US futures

Dow future -1.1% at 41460

S&P futures -0.75% at 5570

Nasdaq futures -0.56% at 19319

In Europe

FTSE -1.08% at 8505

Dax -1.5% at 22376

- Stocks extended yesterday’s steep losses

- Recession fears linger

- JOLTS job openings rise to 7.74M

- Oil rises but gains could be limited

Stocks fall as recession fears remain

US stocks are set to open modestly lower, extending yesterday’s sharp sell-off amid lingering US slowdown fears.

Yesterday, U.S. stocks dropped sharply, with the NASDAQ falling 4% in its worst daily performance in 2 1/2 years. The S&P 500 closed 2.8% lower, and the Dow Jones was down 2.3%.

US equities are tracking bond yields, and the USD is lower amid rising unease over the impact of President Trump’s trade tariff policy. Businesses and households show signs of slowing spending, which could impact economic growth.

Trade tariffs are expected to be inflationary at a time when growth could stagnate or even contract. These worries are far outweighing any tax cuts or deregulation that Trump may bring in. Furthermore, Trump considers this to be a transition of the economy, suggesting that a recession doesn’t worry him.

JOLTS job openings came in slightly higher than expected at 7.75 million, up from 7.5 million. This hasn’t brought any relief to the market despite the data indicating steady demand for workers as the Trump administration took office.

The data comes after the US non-farm payroll report on Friday showed that job creation rose from January, but unemployment also rose to 4.1% from 4%.

Attention will be on tomorrow’s inflation data for further clues over the Fed’s interest rate outlook. The Fed is expected to cut rates three times this year, with a May cut 50/50 priced in.

Corporate news

Khol’s the retailer is falling 14% after Q4 results showed net sales fell 9.4% missing expectations, along with full year guidance missed forecasts. It now expects EPS of $0.1 to $0.6 for the current fiscal quarter. Net sales are expected to fall 5%-7%.

SouthWest Airlines flies higher after the budget airline announced it will start charging passengers to check bags. The changes come following pressure from activitst investor from Elliot Investment Management.

Delta Airlines is falling 5% after slashing its top and bottom line guidance for Q1 due to weak domestic demand.

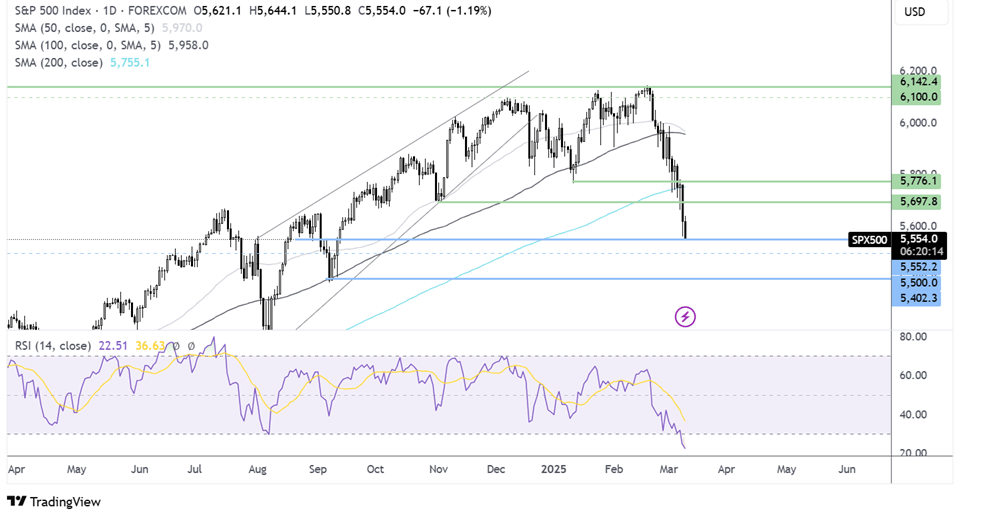

S&P 500 forecast – technical analysis.

The S&P 500 has fallen from its record high of 6139, breaking below the 200 SMA to a low of 5550 yesterday. The price has recovered from the low to 5600 and the RSI is deep in oversold territory. This, together with the long lower wick, could see prices consolidate and sellers should be cautious at these levels. Sellers would need to take out the 5550 support to bring 5500 and 4500 into focus. On the upside, any recovery would need to rise above 5700 round number and the 200 SMA around 5755, this could negate the near term downtrend.

FX markets – USD falls, EUR/USD rises

The USD is falling further to fresh five-month lows amid recession fears. Increased uncertainty under a Trump administration is denting the USD’s safe-haven appeal. The USD has been tracking yields lower. Safe-haven demand would need to pick up to help the USD rise.

EUR/USD is rising above 1.09, at multi-month highs amid a weak USD and optimism that the German Greens could be willing to negotiate to support Friedrich Merz's massive fiscal reform. They predict a deal could be reached this week.

GBP/USD is rising towards 1.30, capitalising on a weaker USD. UK British Retail Consortium retail sales showed a slightly slower growth compared to January. February sales rose 1.1%, boosted by food sales, while demand for clothing was weaker, owing to poor weather.

Oil rises but gains could be limited

Oil prices are recovering after falling 1.5% on Monday and almost 4% last week. However, lingering recession fears and worries over trade tariffs could limit gains.

Concerns about the US economy tumbling into recession have weighed on the demand outlook for oil in recent weeks, pulling the price lower. While the oil price is recovering today, helped by a weaker U.S. dollar that trades at around a four-month low, gains could be capped.

The market would really want to see a scaling back of US tariffs to ease stagflation fears and help the demand outlook.

Separately, OPEC+ will increase output as of next month, although Russian Prime Minister Alexander Novak has said that this will remain flexible and dependent on market conditions in the following months.