US futures

Dow future -0.23% at 42617

S&P futures -0.15% at 5729

Nasdaq futures -0.16% at 20050

In Europe

FTSE -0.37% at 8660

Dax -2.2% at 22910

- US added 151k in February, below the 160k forecast

- Unemployment rose to 4.1% from 4%

- Trump expands trade tariff delay

- Oil rises but it is set for a large weekly decline

NFP misses forecasts & trade tariff uncertainty continues

US stocks point to a weaker opening after the latest US non-farm payroll came in weaker than expected amid ongoing US trade policy uncertainty.

The latest US nonfarm payrolls showed that 151k jobs were added in February, below the 163,000 that analysts had forecast but above the downwardly revised 125,000 in the previous month. Meanwhile, unemployment rose to 4.1%, while wages grew 0.3%.

While the data was weaker than expected, it wasn’t as bad as the market feared, prompting little in the way of an immediate reaction. US futures held onto losses, and the USD remained weak.

The data comes as concerns linger over the US economy's outlook amid uncertainty over President Trump's trade tariffs.

U.S. stocks have fallen sharply across the week, with the Nasdaq falling into correction territory on Thursday, 10% from its recent record high.

Yesterday, Trump suspended the 25% tariffs he had imposed this week on most goods from Canada and Mexico. This is the latest development in Trump’s fluctuating trade policy, which has injected volatility into the markets and raised concerns about growth and inflation.

This latest development is being seen as a delay rather than an exemption, with reciprocal tariffs also set to be announced in early April, keeping the mood depressed.

Corporate news

Broadcom has jumped 10% after the chipmaker calmed investors' worries about AI infrastructure demand with a strong second-quarter forecast.

Hewlett Packard enterprise has slumped 20% after the AI server maker warned that annual profits could be hit by US tariffs.

GAP has jumped 16% after the clothing firm beat its Q4 profit forecast, proving that its turnaround strategy is paying off.

Costco slips over 1% after the wholesale retailer posted lower than expected fiscal Q2 profits, although revenue beat forecasts..

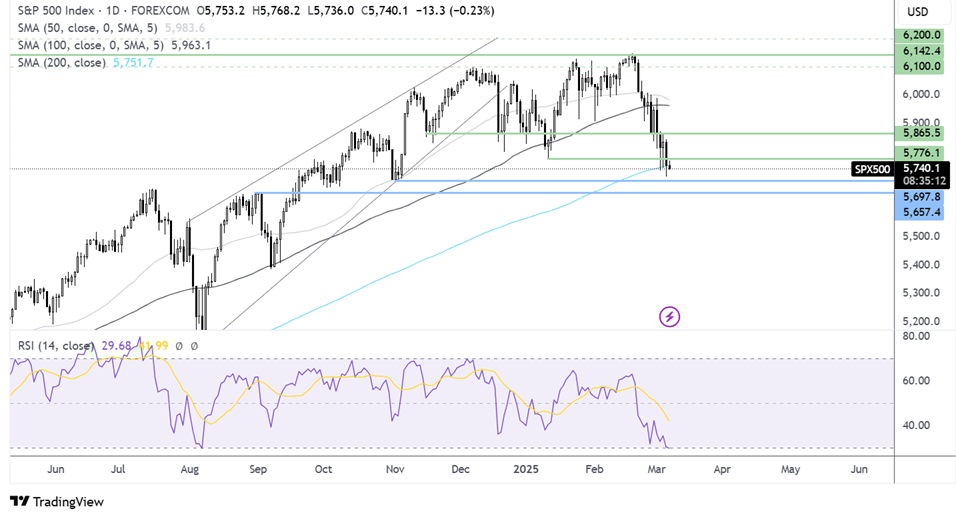

S&P 500 forecast – technical analysis.

The S&P 500 broke below the 5770 support level, and is testing the 200 SMA at 5750. This support has stemmed losses so far this week. Should sellers, supported by momentum, take out this level, it opens the door to a deeper selloff to 5700. Should the 200 SMA hold, buyers will then look to test resistance at 5865 and above there 5916, which could negate the near term selloff.

FX markets – USD falls, EUR/USD rises

The USD is struggling at a 5-month low after the jobs data, amid US recession fears and the ongoing uncertainty stemming from Trump’s trade policy

EUR/USD is rising, extending gains to the highest level since November after a fiscal U-turn from Germany this week. The ECB cut interest rates but hinted towards a pause amid Trump’s trade policy shift.

GBP/USD is rising towards 1.30 and is on track to gain 2.7% this week on USD weakness. The pound is rising despite signs of weakness in the UK economy as house prices fell 0.1% MoM in February. This came after the construction PMI fell sharply yesterday.

Oil recovers from a multi-year low

Oil prices rebounded on Friday but are still on track to book losses of 3.5% across the week, marking the seventh straight weekly decline.

Oil is recovering today after Russia's Deputy Prime Minister, Alexander Novak, said that OPEC+ may reverse oil production increases after April if needed.

His comments come after oil fell sharply this week on reports that OPEC+ would increase oil output next month.

The increase or not in production comes at a time when fears are rising that the US economy could be heading for a recession given the uncertainty surrounding US trade tariffs.