EUR/USD, GBP/USD, US Dollar Talking Points:

- The US Dollar set a fresh 2025 low this morning and U.S. equities set a fresh low since the election in November. Tariff dynamics has many on the edge of their seats, and tonight’s State of the Union Address from President Trump can keep the volatility flowing.

- Tariffs are set to come into effect on Canada and Mexico today and already we’ve heard of retaliation from Canada. This can keep USD/CAD as one of the more attractive pairs for USD-strength until something changes on that front. And for USD-weakness, GBP/USD and EUR/USD both retain some attraction, as each has just pressed up to fresh 2025 highs.

- This is an archived webinar and you’re welcome to join the next. Click here for registration information.

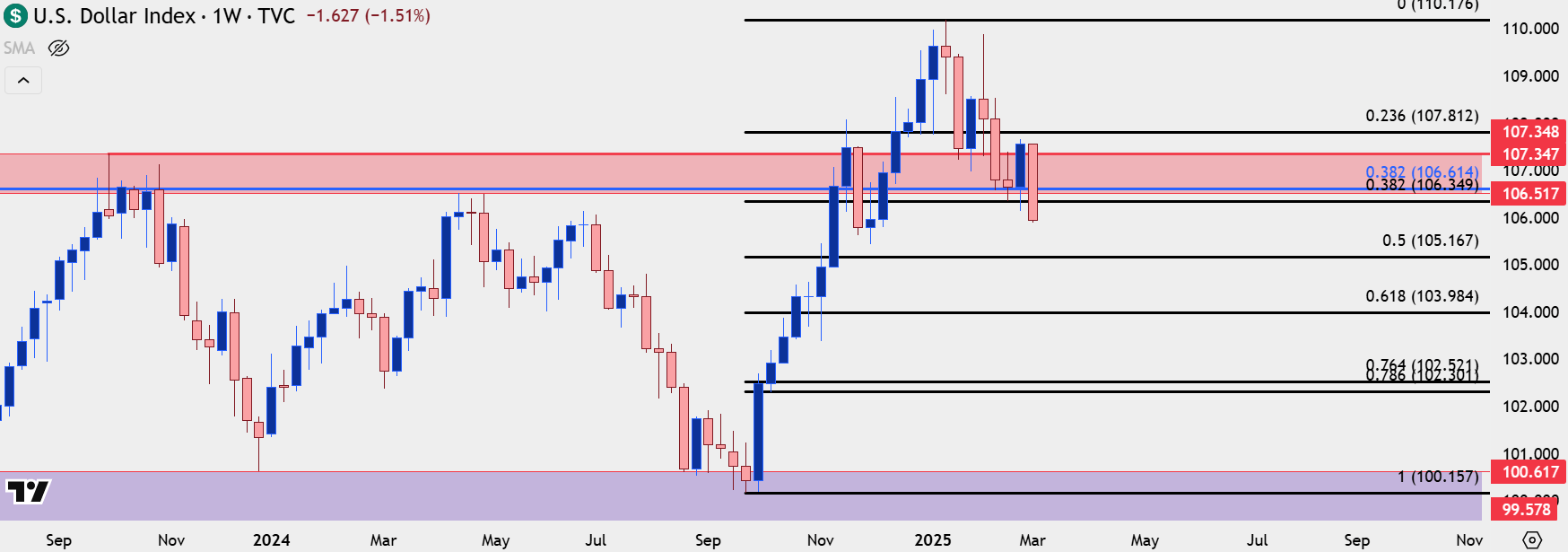

It’s been a volatile past couple of days in the US Dollar as the second half of last week saw a strong bid in the Greenback. DXY negated an evening star formation on the monthly chart with it’s rally in the last few days of the month, but sellers were back with a vengeance this week and that’s allowed for them to press the Dollar down to a fresh 2025 low.

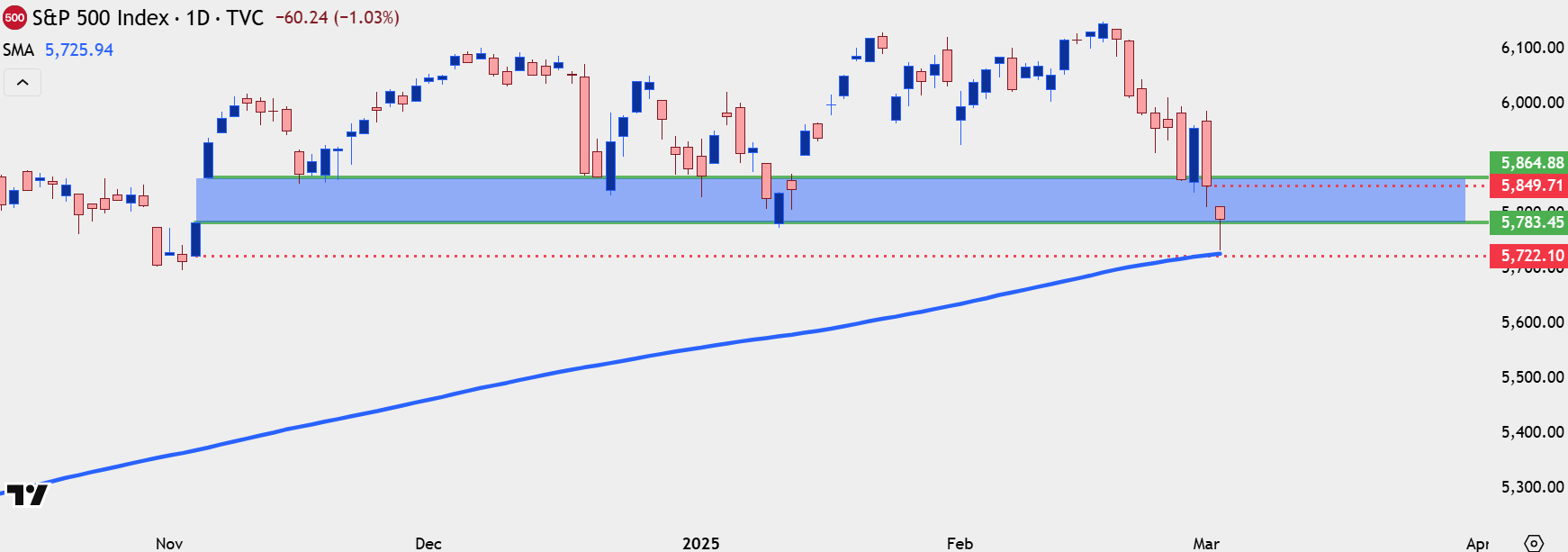

Unlike the inverse relationship that showed with equities two months ago, when the USD topped on January 13th as SPX finished off the election gap, this time both markets are being driven by sellers with stocks similarly setting a fresh 2025 low this morning. SPX has just tested the 200-day moving average for the first time since November of 2023, and this sets up for an interesting backdrop as tonight’s State of the Union Address from President Trump brings the opportunity for even more volatility.

I started off the webinar by looking at this setup, and already there’s been a bounce from that first 200-dma test in more than a year. Price is also finding a bit of support from the prior election gap, which led to a strong rally up to a fresh ATH after that was filled earlier in 2025 trade.

For bears, there’s resistance potential at the top of the gap from this morning’s open, running up to approximately 5850.

This aligns with what I had discussed in the 2025 Forecast for Equities, which you can access from the link below:

SPX Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

US Dollar

The USD is driving on tariff drama and there’s also been the recent trend in US economic data, causing the Atlanta GDP Now estimate for Q1 to dip down to -2.8% in its most recent reading. I think that’s driving some fear of slowdown or possibly even recession in the US economy, and this is a likely reason why tariffs previously were a driver of USD-strength and, more recently, have been a factor of USD-weakness.

Prior support of 106.35 and 106.61 is now short-term resistance potential for DXY, and the next significant spot of support is down around the 105 handle.

US Dollar Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

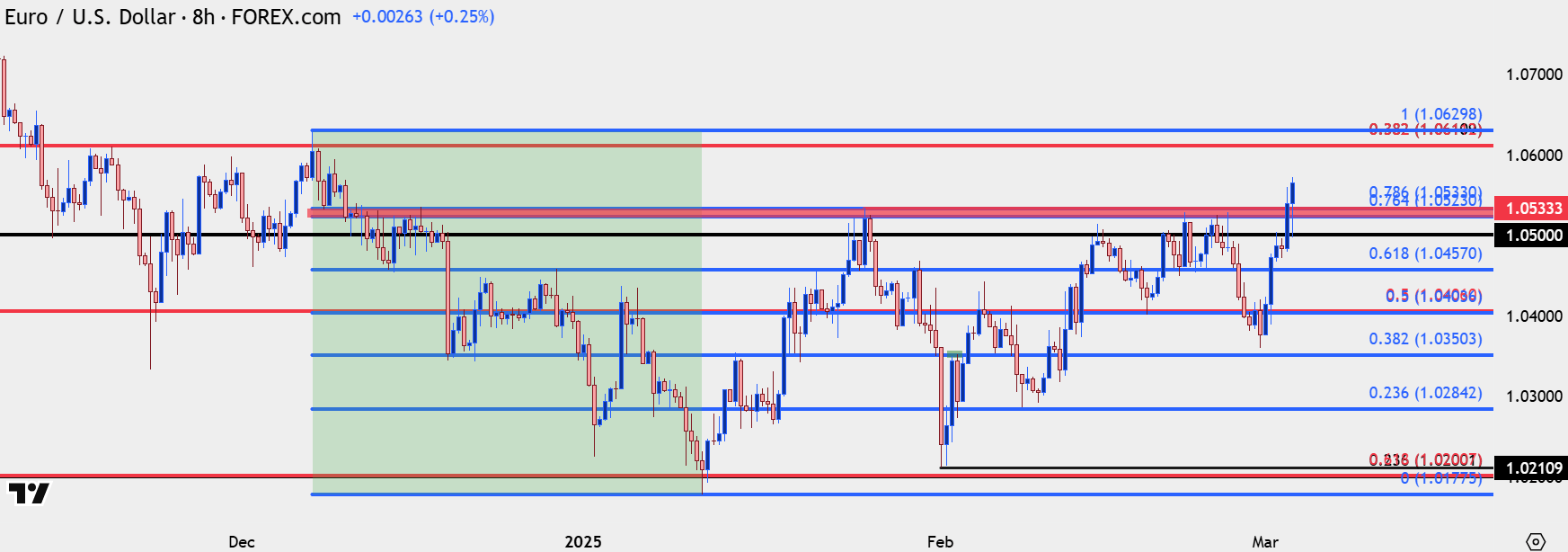

EUR/USD Breakout

I’ve been looking for a EUR/USD breakout as that 1.0500 level was seeing an increasing frequency of tests. Last week showed a strong pullback in the back-half of the week after another resistance hit at 1.0523; but this week is showing a far different tone and EUR/USD is now trading at a fresh 2025 high.

There’s a major resistance level overhead at 1.0611, which is the 38.2% Fibonacci retracement of both the 2021-2022 major move, and the 2022-2023 move. The 1.0200 level had a similar element of confluence and that’s so far held the lows for the year, after coming into play on January 13th when the USD had topped.

EUR/USD Eight-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

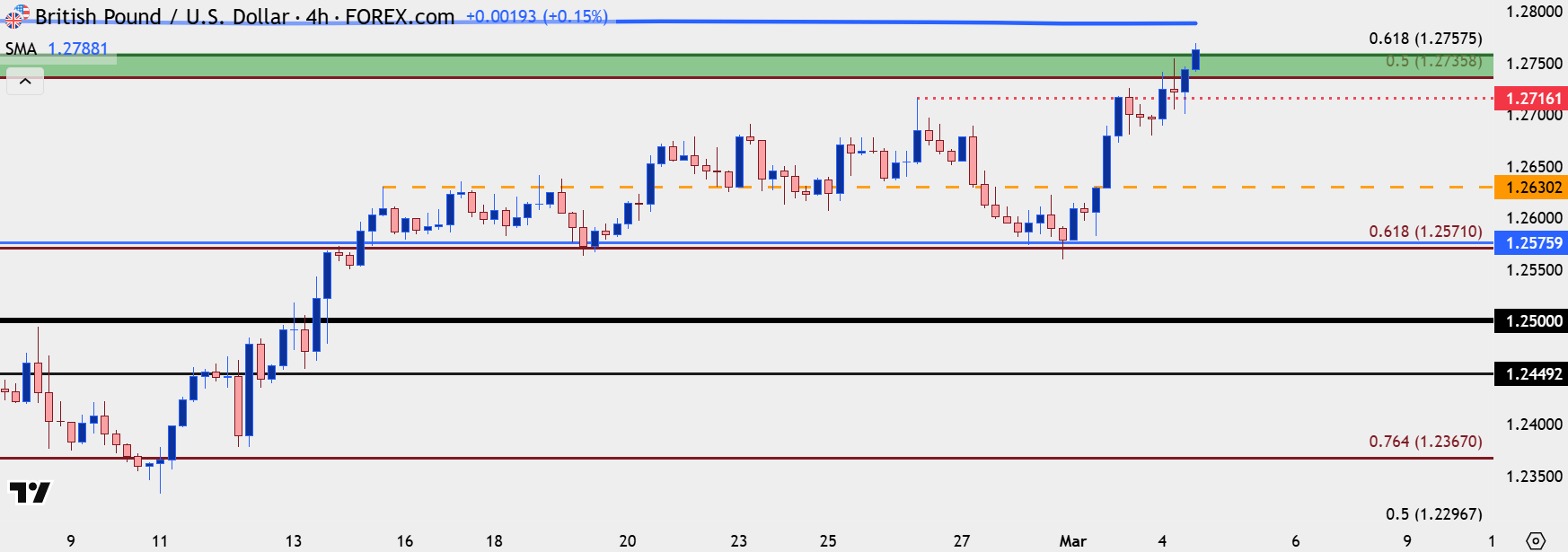

GBP/USD Into Resistance

As I’ve been saying, I think GBP/USD has been a cleaner venue for USD-weakness scenarios and I wrote about the pair yesterday. GBP/USD has since rallied up to the next resistance zone, around the 1.2750 psychological level, and the pair retains a bullish trend. In the webinar, I looked at GBP/USD from a shorter-term perspective in effort of finding higher-low support levels.

GBP/USD Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

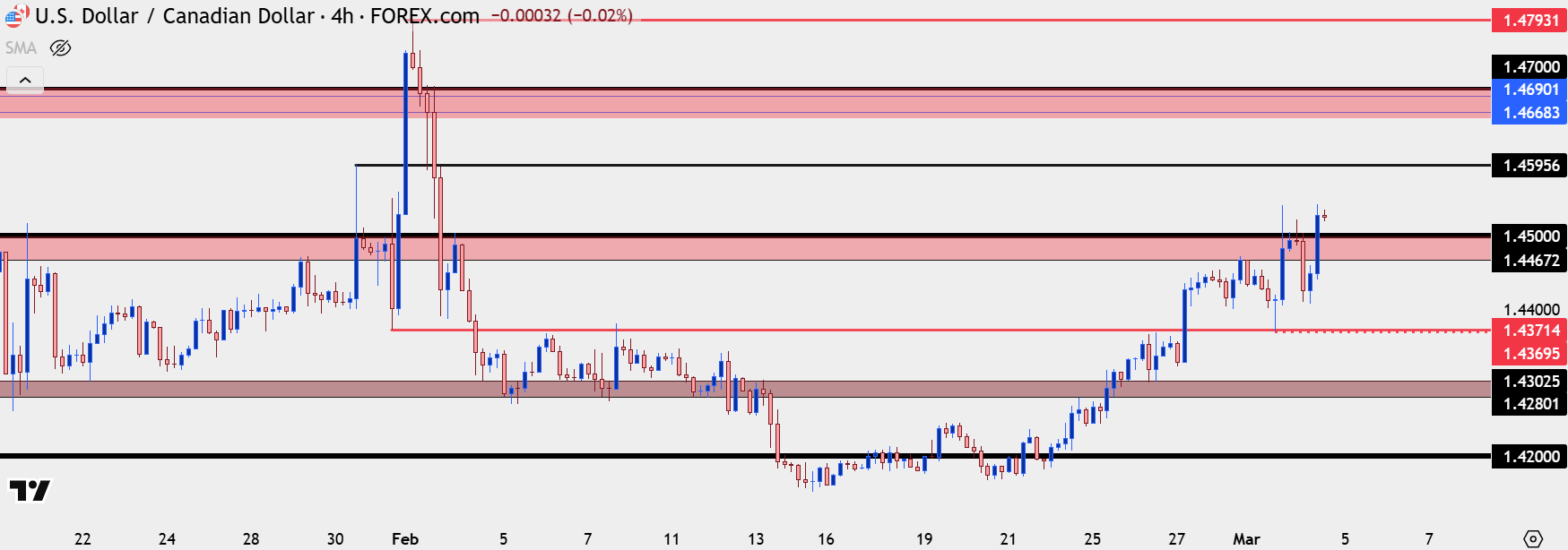

USD/CAD

Given the ongoing tariff drama, I’m continuing to expect USD/CAD to be one of the more attractive major pairs for scenarios of USD-strength. The challenge at this point is the 1.4500 psychological level as that’s been a price that hasn’t seen much bullish activity above, save for the early-February breakout.

At this point, there’s shorter-term support potential down to the bottom of that zone, around 1.4467, and for next resistance, I’m tracking 1.4596 followed by the 1.4668-1.4690 zone.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist