US futures

Dow future -0.85% at 424037

S&P futures -1.75% at 5665

Nasdaq futures -2.56% at 19668

In Europe

FTSE -0.7% at 8614

Dax -1.5% at 22635

- Stocks fall as Trump comments fuel recession worries

- Atlanta Fed GDPNow forecasts Q1 GDP -2.4%

- US CPI data is in focus this week

- Oil steadies after last week’s selloff

Stocks fall amid recession worries

US stocks are set to open lower on Monday as President Trump’s comments over the weekend fueled concerns that the trade war could trigger an economic downturn.

In an interview on Sunday, President Trump wouldn’t rule out a US recession owing to fluctuating trade policies on Mexico, Canada, and China, which were likely to dampen consumer demand and corporate investment.

Trump applied 25% trade tariffs on Mexico and Canada last week and 10% in China before announcing a slew of delays and exemptions, creating confusion and uncertainty. China also applied retaliatory offers.

According to a recent Reuters poll, 91% of economists said the likelihood of a downturn has increased under Trump. HSBC also downgraded U.S. stocks. This comes after the Atlanta Fed GDPNow estimate for Q1 GDP fell to -2.4%

Last week, the S&P 500 and the Nasdaq 100 fell 3%, posting the steepest weekly decline since September. The Nasdaq is also down over 10% from its December high, falling into correction territory.

There is no high-impact U.S. economic data today. At the end of the week, attention will be on job openings, inflation statistics, and Michigan confidence.

Corporate news

Tesla is set to open 3.5% lower after the EV manufacturers' facilities were hit with protests and vandalism across the US and Europe amid rising outrage over CEO Elon Musk’s influence in the Trump administration.

Apple is falling 1% pre-market after Citi lowered its estimates for the tech giant’s iPhone sales amid delays in a Siri update, which was originally planned for next month.

NovoNordisk is trading 7% lower after disappointing trial results for its next-generation weight loss drug CagriSema.

Bitcoin and crypto-related stocks are falling sharply, tracking Bitcoin lower as it fell 5% to send over the past 24 hours despite Trump’s bitcoin strategic reserve and the White House crypto summit. Strategy -6%, Riot and Coinbase trade 5% lower.

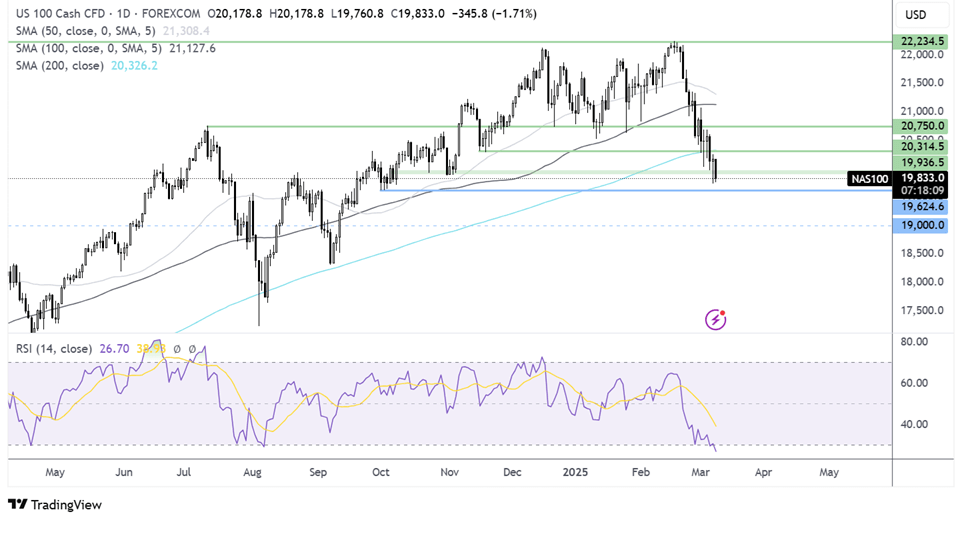

Nasdaq 100 forecast – technical analysis.

The Nasdaq is extending is bearish trend, breaking below the 200 SMA and 20k, falling to a 5-month low. The taking out of these key supports, combined with today’s bearish engulfing candle, keeps sellers hopeful of further losses. 19625 is the next target on the downside, the October 1 low, ahead of 19000. However, the RSI is overbought territory, so sellers should be cautious about chasing lower losses at these levels. Some consolidation could be on the cards. On the upside, resistance can be seen at 20k and above; here, the 200 SMA is at 20340.

FX markets – USD falls, EUR/USD rises

The USD is falling further, extending losses from last week amid ongoing trade tariff uncertainty and fears that the US economy could be heading for recession. The US dollar index trades at a 5-month low.

EUR/USD is rising, extending gains from last week, which saw the pair book its strongest weekly performance since 2009. Today, Eurozone investor sentiment data showed improvement, increasing to -2.9 from -12.7. The prospect of increased defence and infrastructure spending in Germany meant the eurozone’s largest economy experienced a notable improvement in investor sentiment.

GBP/USD is rising towards 1.30 amid ongoing USD weakness and despite signs of weakness in the UK labour market. The Recruitment and Employment Confederation noted that the starting pay growth for permanent positions was lowest since February 2021, whilst appointments for permanent positions fell for a 29th straight month. The data comes ahead of the BoE rate decision next week and the labour government spring statement at the end of the month.

Oil steadies after steep losses.

Oil prices are holding steady after falling sharply across the previous week.

Oil prices fell 3.8% last week, marking the seventh straight weekly decline, dropping to a multi-year low. This marked the longest losing streak since November 2023

Oil prices hold onto most of last week’s sell-off amid ongoing concerns over the impact of U.S. trade tariffs and expectations that OPEC+ producers will increase their output next month.

Separately, weak Chinese inflation data underscored worries of a deteriorating demand outlook. China, the world's largest oil importer, posted a -0.7% YoY drop in CPI, highlighting deflationary concerns.