- USD/JPY is acting more as a risk proxy than a pure rate differential play

- Fed and BOJ decisions will be key drivers, with rate guidance in focus.

- Nvidia’s GTC and China’s stimulus plans could also influence risk sentiment

- USD/JPY technicals turn moderately bullish

Summary

USD/JPY has reverted to being a play on risk appetite rather than interest rate differentials over the past month, though the latter remains important for overall direction. That means alongside guidance from the U.S. Federal Reserve and Bank of Japan (BOJ) after this week’s rate decisions, other events—such as Nvidia’s GPU Technology Conference (GTC) and China’s latest attempts to stoke consumer demand—may be highly influential, especially with the USD/JPY technical picture starting to brighten after a period of bearish dominance.

USD/JPY Reverts to Risk Proxy

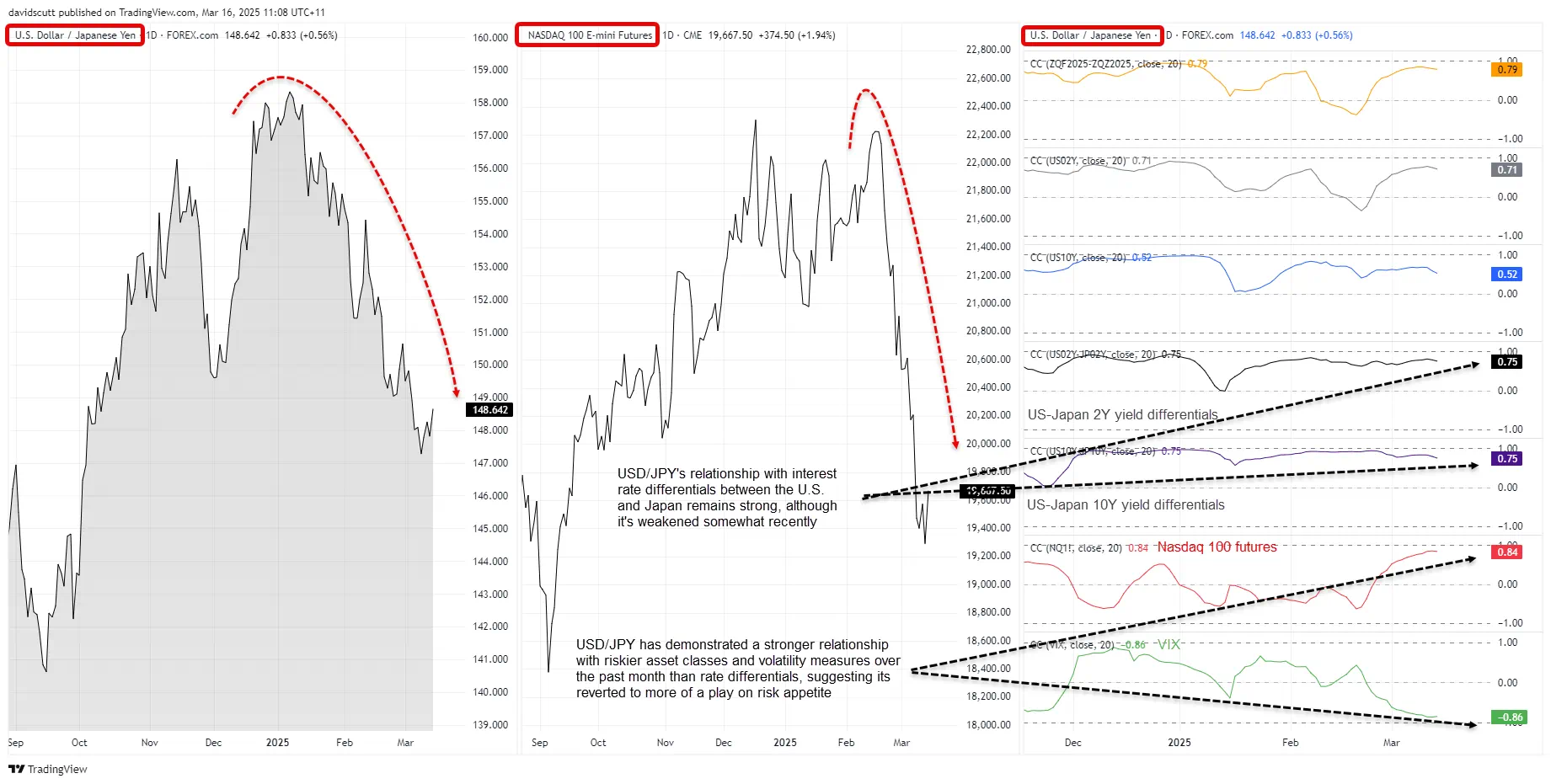

Source: TradingView

Interest rate differentials remain an important driver of USD/JPY movements, as shown by the correlation coefficients with two- and 10-year bond yield spreads between the U.S. and Japan over the past month. At 0.75 apiece, it suggests the recent compression between the two nations explains a lot of the downside seen in USD/JPY recently.

However, as indicated by the red and green lines in the bottom right-hand corner, USD/JPY has actually seen a stronger relationship with riskier asset classes, with a correlation coefficient of 0.84 with Nasdaq 100 futures and -0.86 with the S&P 500 volatility index (VIX) over the same timeframe.

While there’s a clear link to rate differentials given growing unease at the U.S. economic trajectory based on recent spotty data, the analysis suggests USD/JPY has switched to being somewhat of a risk proxy for broader financial markets, declining when fears surge and surging when fears ebb.

Key Market Events

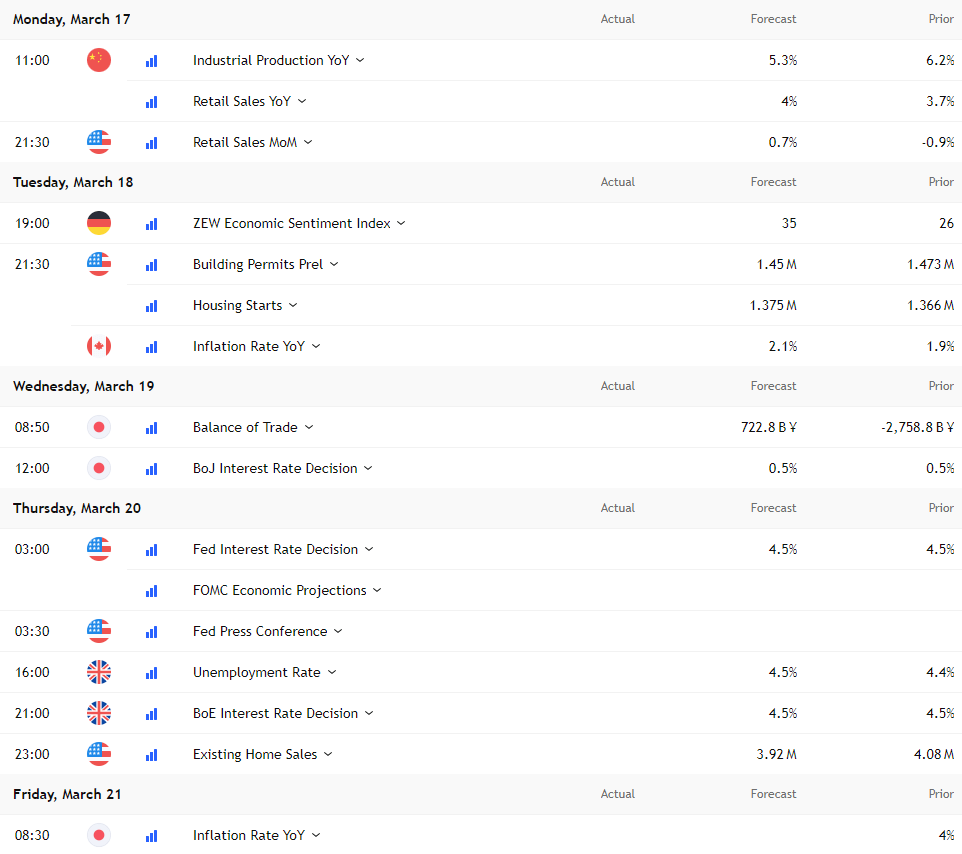

Looking at known event risk this week, movements not only in USD/JPY but broader markets will be heavily influenced by the U.S. Federal Reserve and Bank of Japan interest rate decisions on Wednesday. (Japan standard times shown).

Source: TradingView

Fed Guidance Key for Traders

When it comes to the Fed, traders attach almost zero chance of the funds rate changing from its current range of 4.25-4.50%, putting the probability of a 25bp cut at just 2.7%. Nada. That means the Fed statement, revised dot plot tracking individual member expectations for the funds rate, and Jerome Powell’s press conference will guide direction.

Source: Bloomberg

Three cuts are currently favoured by markets by the end of 2025, up from just one a month ago. Three months ago, the median FOMC forecast had two cuts pencilled in this year. If the Fed delivers an assessment similar to market pricing—which is possible given signs of waning economic strength and softer inflation readings relative to a year earlier—it may spark another leg lower in U.S. Treasury yields, possibly narrowing spreads with Japan and weighing on USD/JPY.

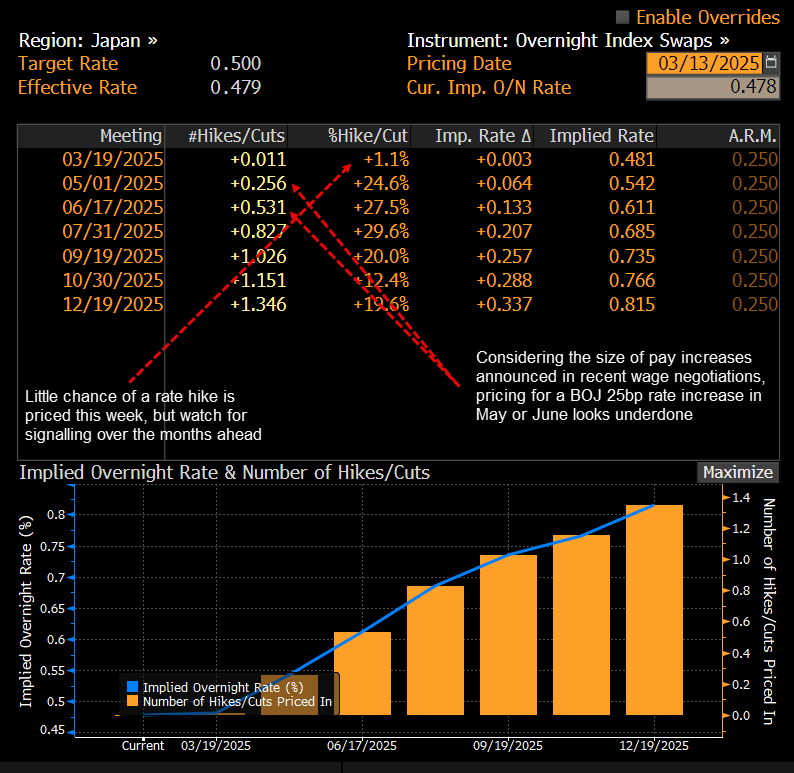

BOJ: Watch for Hawkish Guidance

While the BOJ is highly likely to leave rates steady next week, policymakers could discuss a hike as early as May, with domestic inflation trends and market volatility tied to U.S. trade uncertainty in focus. A strong outcome from the first-round annual wage talks has arguably bolstered the case for further tightening, with the BOJ expecting rising pay to support consumption and sustain inflation near target.

Source: Bloomberg

Source: Bloomberg

Markets still lean towards a move in Q3, but signs of improving real wages and the BOJ’s confidence in policy exit could pull forward expectations. If that’s what Governor Ueda signals next week, look for another leg higher in Japanese government bond (JGB) yields and renewed strengthening in the yen.

Heading into the BOJ meeting, which arrives around 12 hours before the Fed decision, markets put the risk of a 25bp rate increase in May at around one-in-four, and one-in-two by June. Though recent volatility may explain the reluctance to price in the risk of an earlier move, the implied probability from swaps markets still screens as skinny relative to recent BOJ commentary, including from Governor Ueda last week.

Beyond Central Banks

Aside from central bank decisions, other known events to focus on include Monday’s U.S. retail sales report along with Japan’s February inflation print on Friday. Regarding the former, risks to the 0.7% increase forecast may be skewed to the downside based on alternate measures of consumer spending, such as the Chicago Fed’s CARTS survey.

Given its sheer influence over the performance of the U.S. tech sector, Nvidia’s annual GPU Technology Conference (GTC) on Monday is another important event for USD/JPY traders. Earlier in the session, details on what measures China’s government will roll out to boost consumption may also be influential on USD/JPY after contributing to the sizeable rally seen on Friday—a lack of specific detail may see part of those gains unwound.

Nothing has changed on the tariff front relative to recent weeks: an escalation in trade tensions tends to weigh on USD/JPY through a lift in risk aversion, while a de-escalation tends to deliver the opposite.

USD/JPY Technical Picture Brightens

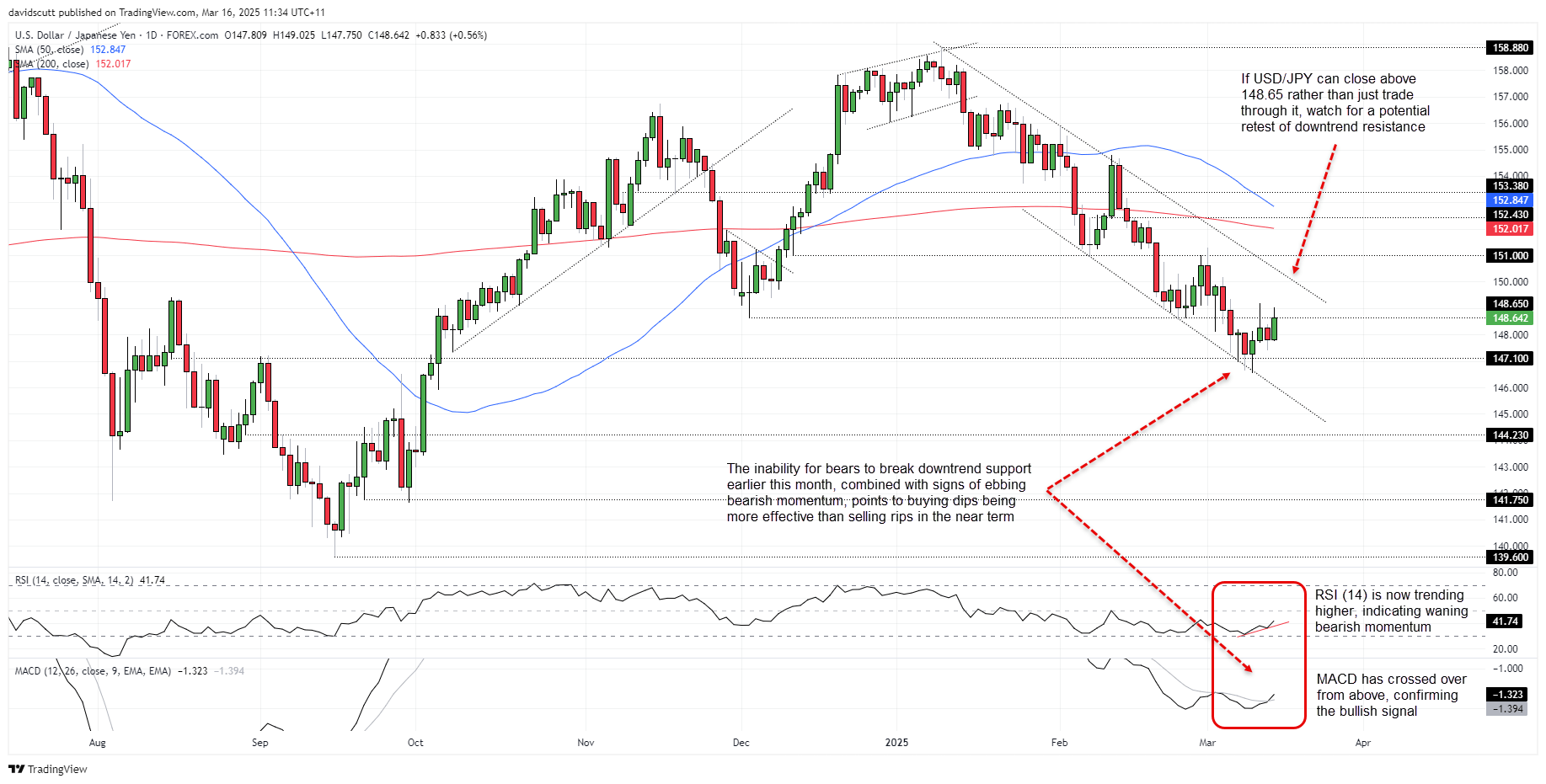

Source: TradingView

After swinging neutral in last week’s USD/JPY outlook, the technical picture has further brightened for bulls with far more constructive price and momentum signals seen.

While USD/JPY remains in a bearish trend, the inability for the price to break downtrend resistance despite multiple attempts earlier this month likely contributed to the bounce last week, seeing the pair test sellers parked above 148.65 on Wednesday and Friday. While the initial probes proved to be unsuccessful, with RSI (14) trending higher and MACD confirming the signal by crossing the signal line from below, momentum is starting to skew in favour of the bulls, pointing to upside risks.

If USD/JPY were to push meaningfully above 148.65, look for a possible retest of downtrend resistance found just above 150. 151 and the 200-day moving average are other topside levels of note.

On the downside, the price was supported on dips beneath 147.10 last week, making that the first downside level of note. Beyond, downtrend support is located nearby, with a break of that level opening the path for an unwind towards 144.23.

Follow David on Twitter @scutty