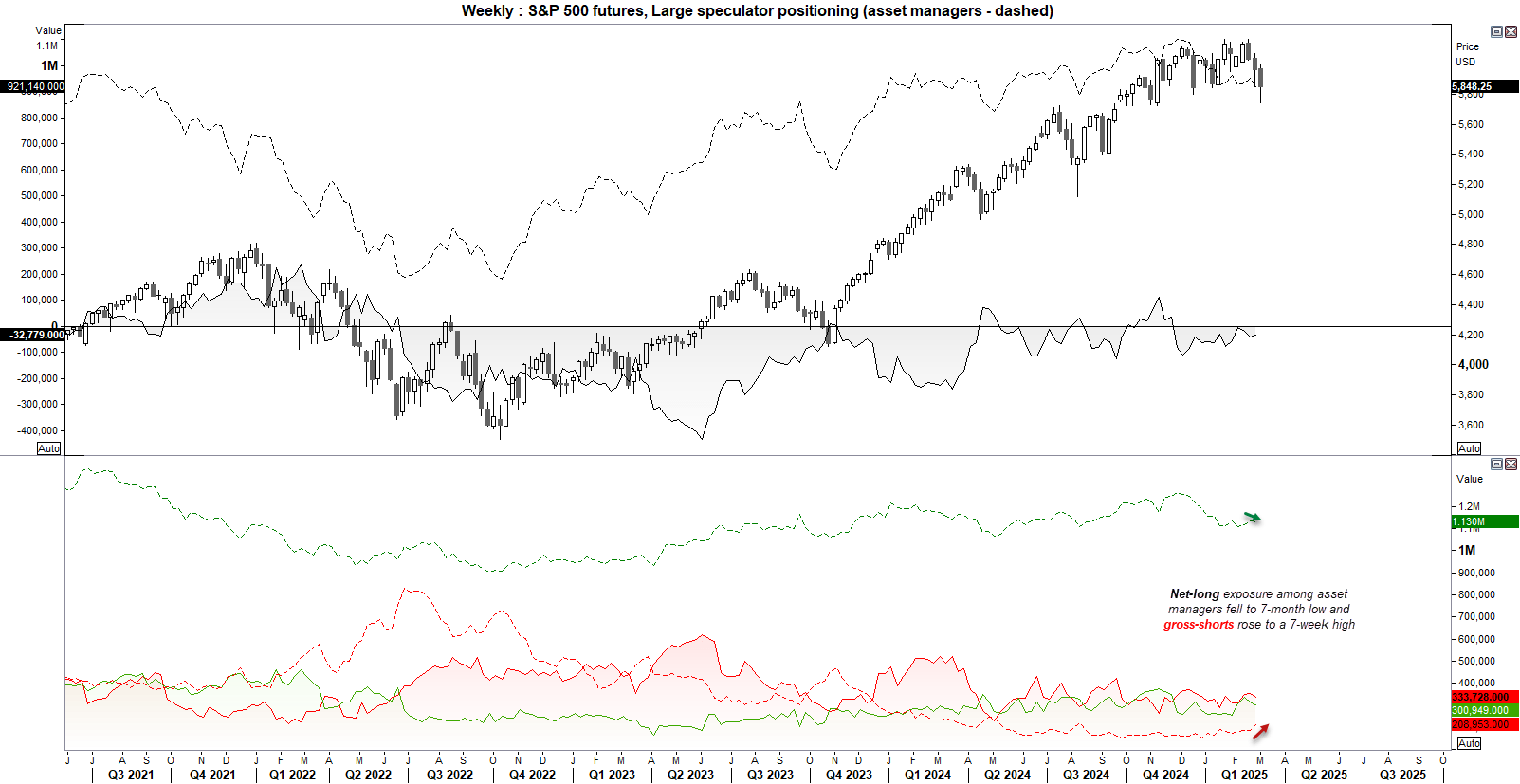

Nasdaq 100 Futures (NQ) Market Positioning – COT report

I am seeing mixed signals between large speculators and asset managers. I generally find the latter to be better at tracking the direction of indices, so more weigh shall given to this subset of trader. Asset managers increased their gross-short exposure to a near 2-year high last week and trimmed longs, which dragged net-long exposure down to a 23-week low. Yet large speculators trimmed both longs and shorts. For this reason, my expectation is for the Nasdaq to trade lower in a few weeks from now, but price action also suggests a bounce could be due first.

S&P 500 Futures (ES) Market Positioning – COT Report

Again, we’re seeing net-long exposure fall on the S&P 500 among asset managers, although net-short exposure has declined among large speculators. But as the latter group saw a reduction of longs and shorts, their bullish case is far from compelling.

Meanwhile, asset managers have increased their gross-short exposure to S&P 500 futures to a 7-month high and trimmed longs. And this suggests the same as above; any bounce could be short lived and a break to a new record high is not currently favoured.

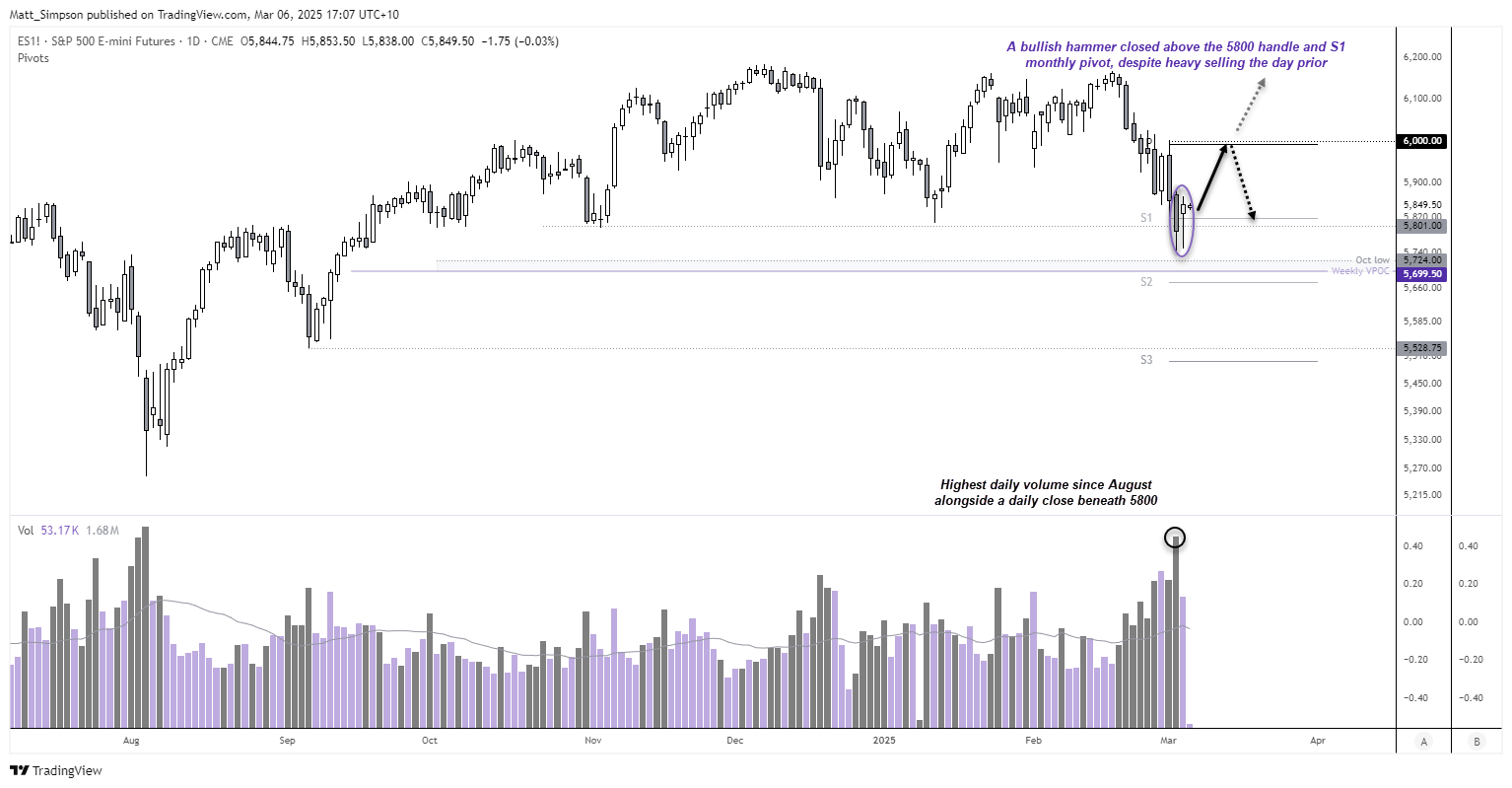

S&P 500 futures technical analysis

A daily close beneath the November low and 5800 level was accompanied by the heaviest daily volumes since August. While this shows bears clearly dominated the session, they must be disappointed with Wednesday’s bullish hammer, which was also a small bullish inside day which close back above 5800 and the monthly S1 pivot.

The bias is to seek dips within yesterday’s range while prices hold above Tuesday’s low, in anticipation of a move towards 6,00 near the monthly pivot point.

I can reassess sentiment if this plays out, but for now the bias is for a bounce to occur ahead of its next leg lower.

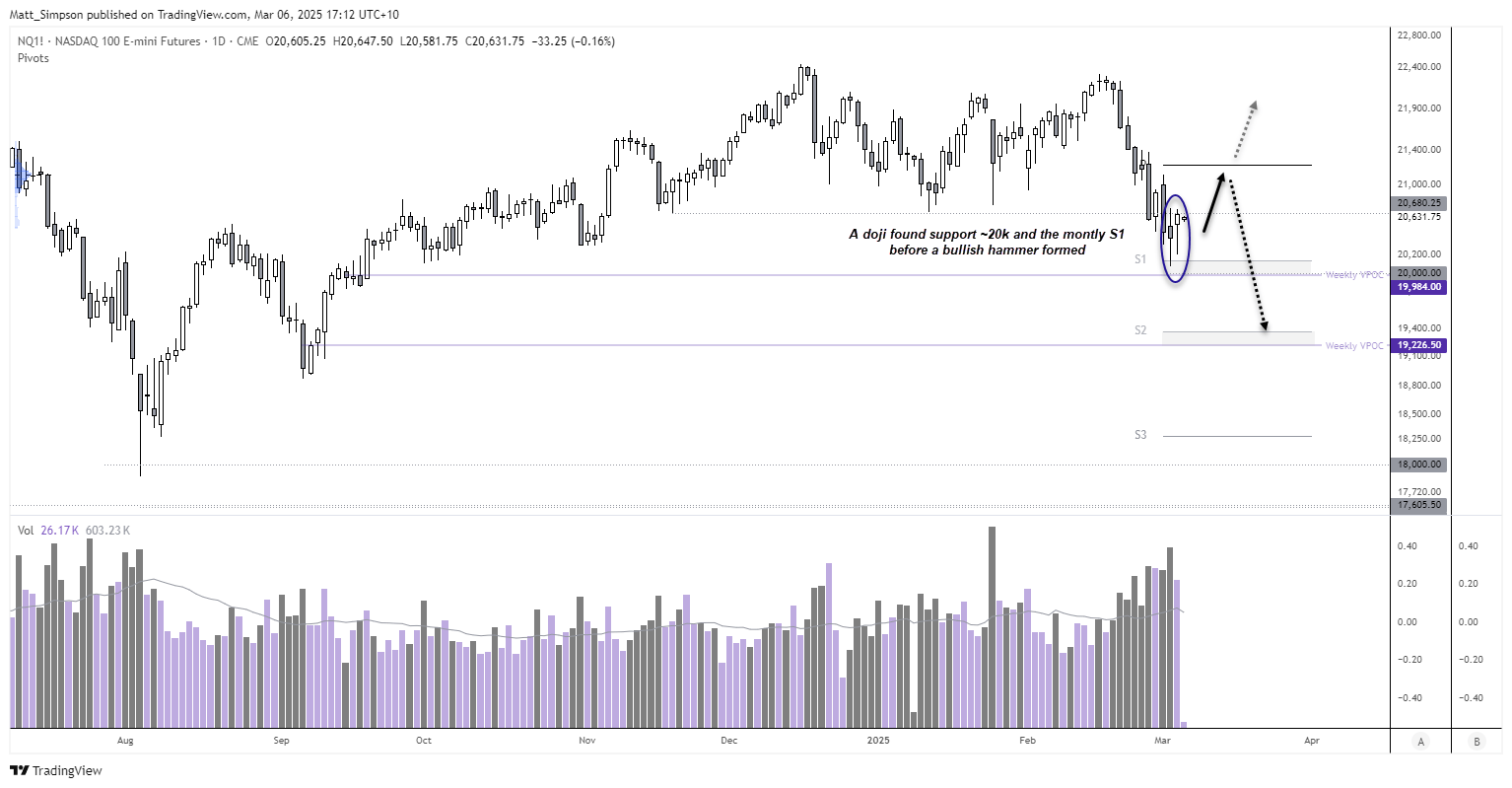

Nasdaq 100 futures technical analysis

It could argued that price action on Nasdaq futures are marginally more bullish than those seen on the S&p 500. While both formed a bullish hammer on Wednesday, the Nasdaq printed a doji instead of a decisively bearish bar with a daily close beneath key resistance. The doji also found support at the monthly S1 pivot, just above a weekly VPOC (volume point of control) and 20k handle.

Like the S&P 500, the bias is for a bounce towards the monthly pivot ahead of its next leg lower.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge