A global bond sell-off extended its run, driven by Germany’s ambitious spending plans, which are poised to reshape the eurozone’s economic outlook and has already had a sizeable impact on the euro forecast and direction. The focus is now turning to the upcoming rate decision from the European Central Bank, before attention shifts to US labour market data as we head to the business end of the week. The EUR/USD forecast is thus subject to change, but we will maintain an overall bullish outlook on the pair and think $1.10 is a realistic target from here in the coming days or weeks. Meanwhile, the EUR/CHF is among the other key euro pairs we are monitoring closely given its technical breakout this week.

Bond sell off gathers pace, boosting the euro forecast

Fuelled by Germany’s announcement of a staggering €500 billion investment in defence and infrastructure, European bond yields have extended their surge. The benchmark 10-year German bund yield has extended its sharp rise to 2.929%, before easing off a little, while bond yields of other European nations have likewise rallied. This has given the euro a broad lift, propelling EUR/USD to 1.0780 and pushing the single currency higher against the pound, franc, and yen.

EUR/USD holds sharp gains ahead of ECB decision

The EUR/USD staged a sharp breakout yesterday and has maintained those gains so far in today’s session. The euro’s strength is driven by expectations that higher German government spending could fuel inflation, which in turn might prompt the ECB to take a more measured approach to rate cuts.

However, markets are still overwhelmingly pricing in a 25-basis-point cut at today’s ECB meeting. The real test, though, will come from Christine Lagarde’s press conference.

With growing concerns over trade tariffs, Lagarde may strike a more cautious tone, which could momentarily weigh on the euro. That said, any pullbacks may well be bought, reinforcing upward momentum in the EUR/USD and euro crosses.

Trump’s tariff delay and Chinese stimulus expectations lift euro forecast

Elsewhere, markets reacted to US President Donald Trump’s move to temporarily exempt automakers from newly introduced tariffs on Mexico and Canada, a decision that buoyed European car manufacturers, and indirectly supporting the euro.

Investors are also increasingly optimistic about further stimulus measures from China, following the government’s decision to opt for an optimistic 5% growth target. With Trump’s tariffs set to hurt China’s economy, the thinking here is that more stimulus measures will be required for the government to achieve its growth target. China is one of the biggest exports destinations for European manufacturers, making stimulus announcements super important for the euro.

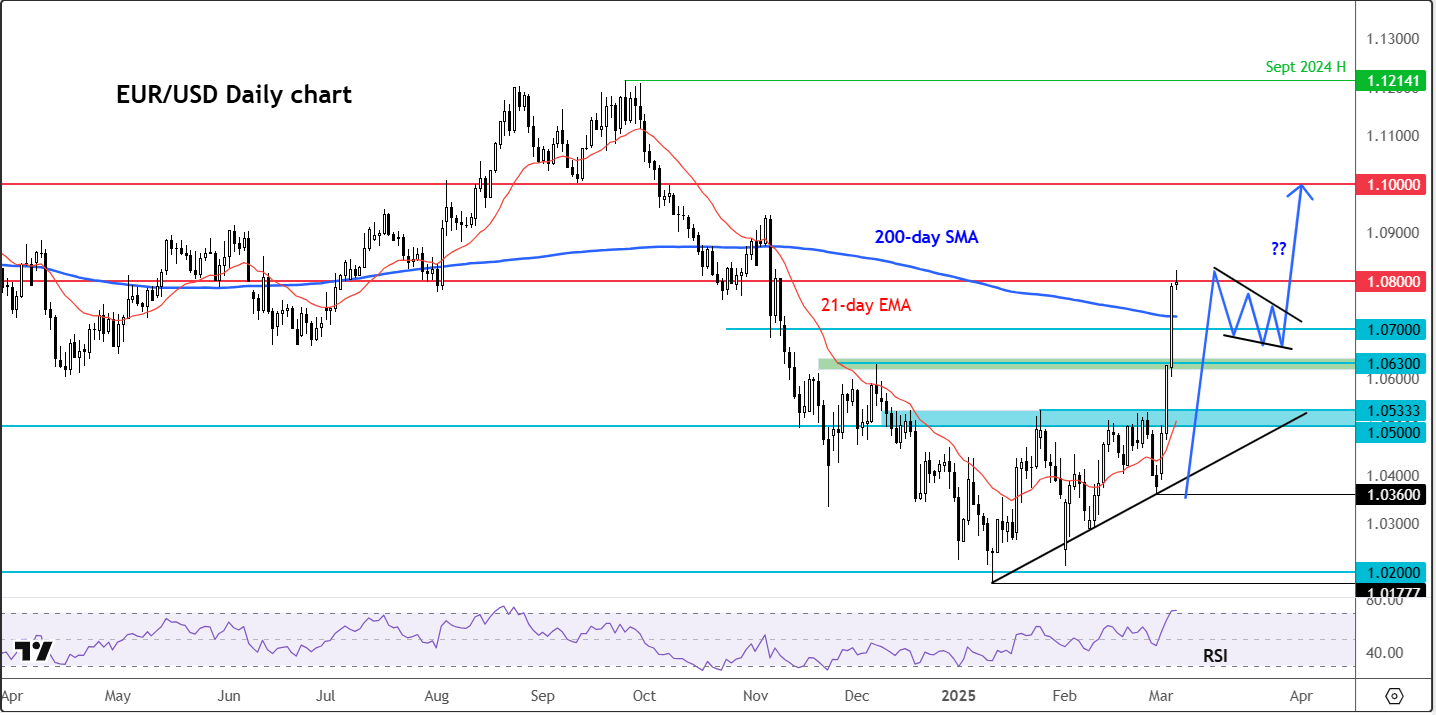

Technical EUR/USD forecast: key levels to watch

With the EUR/USD finally clearing that key 1.0500 hurdle on Tuesday, before extending its gains on Wednesday, the path of least resistance is clearly to the upside for this pair. What the bulls will want to see now is a period of consolidation for a few days, or a slight pullback on the back of the ECB rate decision before potentially looking for dip-buying opportunities.

Key support now is around that 1.0500 area, having previously served as strong resistance. But the EUR/USD may not pull back this far without a significant dollar recovery.

Thus, a more realistic support area to watch is located around 1.0625-1.0630 area. The 200-day average may also come into focus at 1.0725 area today.

In terms of resistance levels to watch, well 1.08 has been tested. If the rally extends further then 1.09 could be the next area of resistance to watch but we could easily see the rally extend to 1.10 handle in the coming days or weeks.

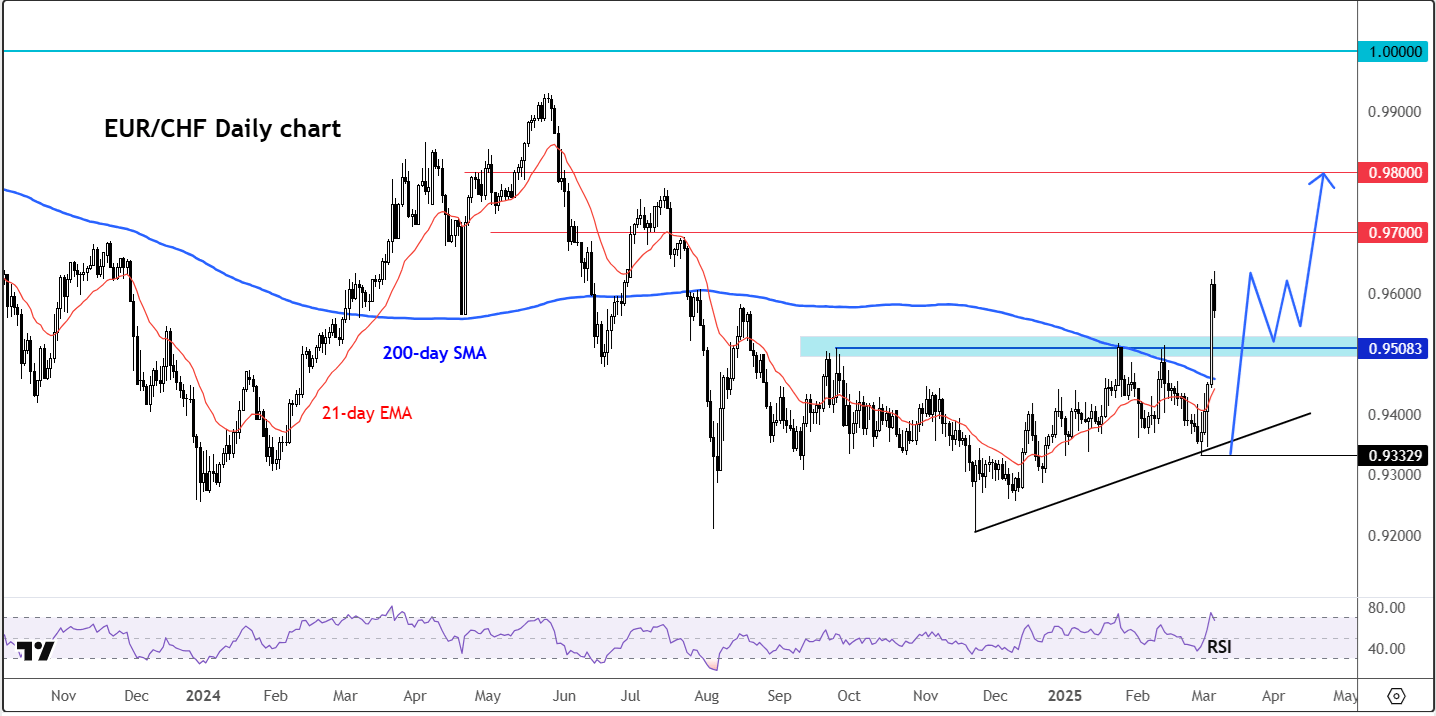

Euro Forecast: EUR/CHF breaks out

The euro is making waves ahead of the European Central Bank’s rate decision, with the EUR/CHF pair breaking key levels this week. Investors are still digesting Germany’s decision to unlock hundreds of billions of euros for defence and infrastructure projects. This significant shift may not only revitalise Germany’s economy but could also spill over to its neighbours in the eurozone.

Thanks to the big rally in the euro, the EUR/CHF has broken out decisively, clearing key resistance at 0.9500-0.9517 and pushing beyond its 200-day moving average. While some resistance is expected around 0.9600, the broader trend remains to the upside. A move towards 0.9700 appears the next logical step, with parity not out of the question further down the line.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R