US index futures were trading higher by mid-morning European session, tracking a firmer tone in Europe, where the major indices like the German DAX approached their all-time highs, boosted by industrial stocks such as Heidelberg Materials. Sentiment has been supported in part because of plans by German Chancellor-in-waiting Friedrich Merz to amend the country’s constitution to exempt defence and security outlays from fiscal spending limits. This will pave the way for a €500 billion infrastructure fund to invest in transportation, energy grids, and housing over 10 years. Also helping sentiment was speculation US trade tariffs may be dialled down…because of the stock market drop. US Commerce Secretary Howard Lutnick hinted at a compromise on tariffs on Tuesday, while Trump himself acknowledged that there may be an “adjustment period” to tariffs. The key question for the near-term S&P 500 outlook now is whether the recovery will hold?

Trade war turmoil erased post-election gains

The rebound follows a bruising session in global markets in recent days, where investors were sent scrambling for cover. Heightened concerns over an escalating trade war saw traders flock to haven assets—short-term bonds, gold, and safe-haven currencies like the yen. Meanwhile, risk-sensitive assets bore the brunt of the selling pressure, including equities, crude oil, and even cryptocurrencies. The S&P 500 was not spared, erasing the entirety of its multi-trillion-dollar rally since the last US election. However, a late-session attempt at stabilisation managed to limit losses, leaving major indices well off their worst levels by the close.

Market jitters: Is the sell-off justified?

Undoubtedly, tariffs have played a significant role in shaking investor confidence, but other factors are at play. Concerns around stretched valuations and profit-taking have also contributed to the sell-off. However, the sharp acceleration in selling pressure was largely triggered by the US implementing one of its most expansive tariff regimes in recent memory. The White House has taken aim at a broad swathe of imports from China, Canada, and Mexico, prompting swift retaliatory measures.

But after the US Commerce Secretary Lutnick hinted at a compromise on tariffs on Tuesday, while Trump himself acknowledged that there may be an “adjustment period” to tariffs, markets have stabilised somewhat. The pressing question now is whether the market rout has run its course—or if further turbulence lies ahead.

Key economic data in focus: ISM and NFP

Amid the trade war narrative, economic data will come back under the spotlight. Weaker-than-expected data has reinforced concerns over slowing global growth, with traders now pricing in three quarter-point rate cuts by the Federal Reserve this year. However, incoming reports this week could see expectations shift yet again.

Recent US data has presented a mixed picture. Consumer confidence indicators have disappointed, while cracks are appearing in the housing sector. Additionally, last week’s S&P Global flash services PMI, a leading indicator for the ISM PMI, slipped into contraction territory. Investors will be keenly watching today’s ISM PMI release—should it follow the same path, speculation around Fed rate cuts could intensify. A reading of 52.5 is expected compared to 52.8 in the previous month.

Attention will then turn to the ECB rate decision on Thursday, followed by Friday’s US monthly non-farm payrolls (NFP) report. January’s payrolls data caught markets off guard with stronger-than-expected wage growth, as average hourly earnings surged by 0.5% month-on-month. Despite an underwhelming headline jobs figure, upward revisions to prior months offset the disappointment. The broader trend suggests that while economic momentum is waning, inflationary pressures remain a concern for policymakers. If upcoming data continues to signal economic weakness, expectations for rate cuts will likely rise, providing a potential cushion for equities amid ongoing trade tensions.

S&P 500 outlook: Technical levels to watch

Source: TradingView.com

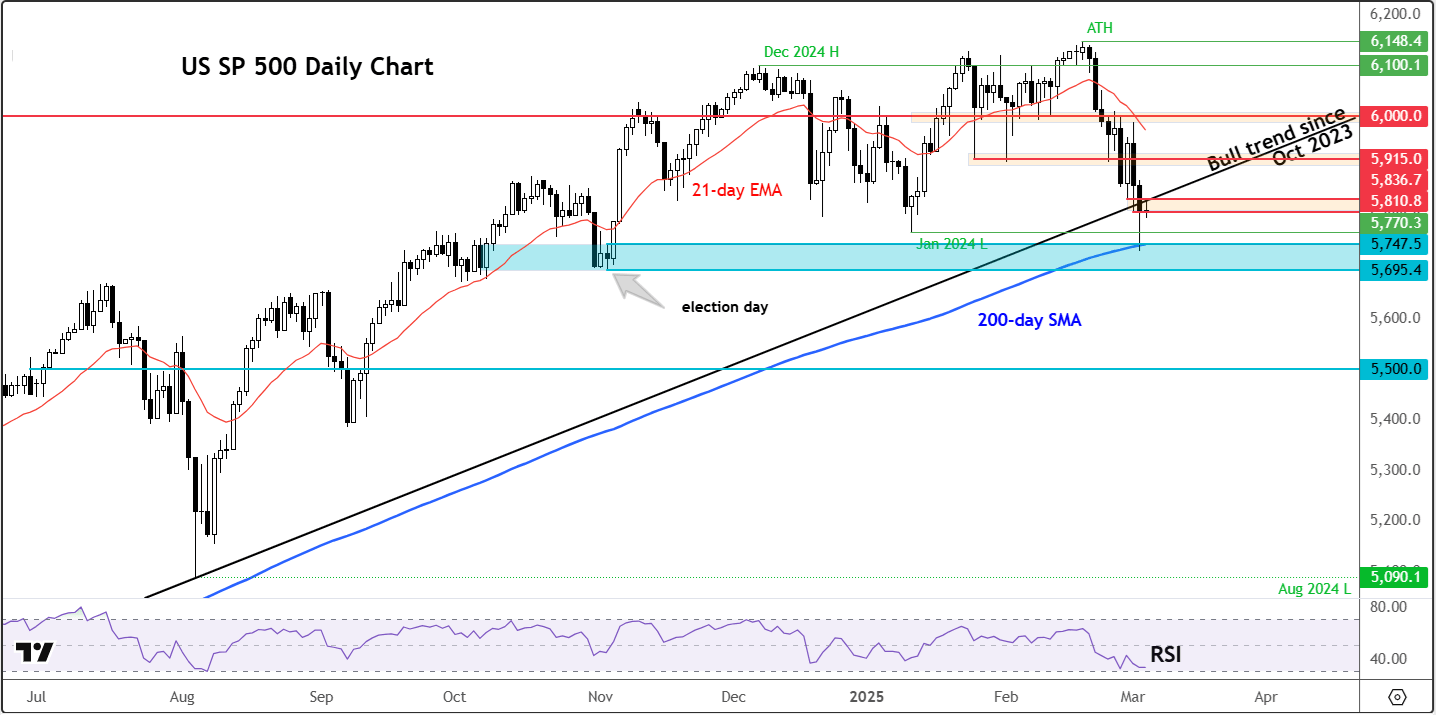

Yesterday’s rebound coincided with the S&P 500 and Nasdaq 100 both dipping below their crucial 200-day moving averages before bouncing back above it. Notably, individual stocks such as MicroStrategy and Oracle saw similar rebounds, while Nvidia stock found firm support around $110, Tesla defended $265, and Alphabet held its trendline support at $170. The question now is whether this technical buying will translate into sustained upside momentum—or if renewed selling pressure will emerge.

From a technical perspective, the S&P 500 tested a critical support zone between 5695 and 5747 —an area marking the origins of the Trump rally. The 200-day moving average aligns with this region, further underscoring its significance. With the daily RSI hovering near 30, the index appears somewhat oversold in the short term, potentially attracting dip buyers.

However, resistance looms overhead. Yesterday’s recovery attempt stalled around the 5810 mark, with additional resistance emerging at 5837—the backside of the broken trendline dating back to October 2023. A sustained break above this 5810-5837 zone would indicate a meaningful bullish reversal, potentially paving the way for a broader recovery.

Conversely, should selling pressure resume and the S&P 500 breach the 5695-5747 range, the market could be in for a deeper correction—one that has been notably absent in the last couple of years. With volatility running high, all eyes will be on whether the index can stabilise or if further downside lies ahead.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R